JPMorgan is developing a ChatGPT-like AI service for investors 😳; Klarna to achieve profitability before the end of 2023 🤑; QED raises ~$1 billion to invest in FinTech 💸

FinTech is Eating the World, 29 May

Hey Everyone,

Happy Monday and welcome back to the regular daily newsletter! Today’s issue is super exciting as we’re looking into JPMorgan which is developing a ChatGPT-like AI service for investors (why it’s a game-changer + 10 deeper dives into AI + Finance); Klarna that’s to achieve profitability before the end of 2023 (+ a deeper dive into Klarna & how it’s doubling down on AI), and QED that raised ~$1 billion to invest in FinTech (+ bonus reads on how to make your fundraising efforts much easier & 60,000+ startup resources). Let’s jump straight into the hot stuff 🌶

JPMorgan is developing a ChatGPT-like AI service for investors 😳

The MASSIVE News🔥 JPMorgan JPM 0.00%↑, one of the biggest and most powerful banks in the world, is developing a ChatGPT-like artificial intelligence service for investors called IndexGPT 😳

It’s a game-changer.

More on this 👉 The banking giant applied to trademark a product called IndexGPT earlier this month. The service will tap cloud computing software using AI for analyzing and selecting securities tailored to customer needs.

The USP 🥊 In the same way you now use OpenAI's ChatGPT for writing or coding, you can soon use JPM's IndexGPT to help pick, analyze, and recommend financial securities like stocks, bonds, commodities, digital assets, etc.

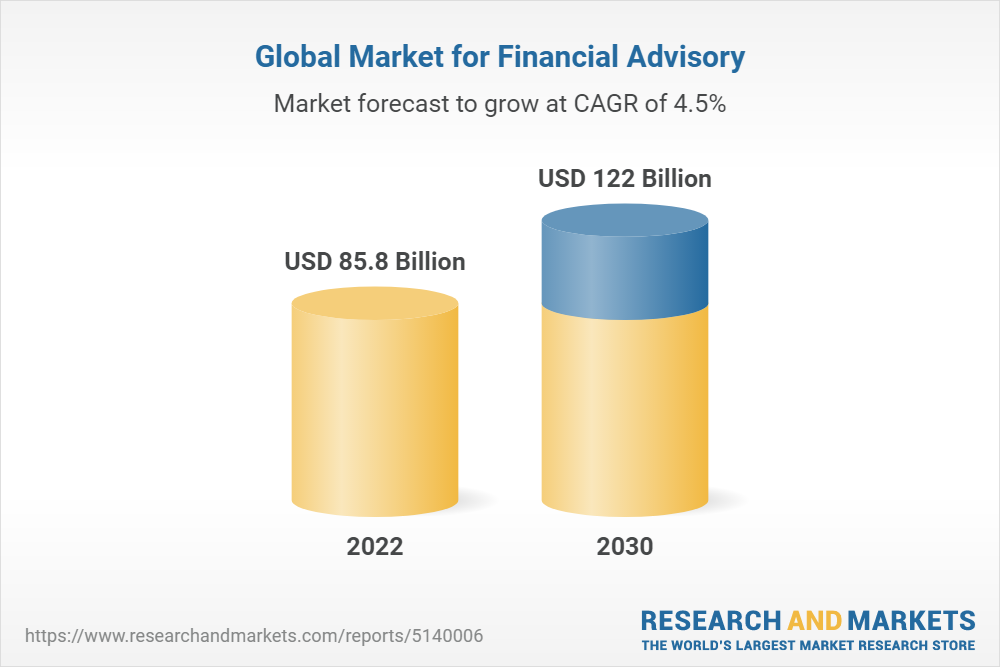

This could be a massive move that can disrupt the traditional financial advisory market currently worth around $90 billion. And that’s just the start.

While banks like Goldman Sachs GS 0.00%↑ and Morgan Stanley MS 0.00%↑ have already begun testing artificial intelligence for internal use, JPMorgan would be the first financial firm to launch a generative AI product directly to its customers.

✈️ THE TAKEAWAY

What’s next? 🤔 This is a big deal but it should come as no surprise. JPM has already built its own ChatGPT-based large language model (LLM) to analyze Federal Reserve statements and speeches in an effort to sniff out potential trading signals. On top of that, JPMorgan Chase boss Jamie Dimon earlier revealed that the bank has more than 300 AI use cases in production 🤯 This yet again proves that the banking giant is super serious about the future and Dimon is walking the walk - JPM now employs more than 2,000 data scientists and machine learning engineers to help build out its AI capabilities. The future of finance will never be the same, but JPMorgan will sure be part of it.

ICYMI: JPMorgan has built its own ChatGPT for Finance 😳

The second-largest US bank failure ever & the Microsoft of Banking 🤯 [+4 more bonus reads]

ChatGPT for Finance is here, and it’s a game-changer 🤯

Bonus: The insurance sector is more and more exploring the benefits of AI 🤖

Generative AI will completely transform FinTech and Banking over the next 3 years 🤖🏦