Software Ate the World. Is AI Eating Software Now? 🤖

Wall Street is pricing the death of SaaS when it should be pricing the death of the middleman 📉

👋 Hey, Linas here! Welcome to another special issue of my daily newsletter. Each day, I focus on 3 stories that are making a difference in the financial technology space. Coupled with things worth watching & the most important money movements, it’s the only newsletter you need for all things when Finance meets Tech. If you’re reading this for the first time, it’s a brilliant opportunity to join a community of 370k+ FinTech leaders:

One week ago, Anthropic released 11 open-source plugins for its Claude Cowork desktop application.

Not a new model. Not a pricing change. A collection of structured prompts, YAML configuration files, and markdown documents, uploaded to GitHub for anyone to download, fork, and deploy.

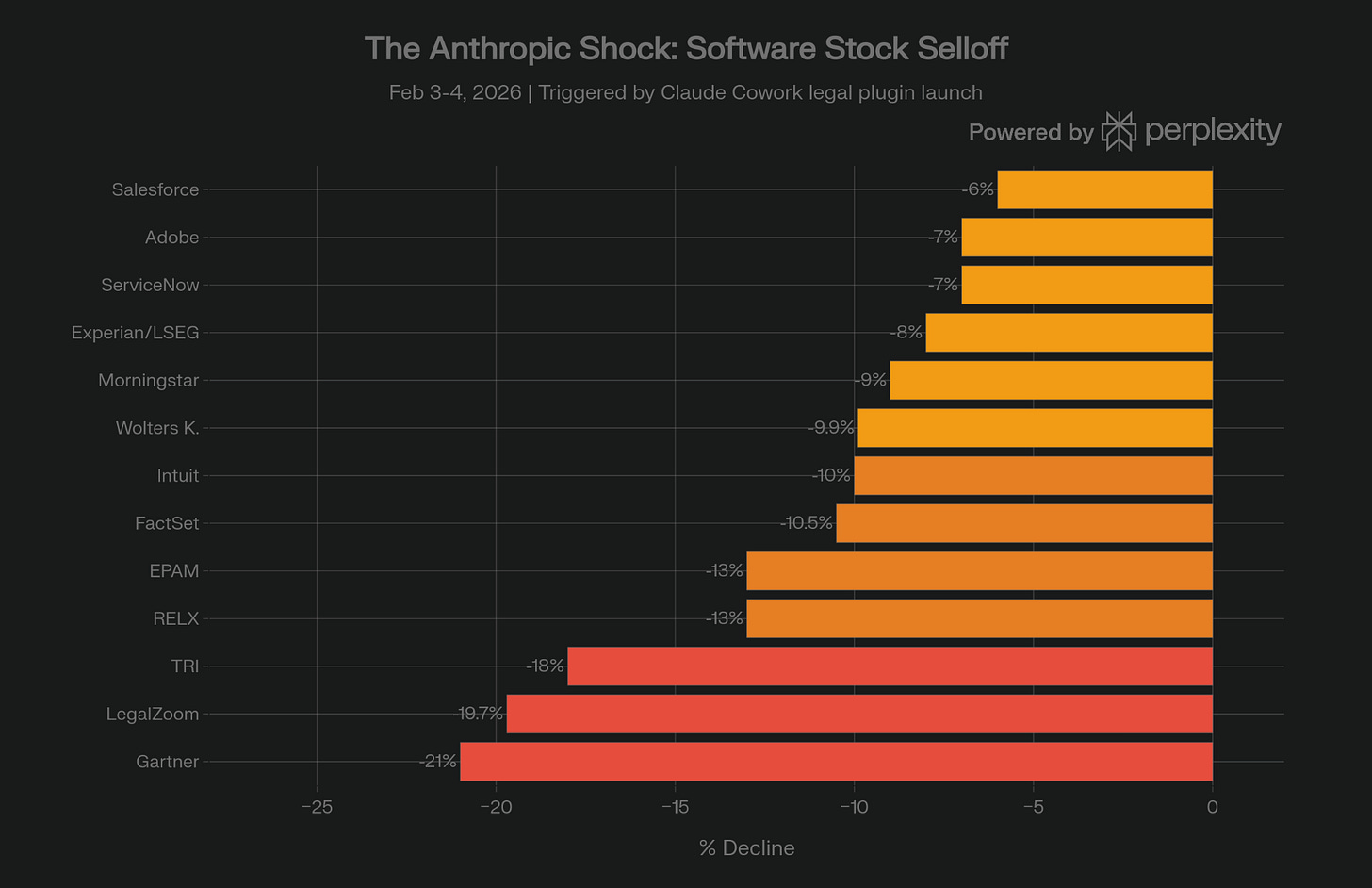

Within just four trading days, software and data stocks shed roughly $285 billion in market value 😳

Thomson Reuters suffered its biggest single-day drop on record, falling about 16%. RELX, the owner of LexisNexis, fell 14% in London. Gartner crashed by more than 21%. LegalZoom lost a fifth of its value. The iShares Expanded Tech-Software ETF entered bear market territory, down 28% from its September 2025 peak.

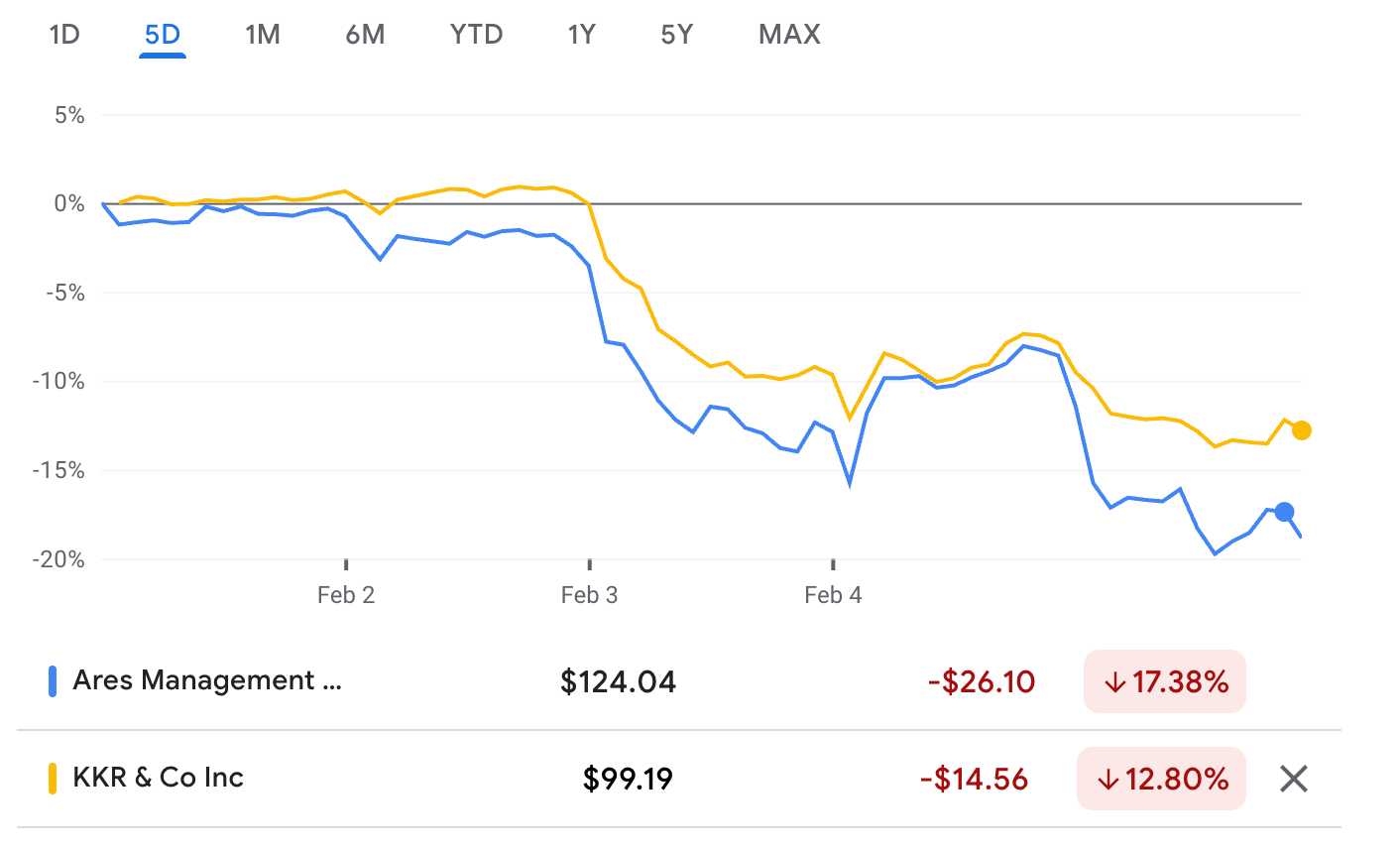

Private equity firms that had spent years loading up on software assets saw their own stocks crater. Ares Management and KKR each fell more than 10% 👀

The selloff triggered an avalanche of SaaS is dead takes.

Pundits on X and LinkedIn declared the end of an era. Analysts at JPMorgan titled their note “Software Collapse Broadens with Nowhere to Hide.” Traders at Jefferies even coined the term SaaSpocalypse. The narrative coalesced around a single idea: AI is eating software, and the entire industry is toast 🍞

That narrative is half right. Which half you understand will determine whether you make or lose money over the next five years.

What Actually Happened

To understand why a batch of text files triggered the largest single-day wipeout in legal tech history, you need to understand what Cowork is and what the plugins demonstrated.

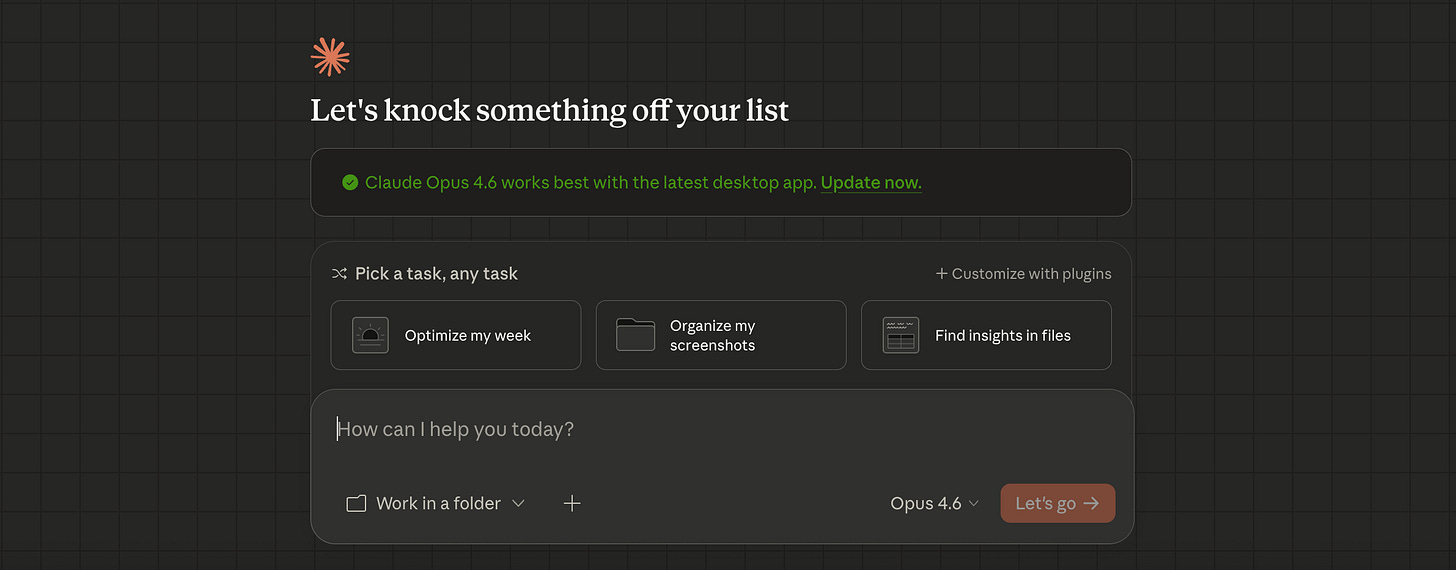

Cowork is a desktop application that gives Claude, Anthropic’s large language model (LLM), direct access to a user’s local file system. It can open folders of PDFs, read them, cross-reference them, and generate output files in the same directory. It can plan multi-step workflows, execute them for hours without human intervention, encounter errors, debug them, and continue. The earlier generation of AI tools were chatbots that responded to prompts. Cowork is an agent that does work.

The plugins targeted specific professional domains: legal, finance, sales, marketing, data analysis, and customer support. The legal plugin automates contract review, NDA triage, compliance checks, and risk flagging. The finance plugin analyzes financial statements and builds valuation models. The sales plugin integrates with CRMs to research prospects and plan outreach campaigns.

What spooked the market wasn’t the existence of these capabilities. It was how they were built.

The legal plugin, the one that triggered Thomson Reuters’ worst day ever, was not a compiled binary or a proprietary software suite. It was a set of markdown files containing structured prompts and configuration instructions. A domain expert could replicate it in an afternoon. As one developer who read the GitHub repo put it: the entire thing was roughly 2,500 lines of structured prompt instructions, “the kind of thing thousands of developers write every day.”

The implication was immediate and devastating for a specific class of companies. If the “business logic” of contract review, the step-by-step playbook a SaaS vendor spent years encoding into a specialized product, could be expressed in a few text files and executed by a general-purpose model, then what exactly were customers paying $15,000 to $20,000 per year in license fees for? 🤔

The Structural Shift Underneath the Panic

The Cowork plugins were an accelerant, not the origin, of this repricing. Three forces have been converging for over a year, and understanding each one is the only way to distinguish signal from noise.

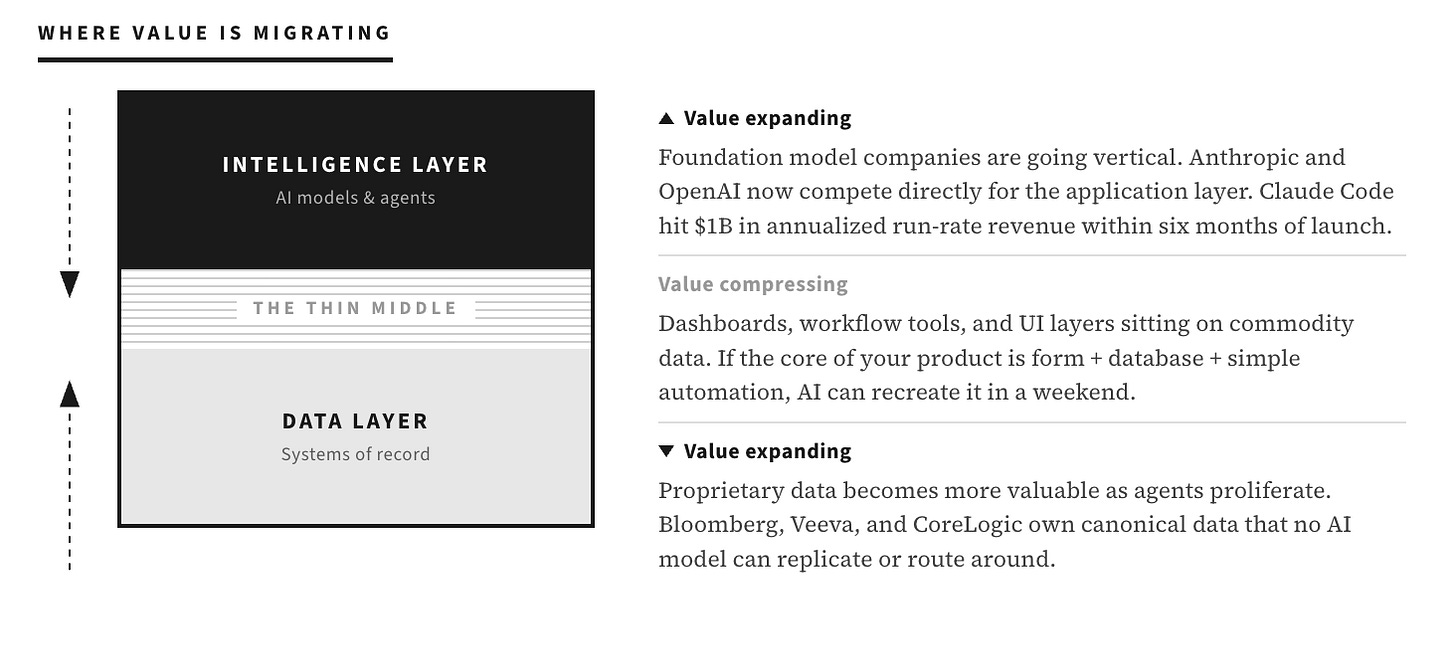

→ The first force is that foundation model companies are going vertical. For years, the tacit agreement in the AI ecosystem was that model makers like Anthropic and OpenAI would provide the plumbing, and application-layer companies would build products on top. Anthropic broke that agreement. By packaging model, workflow, and domain-specific configuration into a single free product, it positioned itself as a direct competitor to the legal tech, sales tech, and finance tech vendors that were previously its customers. OpenAI amplified the message the same week by launching Frontier, an enterprise platform for building and managing AI agents that connect directly to CRM, HR, and internal systems. “What we’re fundamentally doing is transitioning agents into true AI co-workers,” said Barret Zoph, OpenAI’s GM of business-to-business. The foundation models are no longer neutral infrastructure. They are competing for the application layer 📱

But the Cowork plugins are only part of the picture. As we covered in-depth last week, Anthropic’s MCP Apps launch may be the more structurally important move. Ten software companies - Asana, Figma, Slack, and others - volunteered as launch partners for a feature that lets Claude render their interfaces directly inside the chat window. Users can drag Asana tasks, edit Figma diagrams, and query Amplitude charts without ever leaving Claude. The pitch was productivity. The subtext was that these companies just handed their user relationships to an AI company. For two decades, SaaS bundled three things: data, logic, and interface. The interface was the moat. MCP Apps unbundles the interface. The app becomes a backend. The companies that showed up did so not because they wanted to, but because the alternative - being invisible to the agentic workflow - was worse.

→ The second force is the collapse of the build vs. buy equation. For over two decades, companies bought SaaS because building custom software was too slow and too expensive. Generative AI is inverting that logic at speed. Netlify’s CEO recently described employees using AI to build internal replacements for survey and quoting tools. StackBlitz’s CEO said, “There are many SaaS vendors we would have likely previously used that are no longer relevant.” Publicis Sapient is reportedly cutting traditional SaaS licenses by roughly 50%, substituting them with generative AI tools. FinTech giant Klarna ditched Salesforce and Workday, consolidated onto its own AI-augmented stack, and used an OpenAI-powered bot to handle customer service work that previously required 700 employees. When the marginal cost of building a custom tool approaches zero, the SaaS vendor’s value proposition has to be about something more than the tool itself 📊

→ The third force is the structural impairment of per-seat pricing. The SaaS investment thesis was built on headcount expansion: more employees meant more seats, which meant more revenue. If an AI agent makes one employee as productive as three, the company buys a third of the licenses. The software doesn’t get replaced. The headcount that justifies the seats does. In other words, AI doesn’t kill the software directly. It kills the headcount that uses the software, which kills the per-seat revenue model, which kills the business. BCG’s buyer survey found 40% of enterprise customers cite seat reduction as their primary lever to cut software spending. AlixPartners predicts that hybrid usage-based and outcome-based pricing models will account for over 40% of AI software revenue by the end of 2026 📈