PayPal’s focus on efficiency is starting to pay off 💸; Mastercard just redefined digital account opening with open banking 👀

FinTech is Eating the World, 11 May

Hey Everyone,

TGIF! Today’s issue is really interesting as we’re going to look at PayPal’s focus on efficiency which is starting to pay off (how + a deeper dive on why PayPal is one of the strongest companies in the digital money space), and Mastercard that just redefined digital account opening with open banking (& why open banking is now more important than ever). Let’s jump straight into the cool stuff 🌶

PayPal’s focus on efficiency is starting to pay off 💸

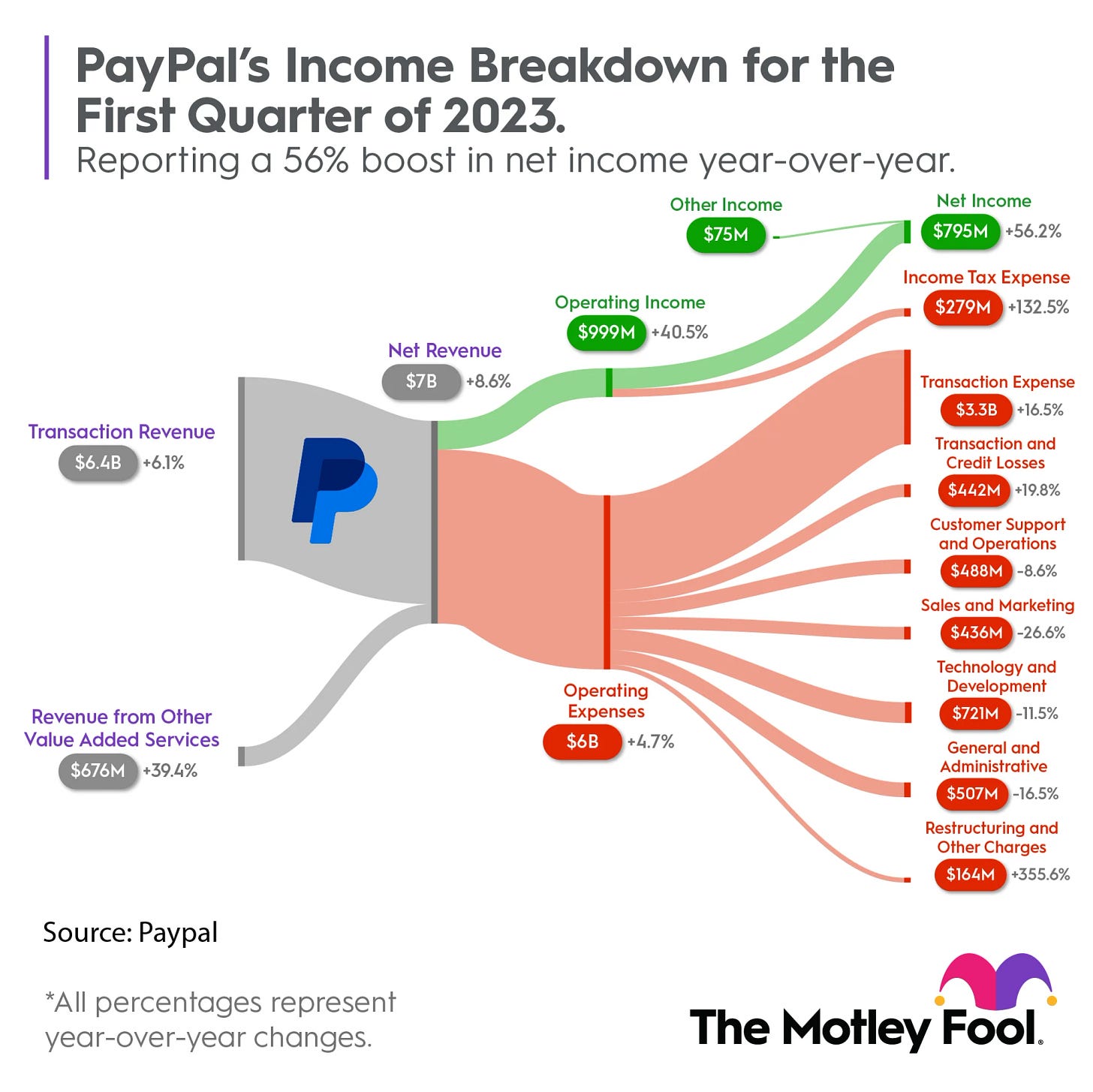

Earnings call 📞 Digital payments pioneer PayPal PYPL -4.31%↓ just reported its Q1 2023 results. They came in rather solid, beating expectations, so let’s take a closer look.

More on this 👉 Here are the key numbers for the latest quarter:

PayPal’s total payment volume (TPV) increased 12% year over year (YoY) in Q1 2023 and hit $354.5 billion, a slight slowdown from the 15% YoY jump during the same period in 2022.

The volume came from 5.8 billion transactions, up 13% YoY. This averaged to 53.1 transactions per active account.

Net revenues grew 10% YoY to reach $7.04 billion, compared with 8% growth a year ago.

How we got here? 🤔 We must remember that at the start of Q1, PayPal laid off 7% of its staff, or about 2,000 workers, to cut costs and focus resources on core growth segments. PayPal is “just at the beginning [of] a multiyear efficiency journey,” CEO Dan Schulman said during the earnings call.

But what’s next? 🤔 Here’s the takeaway & 3 primary growth drivers to focus on + a deeper dive into why PayPal is one of the strongest companies in the digital money space: