Cutting Through the Noise: Bitcoin Fundamentals & Why it Was Created

Because you can only connect the dots looking backwards

I've just re-read the Bitcoin whitepaper. Again. I think it's crucial to understand this so you could navigate through the crypto space better, cutting through all the noise, the utter nonsense, and all the BS. Here are the fundamentals and the basics you must know and understand.

P.S. Before we go forward, make yourself a favor and subscribe to this newsletter if you haven’t done so yet (I’m talking about Premium here!👀). You will get at least 2 newsletters every week, 2 monthly digests on FinTech, and Blockchain & Cryptocurrency, and more!

First things first, the whitepaper is called "Bitcoin: A Peer-to-Peer Electronic Cash System" and it was published back in 2008. As the name indicates, the underlying idea of Satoshi Nakamoto (the pseudonymous creator of Bitcoin) was to propose an alternative, purely peer-to-peer cash system that would function without a central authority.

Hence, the term *trustless* as it purely relies on mathematics and code - not any governing body. But it doesn't have any references to gold, inefficiencies in the current (at the time) financial system, problems with fiat currency being inflationary, etc.

In fact, the paper explicitly states that the solution to the proposed problem (more on that later) "can be avoided in person by using *physical currency*" but the issue is that one cannot make payments over a communications channel without a trusted [third] party.

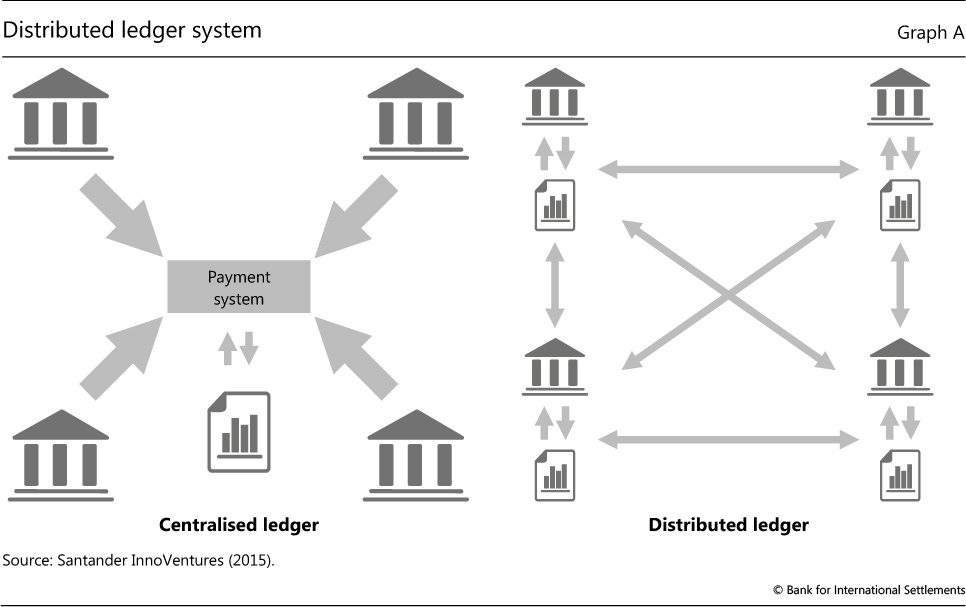

The graph below is a good illustration of traditional (= centralized) vs. distributed (=no central authority) systems.

Problem: commerce has to rely on financial institutions as trusted 3rd parties to make/process payments.

Solution: a p2p version of electronic cash that allows online payments to be sent directly from one party to another without going through a financial institution.

Problem: trust-based model/system, which is seen as inherently weak.

Solution: a trustless model based on cryptographic proof instead of trust, allowing any two willing parties to transact directly with each other.

To prevent double-spending (=you sending the same money twice), the proof-of-work (PoW) mechanism is introduced. The network timestamps transactions by hashing them into an ongoing chain of hash-based PoW, forming a record that cannot be changed without redoing the PoW.

These chains form a block of chains, hence, the term *blockchain* (=database of records). The longest chain not only serves as proof of the sequence of events but proof that it came from the largest pool of computing power.

As long as a majority of computing power is controlled by honest nodes that work for the benefit of the system, it cannot be compromised.

On 21 million Bitcoin Cap:

A fixed supply obviously gives Bitcoin anti-inflationary properties, but the reason it was set to 21 million is hidden in personal correspondence between Nakamoto and software developer Mike Hearn.

Nakamoto intended Bitcoin’s unit prices to eventually align with traditional fiat currencies, so that 0.001 Bitcoin would be worth $1, for instance. He said:

“I wanted to pick something that would make prices similar to existing currencies, but without knowing the future, that’s very hard. I ended up picking something in the middle,” (Nakamoto)

More importantly:

“If Bitcoin remains a small niche, it’ll be worth less per unit than existing currencies. If you imagine it being used for some fraction of world commerce, then there’s only going to be 21 million coins for the whole world, so it would be worth much more per unit”.

So the fundamental idea behind Bitcoin was to create a trustless electronic cash system. Yet, it emerged into being the *digital gold*. Primarily because of Store-of-Value (SOV) feature, which in essence is fueled by the rising price (low supply vs. growing demand).

And this is happening because of the currently pushed narrative (+hype & FOMO on steroids).

At the end of the day, money is valuable as long as people believe in it. Right now, people chose to believe in BTC and/or in its rising price, hence, buying more/continuing to HODL.

If there’s one thing to take away from this read is this…

What you have to be aware of is who's pushing the narrative & why they are doing that. The biggest supporters are *surprise surprise* the people who have a huge vested interest in the rising price of Bitcoin. Thus, they're pumping & hyping it as it directly impacts them and their net worth.

At the end of the day, we're all selfish and looking only for our own self-benefit. But consciously understanding the above is crucial so you could think critically and navigate through all the noise and craziness.

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

Note: this article initially appeared on my Twitter.

***

About: I am a business developer, sales professional, FinTech strategist, as well as Cryptocurrency and Blockchain enthusiast. I'm highly passionate about Financial Technology and Digital Innovation, and strongly believe that it will change the world for the better. Apart from my daily job at a global payments startup where I'm leading the company's expansion into Europe, I'm an active member of the FinTech community and a TechFin evangelist.

If you've enjoyed this piece, don't hesitate to press like, comment on what you think, and share the article with others. Let's spread the knowledge together!

For more, you can check me on LinkedIn & Twitter where I’m sharing my thoughts and insights daily!🔥🚀