2024’s FinTech Superstars: 10 Stocks That Surged Beyond Expectations 📈😮💨

From BNPL breakouts to neobanks & cross-border payments: the FinTech titans that redefined 2024 🚀

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 310k+ FinTech leaders:

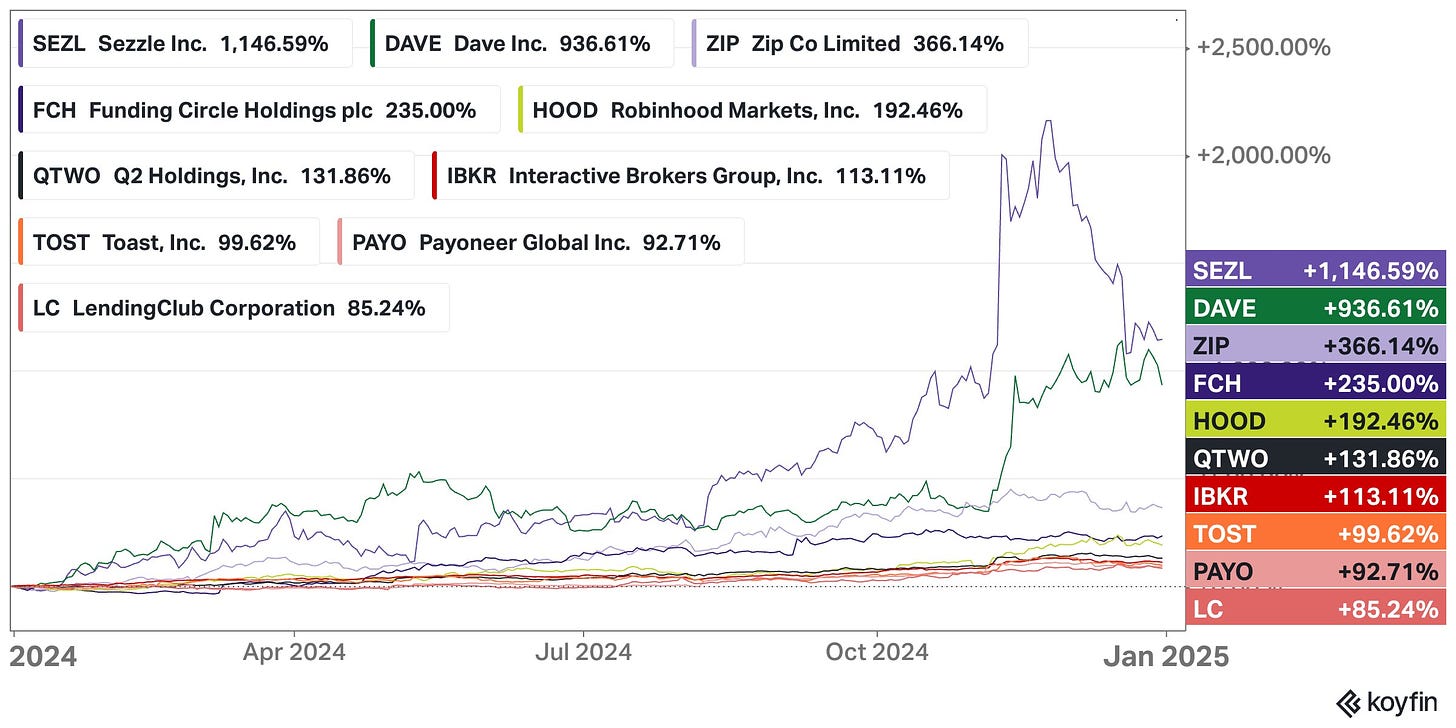

2024 has been a remarkable year for many financial technology stocks, driven by a combination of factors including increased consumer adoption, innovative product offerings, and favorable market conditions.

In fact, for some (hint: Sezzle & Dave) it was so great that they even outperformed assets like Bitcoin or AI giants like NVIDIA NVDA 0.00%↑:

Let’s take a quick look at the top performers & how their year has been, and learn some of the key drivers behind their stellar performance in 2024:

Sezzle SEZL 0.00%↑ : Sezzle's stock surged 1,146% in 2024, fueled by strong financial performance and increasing adoption of its Buy Now, Pay Later (BNPL) services. The company's robust business model and ability to capitalize on the growing BNPL market have contributed to its impressive growth. ICYMI: Sezzle’s masterclass on how to make BNPL profitable 💸 [old but still accurate strategy worth stealing]

Dave DAVE 0.00%↑: Dave's stock soared 936% in 2024, as it continued to innovate and expand its financial services offerings, including overdraft fee avoidance and automated savings. Despite facing regulatory challenges, Dave has demonstrated resilience and a commitment to providing value to its customers. ICYMI: Dave's remarkable turnaround 🐻 [how it flipped even NVIDIA & what can we expect next + bonus dives into Dave & co]

Zip: Zip's stock price skyrocketed 366% in 2024, driven by the increasing popularity of BNPL services and the company's strong growth in Australia and international markets. More importantly, Zip's user-friendly platform and focus on customer experience have contributed to its success.

Funding Circle: Funding Circle's stock rose 235% in 2024, benefiting from a favorable economic environment for small businesses and increased demand for SME lending. The company's strong performance and strategic initiatives have positioned it for continued growth.

Robinhood HOOD 0.00%↑: Robinhood's stock climbed 192% in 2024, as it continued to attract retail investors and expand its product offerings. The company's focus on user experience and innovative features has helped it maintain its position as a leading trading platform. ICYMI: Robinhood accelerates global expansion amid strong growth metrics and record performance 🚀🌍 [a recap of their latest numbers, plans for the future & why they matter + a bonus deep dive into Robinhood & its latest financials]

Q2 QTWO 0.00%↑: Q2's stock performance improved 131% in 2024, driven by strong growth in its digital banking solutions business. The company's focus on innovation and partnerships has enabled it to capitalize on the increasing demand for digital banking services.

Interactive Brokers IBKR 0.00%↑: Interactive Brokers' stock increased 113% in 2024, benefiting from its low-cost trading model and expanding global client base. The company's ability to adapt to changing market conditions and provide value to its customers has contributed to its success.

Toast TOST 0.00%↑: Toast's stock rose 99% in 2024, driven by strong growth in its restaurant technology business. The company's innovative solutions and focus on customer satisfaction have helped it become a leading provider of point-of-sale and restaurant management software. ICYMI: Toast: a tasty bet on the restaurant industry's digital transformation 🍞 [breaking down the key facts & figures, uncovering the most important numbers and insights & why you shouldn’t ignore this FinTech giant + a bonus deep dive into one of Toast’s biggest competitors]

Payoneer PAYO 0.00%↑: Payoneer's stock grew 92% in 2024, as it continued to expand its cross-border payment solutions. The company's focus on serving the needs of freelancers and small businesses has driven its growth. ICYMI: Payoneer: a hidden FinTech giant accelerating B2B cross-border payments growth 😤🚀 [breaking down their latest Q3 2024 financials, what they mean, why I’m bullish & why you should be too]

LendingClub LC 0.00%↑: LendingClub's stock increased 85% in 2024, as it diversified its business model to include wealth management services. The company's strong performance and strategic initiatives have positioned it for continued growth. ICYMI: LendingClub poised for continued growth as FinTech lending leader 😤💸 [breaking down the key numbers, what they mean & why LendingClub is worth your time and money in 2024 & beyond]

ICYMI:

👋 And that’s a wrap. I will share my top 10 FinTech & Finance stocks for 2025 shortly, so stay tuned.

In the meantime, Happy New Year to everyone I’ve not yet spoken with! I hope this will be your best year ever!

🥂🥂🥂

As always, if you enjoyed this newsletter, invite your friends and colleagues to sign up:

Disclaimer: This analysis is for informational purposes only and should not be considered financial advice. Conduct thorough research before making investment decisions.

Good stuff - thanks for the recap.