Bitcoin in 2021: a story in 5 graphs, and what might come in 2022

Tesla buying Bitcoin, Coinbase going public, NFTs exploding - all contributed to a fascinating 2021. But what 2022 will bring for Bitcoin?

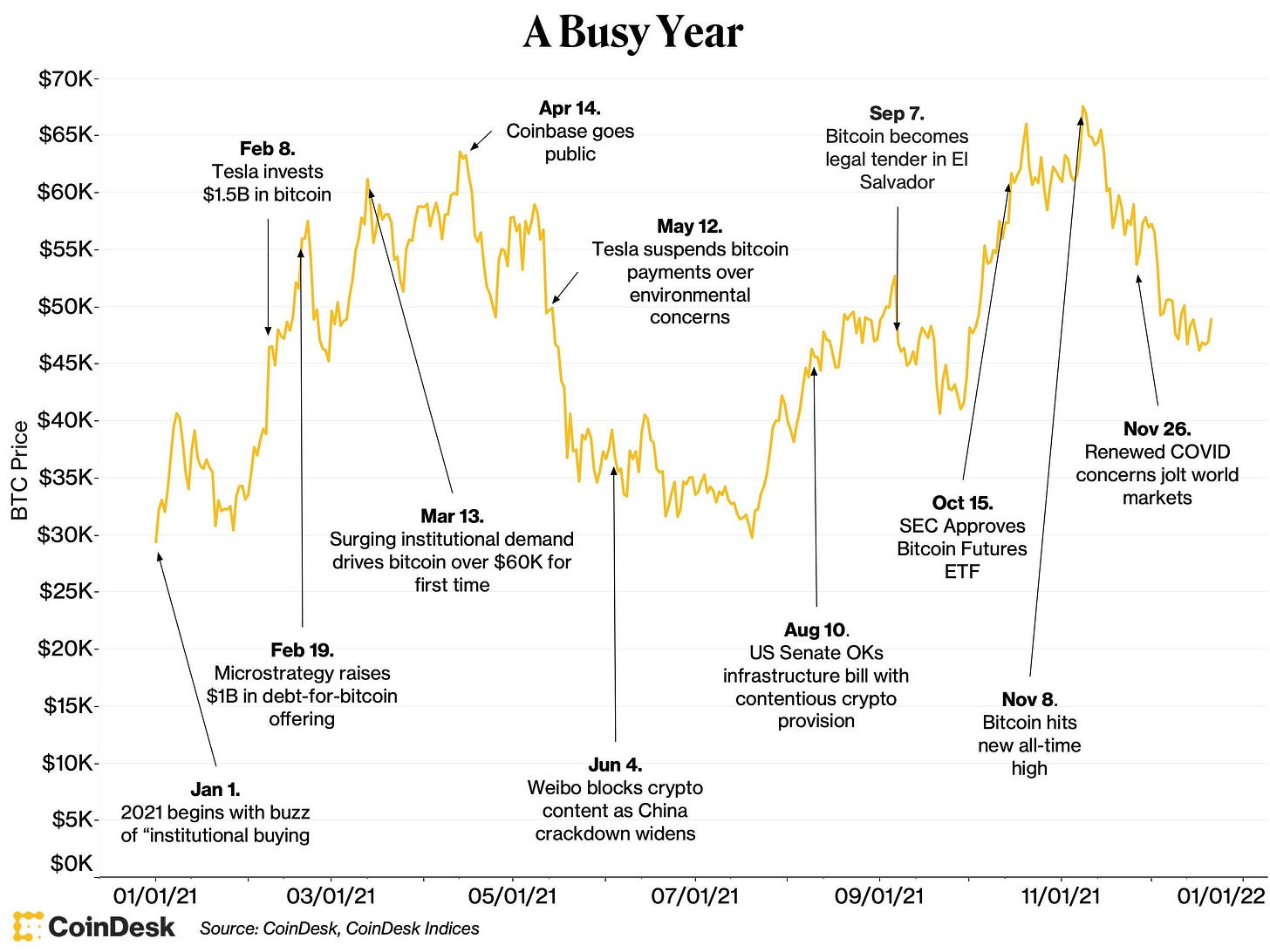

2021 was another crazy year for the crypto markets, and especially for the biggest and most popular crypto out there - Bitcoin. Institutional buying buzz, Tesla investing into Bitcoin, Coinbase going public and marking the first-ever crypto exchange to IPO, NFTs exploding, El Salvador🇸🇻 buying the dip while China🇨🇳 cracking down on Bitcoin miners were only a few among many developments that shaped and pushed 2021 forward. It was a real rollercoaster! 🎢

The graph below is a good snapshot that chronologically depicts some of the biggest events of that year:

But this article isn’t about the events or most important developments that took place last year. What I wanted to do was to have a step back and look at 2021 holistically, so we could see a bigger picture. Both for Bitcoin and crypto markets in general.

That said, I invite you to take a look at the 5 graphs that help put things into perspective and paint a rather consistent story as to what 2021 was all about.

P.S. Before we go forward, make yourself a favor and subscribe to this newsletter if you haven’t done so yet (I’m talking about Premium here!👀). You will get a daily newsletter on all things where Finance meets Technology, plus more great stuff. It’s the only newsletter you need to connect the dots in FinTech, and more!

No Santa Claus in December🎅

Let us start the review in December. The last month of 2021 was a hectic month for the investors. Well, not all - only crypto investors. Everyone who put their money into boring old large-cap stocks recorded solid returns while those who kept it parked at crypto felt miserable.

That said, the S&P 500 gained 6% in December, while Bitcoin and Ether lost nearly 19% and 20%, respectively. Ouch.

So it’s clear that the Santa Clause didn’t come to the December party and the year was ended on a negative note.

Not a bad year in retrospect 📈

Despite unpleasant December, one cannot say that 2021 was a bad year. Quite the opposite - looking at the bigger picture, crypto investors should not be disappointed at all as 2021 was a fantastic year in retrospect. Returns on Bitcoin came in at nearly 60%, while Ether shot up as much as 387%. Boom. The S&P 500, on the other hand, wasn’t that good but still managed to return a solid 28%.

Hence, almost everyone won who was in the market. The Bull market 🐂

Volatility is still the story 🤷♂️

One important point for portfolio managers (and you if you have a diversified portfolio) though is that crypto volatilities were still outstanding when compared to stocks. That means risk-adjusted returns were a mixed bag. If you are all in crypto, you most certainly could have had a heart attack… A couple of times 😬

By the way, Ether is a huge outlier here, even outperforming Bitcoin.

Redistribution of wealth 💎🤲

Looking at the on-chain data, some interesting things have happened. First, let us take a look at the changes in supply.

As it can be seen from the Glassnode graph above, in 2021 there has been a noticeable redistribution in coin supply from Short-Term Holders to Long-Term Holders (=someone that holds Bitcoin for at least 155 days as per Glassnode).

Long-Term Holders have hence added 1.84M BTC to their holdings, bringing their total stack to 13.33M BTC (an increase of 16% over the year). Meanwhile, Short-Term Holder supply has declined by 1.42M BTC, with this cohort currently holding ~3M BTC (decline of 32% on the year). Finally, Sovereign Supply, defined as all coins held outside exchange reserves, is currently at an all-time high of 13.34M BTC.

Furthermore, as a proportion of Sovereign Supply, Long-Term Holders have seen their ownership stake increase by 4.8% to reach 74.8% of sovereign supply, whilst STHs ownership has declined from 28.0% in Jan, to 25.2%.

That said, one can conclude that this subtle transfer of wealth from Short-Term to Long-Term Holders, regardless of multiple price ATHs over 12 months, suggests that 2021 could be described as a macro consolidation and coin redistribution from weaker (=paper) hands to those with stronger (=diamond) hands and having a longer-term conviction aka the Bitcoin Bulls.

Put it in other words, the HODLers were hodling and accumulated more while the speculators have reduced their Bitcoin stack.

Exchange balances remained stable ⚖️

Exchange Balances have seen very little net change over the course of the year. According to Glassnode, exchange reserves have declined from 2.623M BTC at the start of the year, to 2.560M BTC. This is a net decline of 67.8k BTC, a reduction of just 2.5% from the opening balance.

As it can be seen from the graph above, the Net Volume in/out of exchanges has spent 2021 oscillating between ±5k BTC. Moreover, during the last week of the month, we have seen another reversal from net exchange outflows, back to net exchange inflows. This is something to keep an eye on in the coming weeks.

✈️ THE TAKEAWAY

To sum things up and put all 5 graphs together, we can say the following:

Santa Clause didn’t come to the party in December and the year was ended on a negative note. Bitcoin dropped ~19%.

Nevertheless, the year was good in retrospect and almost everyone who was in the market made money. Bitcoin returned ~60%.

Volatility is still part of the story with crypto being crazy volatile compared to stocks. Ether > Bitcoin here.

In 2021, we saw a modest redistribution of wealth where the HODLers were hodling and accumulated more while the speculators have reduced their Bitcoin stack.

Finally, exchange balances were oscillating sending mixed signals, which makes it worth keeping an eye on in the next couple of weeks.

All-in-all, 2021 has definitely been a wild ride for Bitcoin investors, traders, HODLers, analysts, miners, and critics alike. Having the protocol Taproot upgrade implemented, the miners relocating out of historically dominant China, Bitcoin in 2021 could be summarised as a year of macro, high time-frame consolidation, although a volatile one.

What’s next? 🤔

2021 was interesting, exciting and it’s gone. The most interesting question now is so what’s next?

While it’s relatively easy to give crazy predictions here, especially if you’re a Bitcoin maximalist, I won’t do that. What I do believe makes the most sense now is to take a look at what happened in the first two weeks of 2022 and see how that might shape the upcoming year.

What we have seen during the first week of January were mostly bearish signals. Despite a spike in transaction count, which is likely due to increased selling demand, network activity in terms of active addresses, new addresses, and active supply were all down week-on-week. Hence, Bitcoin’s market cap fell a significant -7%. Moreover, though Kazakhstan’s🇰🇿 government shut down internet access across the country, the hash rate remained up nearly +9% during the week, which further illustrates the strength of the protocol. But don’t salute just yet.

On the second week of January, we have seen the on-chain activity falling. Again. The only exception was when it comes to the new addresses, which saw a significant +3.8% rise. The transactions fell a whopping -43% week-over-week ostensibly being driven by increased selling demand. That said BTC's market cap fell another notable -7.4% this week to ~$801B. Furthermore, we have seen a completely different story when it comes to the hash rate - it has dropped -1.5% to 180.39 EH/s after rising nearly +9% last week. One must note that Bitcoin's hash rate is still down -12.8% from its all-time high of 203.5 EH/s recorded on January 2. Finally, Bitcoin's miner market cap experienced a decrease of -3.4% suggesting miners may be taking some profits at these levels.

All in all, it’s clear that the market is sending bearish signals 🐻. We only see a slight demand for the coin while the majority of on-chain metrics point us to the dominance of HODLers in accumulation. Which is again typical for bearish markets with low retail interest.

Add that to the FED that’s trying to combat inflation more and more, and it’s clear that we’re currently in a downtrend and there are no signs of a decisive reversal in sight. The downward pressure on the price is thus expected to continue until the market fully prices in the tighter-than-expected future monetary policy.

And nobody can tell you when that’s going to happen. But it will eventually. So fasten your seatbelts and follow the markets closely for the next couple of weeks - they are going to be interesting for sure.

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

***

About: I am a business developer, sales professional, FinTech strategist, as well as Cryptocurrency and Blockchain enthusiast. I'm highly passionate about Financial Technology and Digital Innovation, and strongly believe that it will change the world for the better. Apart from my daily job at a global payments startup where I'm leading the company's expansion into Europe, I'm an active member of the FinTech community and a TechFin evangelist.

If you've enjoyed this piece, don't hesitate to press like, comment on what you think, and share the article with others. Let's spread the knowledge together!

For more, you can check me on LinkedIn & Twitter where I’m sharing my thoughts and insights daily!🔥🚀