Adyen just became a bank in the UK 🇬🇧🏦; Square suffers a major outage 🫣; RegTech is rising and raising 💸

FinTech is Eating the World, 8 September

Hey Everyone,

TGIF! Despite a really intense week in FinTech - it’s not over yet 😎 Today’s issue is the best one yet as we’re looking at Adyen which just became a bank in the UK (why this is huge for the future of Adyen + a deep dive into undervalued FinTech giant), Square that suffers a major outage (what can we learn here?), and RegTech, which is rising and raising (if you’re not bullish yet - you should be!). So let’s jump straight into the interesting stuff 🌶

Adyen just became a bank in the UK 🇬🇧🏦

The news 🗞️ Dutch payment giant Adyen recently obtained a full banking license in the UK from the Prudential Regulation Authority and Financial Conduct Authority.

This license is a significant milestone that will allow Adyen to expand its offerings in the UK market and further strengthen its position as the ultimate financial services platform globally.

Let’s take a look.

More on this 👉 The UK license solidifies Adyen's position as a local acquirer in the region. By having full control of its services, Adyen can continue providing its trademark speed, flexibility, and reliability that benefit UK customers. Also, the license ensures Adyen can maintain its full suite of services in the UK post-Brexit under the Temporary Permissions Regime.

Additionally, the license enables Adyen to offer its newly launched embedded financial products to UK platform businesses. These products include business bank accounts, debit cards, and cash advances to provide financial services to SMBs directly within platforms.

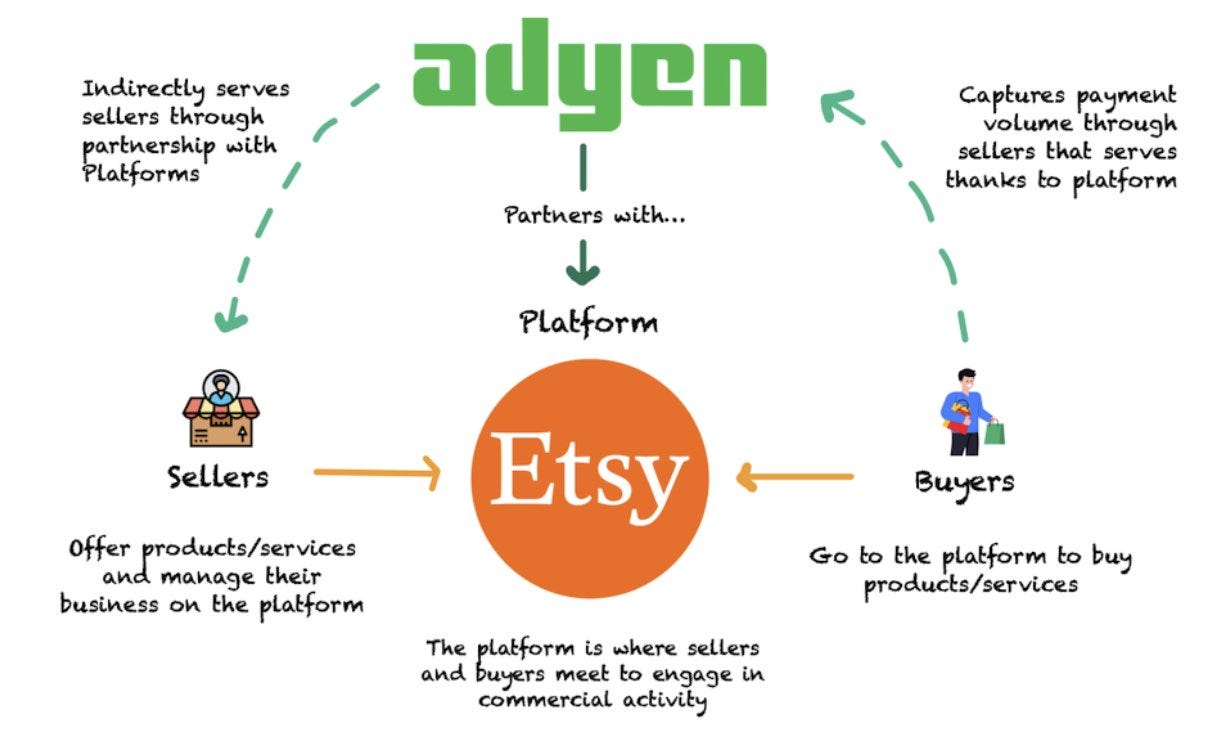

For example, Adyen is targeting platforms such as eBay and Etsy to provide their SME customer bases with direct access to cash advances when they need them. These are the businesses that have massive potential and untapped growth potential.

✈️ THE TAKEAWAY

What this means? 🤔 First and foremost, we must again state that the UK banking license represents a key step as Adyen aims to become a full-spectrum financial services provider globally. We can remember that Adyen has already obtained a banking license in the Netherlands and launched real-time payments through integration with the US FedNow system (the only FinTech and a single European player). The UK license therefore solidifies Adyen's footprint in another major market. Looking at the big picture, Adyen is now very well positioned to leverage its global banking licenses and unified platform to embed customized financial services within platforms (as aforesaid Etsy or eBay) and further compete with other FinTech giants like Stripe. Especially when it comes to huge and complex customers that require non-standardised solutions.

Given the recent collapse of its stock price, this development is yet another strong argument for Adyen’s global growth story.

ICYMI:

+ bonus is a deep dive into Adyen + latest analysis of other important FinTech companies