Too fast, too luxurious: lessons from the failure of Stripe-backed Fast

Moving fast is not the same as going somewhere.

Disclosure: trying and failing at something is infinitely better than having a perfect solution in your dreams. But there is a massive difference between a well-intended failure and a blatant hoax. You be the judge.

If you’re working in the financial technology space, you most definitely have heard about Fast, a payments company that reportedly offered the fastest online checkout on the entire Internet. Even if you haven’t, I think you should because it offers some great takeaways for startups beyond just FinTech.

Despite having raised hundreds of millions of dollars, Fast has just failed and closed shop. Apparently, it was just too fast and too luxurious.

But let’s take a holistic view here, map out all the red flags, and most importantly focus on the lessons to learn. For FinTechs & tech startups, venture capitalists, and startup employees.

The Fast Brief

Before we take a deeper dive, let’s do a quick recap of Fast.

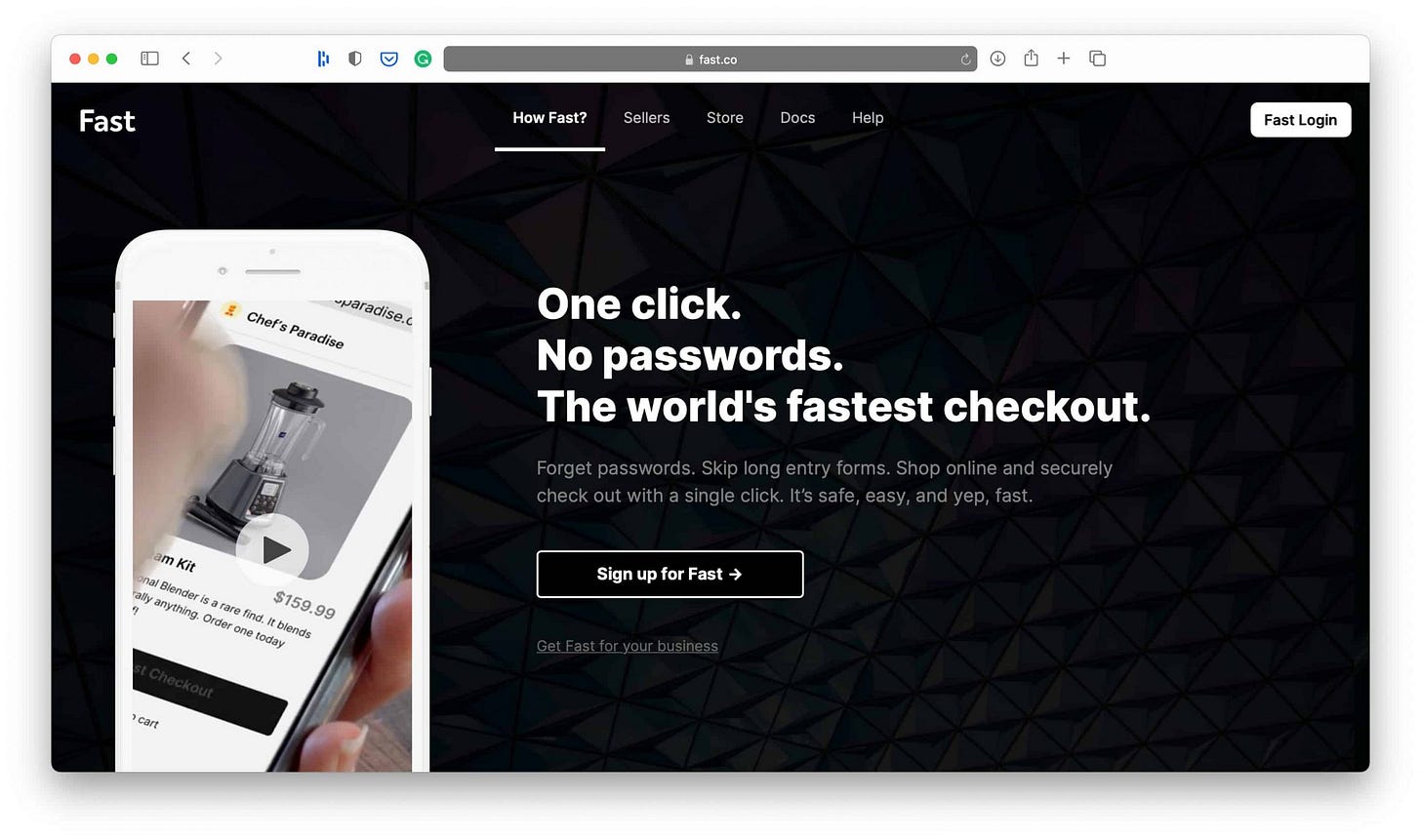

Founded in 2019, Fast was a US-based payments FinTech that offered a one-click purchasing process aka one-click checkout that reportedly took less than a second, without requiring a password or manually inputting information for every order you made. Buyers were automatically signed up for Fast after their first purchase, making future shopping effortless on any website with Fast. Additionally, sellers could also place Fast Checkout on individual product pages, enabling buyers to forego the clunky shopping cart process altogether.

Before closing the door, the 3-year-old firm has managed to raise a whopping $124.5 million from a number of prominent investors and VCs. Besides payments giant Stripe, which led both their Series A & Series B, other investors include Index Ventures, Susa Ventures, and Global Founders Capital.

But the exciting part begins elsewhere.

The Founder

A conversation about a startup should begin with its founding team. In the case of Fast, it was its co-founder and chief executive Domm Holland. He was the public face of the company previously claiming to be the world’s fastest CEO (well, that ended really fast). And he was quite a character.

Despite charisma and great marketing skills, his past was full of red flags. It still blows my mind how he managed to raise crazy amounts of money and hire hundreds of great people. Here’s Holland’s impressive CV:

The CEO's real name is not "Domm". It's actually "Dominic", and he’s an Australian native.

Dominic got his start by punking Australia’s biggest airline, Quantas. In 2010, Holland bought the domain Qant.as for $20 and waved it in the face of the airline. He threatened to sell it to a rival airline and began redirecting all traffic to rival Virgin Blue's site. He eventually sold the domain for $1.3M.

Holland later founded Tow.com.au, or as he called it - "the Uber of towing". His towing company provided a quick way to contact towing contractors when vehicles had violated reckless driving laws. It ended up with a $15M dispute, going bust, and firing staff via text messages. The crazy part? Because of the dispute, Domm threatened to sell the private bank account and driver’s license data of 21,000 drivers.

Dominic then traveled to the US, the one & only Silicon Valley, and started what would eventually become Fast. He hence hired contractors remotely from Nigeria at ~$200/week. Once he raised funding off the back of what they built, he terminated everyone and never acknowledged their work.

I’m not here to judge, but the above alone are some really huge red flags showing that Domm Holland has no respect for any business ethics or morale altogether, and he fundamentally doesn’t care about his employees or the people he works with.

The Product

When we talk about one-click checkout or just 1-Click, we must understand that it’s anything but new. E-commerce giant Amazon has created it, filed the patent in 1997, and secured it in 1999. Back then, the idea that consumers could enter in their billing, shipping, and payment information just once and then simply click a button to buy something going forward was unheard of and magical. More importantly, it represented a breakthrough for the idea of hassle-free online shopping and undoubtedly gave a solid boost both to Amazon and the overall e-commerce sector.

September 12, 2017, marked the end of an era as the patent expired for Amazon’s “1-Click” button. As an effect, PayPal, Apple, Shopify, Stripe, and Bolt all jumped on the technology. Fast joined the crew in March 2019.

The problem with one-click checkout is that it’s a really tough business model - it has no real moat, so it’s all about scaling and scaling fast. And scale is often very difficult in payments.

An even bigger problem was that there was practically no differentiation and nothing unique in what they were offering (apart from great marketing). Fast was like Shop Pay or Amazon Pay, just that… There’s no just, that was literally it.

That said, in order to validate Fast’s proposition, one had to believe that (a) customers will be more likely to checkout with Fast over Shop Pay/Amazon Pay/Apple Pay, etc. OR (b) Fast would provide 10X better merchant service than Shop Pay/Amazon Pay/Apple Pay, etc. None of this was true.

But Fast believed otherwise. In fact, they managed to sell this to investors too. Here’s one of the last slides from their pitch deck which was used to raise $20M in Series A:

(I will teardown their pitch deck soon too, laying out both the good & the ugly, so hit the subscribe button if you haven’t yet so you won’t miss it)

One of the craziest things here is that soon after funding them, Stripe built their own “remember card details” feature into their Checkout product. It’s called Link with Stripe, and it’s literally the same thing that Fast was doing.

The Traction

The fact that you aren’t the first in the market or that your product isn’t unique doesn’t necessarily mean you can’t be successful. Examples from Google, Stripe, and Facebook prove that. But as noted earlier, payments is all about economies of scale and traction. Fast didn’t have either.

Despite raising a whopping $124.5M since its 2019 inception, the company’s burn rate was wild - Fast was said to be burning as much as $10 million. Every single month. Unsustainable is an understatement here.

Despite burning $10M/month and having more than 500 people, Fast managed to do only $50,000 per month in sales. That’s beyond nuts.

Regardless of operating as a charity, Fast didn’t refuse to spend ridiculous amounts of money on marking. Following the $102M raise, the company even agreed to pay Chainsmokers $1 million for their performance in a company event. Let that sink in.

All the flashy lights and extravaganza did create FOMO & hype. But mainly for VCs and not the core business, which was probably in huge trouble since Day 1. I’ve also read some stories that Fast was offering as much as $10,000 for some websites so that they would just integrate its checkout solution. If that’s actually the case, it pretty much summarises everything.

The Lessons

You have made it up to this point, congrats! Having covered all the ins and outs of Fast, it’s time for the lessons.

I genuinely believe Fast story is a brilliant teacher for everyone, including startups, venture capitalists, and employees. Here are the brief lessons for all of them:

For FinTechs & Startups

Startups are hard, but FinTech is harder. Especially if you are in payments. Payments is all about scale and traction, and that’s very hard to achieve with one-click checkout as a standalone business because it has no moat.

Crowder market. Although launched in 2019, Fast entered an already crowded market which meant that it will be very hard to build loyalty. Even more importantly, in a world where Shop Pay/Amazon Pay/Apple Pay already has massive traction and almost limitless resources, Fast had to either attract lots of customers and make them change their buying habits or provide 10X better merchant service than the incumbents. None of this was true.

Making money > raising money. Because getting the startup right is so much more than raising capital. Hence, Fast is a classical case study for all entrepreneurs reminding them that they should focus more on revenues rather than just fundraising. This is pretty basic, but it seems that it’s being forgotten way too often as we tend to glorify loud funding rounds over bootstrapping in silence.

Don’t hire too fast. Being just 3 years old and barely generating any revenue, Fast managed to employ more than 500 people. Not only there’s no Fast now, but lots of those people (and some are really great people) will be left without anything. As Paul Graham has brilliantly put it back in 2015, hiring too fast is by far the biggest killer of startups that raise money. It killed Fast fast too.

For VCs

Don’t allow the hype to ignore proper due diligence. This is primarily related to the founding team and CEO in particular. As briefly presented above, Domm Holland’s CV was more than colorful. Once: a mistake. Twice: a pattern. There were obvious patterns and red flags that could have easily been identified with just a quick Internet search. If I ever will be in venture capital, I will avoid this type of founders at all costs.

Business model validation beats FOMO. We can easily understand that it’s hard not to write a cheque when you see your buddies have already done that, some even twice. It becomes even more difficult when you see payment giants like Stripe on the cap table too. But it’s clear VCs should have asked that Fast must have validated its business model first (or for a longer) before raising that kind of money. Otherwise, it’s not investing - it’s gambling (though some investments are gambles).

With great money should come great responsibility. Fast news makes you seriously question how their quarterly board meetings were conducted (if at all). Were financials, partnership pipeline, etc. not discussed at all? This should be a default setting, especially in such a competitive field as payments FinTech. But if you’re only giving money and don’t care about the performance whatsoever, then you’re in the wrong game IMHO.

For Employees

Do VC level due diligence. Just not the one that was done by Fast investors... 😬 If you're joining a startup, you should always be vetting the company and founder like a proper VC would (or should). First and foremost, check the background of the founder(s) (=founder-market fit), the structure of the founding team and their experience, the amount of money raised to date, competitors, GTM strategy, what's their competitive advantage, etc. It might be time-consuming at first, but it will save you a lot of headaches down the road.

What’s your CAC? If you are interviewing for a job at a growth-stage VC-funded startup, one of the first questions you should always ask is "What is your CAC?" aka customer acquisition cost (in current and future steady-state). This tells you a lot about how scaleable the company's business model is. If they cannot answer that, run from them and never look back.

Equity is worthless until it isn’t. 9/10 of startups fail, which means that regardless of how attractive your stock options or equity is, there’s a 90% chance they will be worthless when you can exercise them. Even more important is the fact that at the present time they are worthless too - paper value doesn’t pay the bills. Hence, don’t ignore the importance of having a competitive salary, and don’t allow any startup to make you live below your means just because they sold you their vision (or cool hoodies). Vision doesn’t pay the bills.

All in all, we can confidently say that Fast was way too fast and too luxurious. The fact that Stripe didn’t acquire them and just allowed them to fail tells you a lot. Let’s hope the lessons will be learned and better solutions will be born out of this story.

It’s time to build now.

If you found this useful, first - go Premium:

Then - share it with others and spread the word: