Venture Capitalists Love Them: 10 Biggest FinTech Funding Rounds of 2020

“Raising venture capital is the easiest thing a startup founder is ever going to do”,- Marc Andreessen

2020, the year which everyone will remember as the year of the pandemic, was very successful for the Financial Technology space. Venture Capitalists have poured more than $42 billion into various FinTech ventures. That’s $3.5 billion every month… 🤯

It’s worthwhile to note that 2020 has set a record for FinTech mega-rounds (deals worth $100 million+), which undoubtedly shows strong investor appetite for large, mature, and developed FinTech enterprises.

Let us take a look at the 10 biggest FinTech funding rounds of 2020, mapping the names, business verticals, and key backers.

P.S. Before we go forward, make yourself a favor and subscribe to this newsletter if you haven’t done so yet (I’m talking about Premium here!👀). You will get at least 2 newsletters every week, 2 monthly digests on FinTech, and Blockchain & Cryptocurrency, and more!

Zooming Out

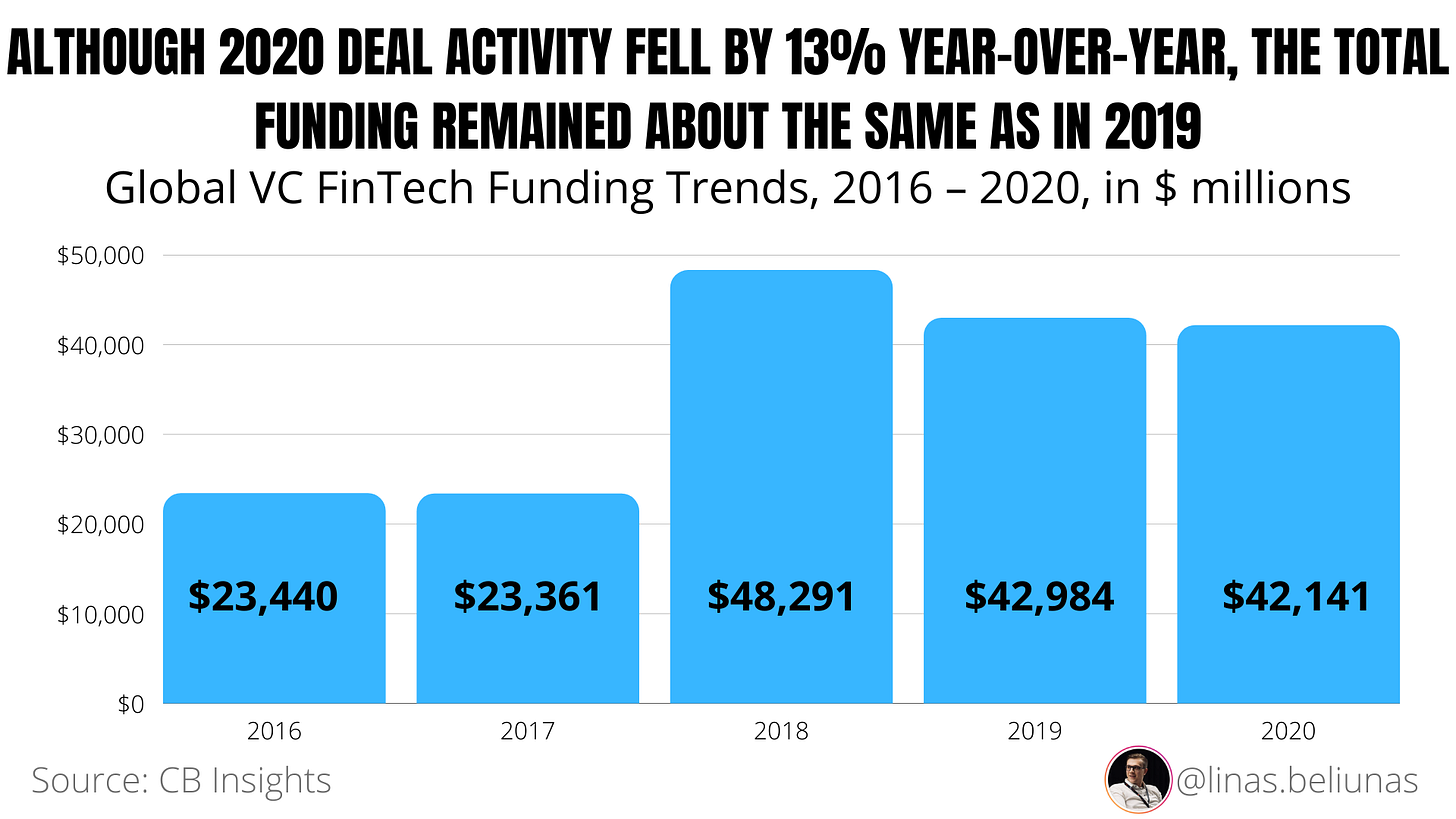

First, let us take a look at the bigger picture. FinTech 2020 in a nutshell:

As it can clearly be seen, both funding and deal activity in 2020 declined slightly. Funding fell 2% while deal activity dropped by 13% year-over-year (YoY), CB Insights found. What’s interesting here is that deals in every FinTech vertical fell except for SME, which grew 13% YoY.

Furthermore, it must be noted that the FinTech industry has recorded as much as 97 mega-rounds, surpassing 2019’s total of 92 mega-rounds. Mega-rounds represented as much as 54% of all FinTech funding. Will that become a trend? 2021 FinTech funding will certainly show.

Let us now go briefly over the top 10 biggest FinTech deals in 2020.

Robinhood ($660 million, September)

US brokerage heavyweight Robinhood in September has raised an additional $460 million round to add to their $220 million raised in August and hence closed their Series G funding. This brought their valuation to $11.2 billion at the time.

Their Series G was led by Sequoia, Andreessen Horowitz, and 9Yards Capital.

Bonus: Robinhood: Robbing the Poor to Give to the Rich? A Story about the Fragility of the Brand

Klarna ($650 million, September)

Swedish Buy Now, Pay Later provider has netted a jaw-dropping $650 million in its latest funding round in September. This was also the biggest funding of the year in Europe and it has thus made the company Europe’s most valuable FinTech, as well as gave Klarna a $10.65 billion valuation ahead of its rumored IPO.

The funding was led by Silver Lake.

Stripe ($600 million, April)

San Francisco-headquartered payments giant brought in a $600 million injection in April, its biggest to date. It must be noted that this was an extension to the company’s Series G round, which was first confirmed in September 2019 with $250 million raised. The new capital brought Stripe a $36 billion post-money valuation.

Series G was led by existing investors, including Andreessen Horowitz, General Catalyst, GV, and Sequoia.

Revolut ($580 million, February/July)

London-based Revolut brought the funding in two batches. The $500 million round was announced in February, with an extension in July. The Series D round gave them a $5.5 billion valuation.

One must note that according to CEO Nikolay Storonsky, the company quietly broke even in November last year, putting stronger financial expectations for the year 2021.

The first tranch was led by TCV while July’s extension by TSG Consumer Partners.

Chime ($485 million, September)

The $485 million Series F put the US neobank at a $14.5 billion valuation. That was quite a jump given that Chime was worth $5.8 billion after raising $700 million in December 2019.

In addition to a massive round, Chime also claimed to be EBITDA profitable and that it could be “IPO-ready” in its CEO’s eyes in around a year’s time.

Their Series F was led by Tiger, ICONIQ, and General Atlantic, along with Dragoneer and DST Global.

Toast ($400 million, February)

Boston-headquartered restaurant management startup Toast brought $400 million in a new round of funding in February. This has boosted its valuation to $4.9 billion (nearly double from its last one at $2.75 billion).

The newest funding round was led by Bessemer Venture Partners, TPG, Greenoaks Capital, and Tiger Global Management.

Molo ($345 million, October)

Molo, the UK’s first digital mortgage lender, has raised $345 million in debt and equity funding in October, completing its Series A equity funding round.

The round was led by Macquarie Group (Macquarie) and Patron Capital, as well as Yabeo.

Nubank ($300 million, August)

Brazil's FinTech giant Nubank has raised $300 million in equity investments in August, according to a filing with the U.S. Securities and Exchange Commission.

Five investors participated in the deal, according to the document, which did not disclose their names.

Having 34 million customers, Nubank is worth at least $25 billion today.

Bakkt ($300 million, March)

Owned by the Interconnected Exchange (the owner of the New York Stock Exchange), Bakkt, their digital asset unit that operates a consumer digital wallet and crypto exchange, brought $300 million in March for a consumer market push.

The round was led by ICE, Microsoft’s M12, PayU, Boston Consulting Group, Goldfinch Partners, CMT Digital, and Pantera Capital.

AvidXchange ($260 million, January)

Charlotte-based AvidXchange, a provider of accounts payable (AP) and payment automation solutions for the middle market, announced in January it has raised $260 million in funding. The newest funding brought the company’s value at around $2 billion.

TPG Sixth Street Partners and other unnamed investors participated in the financing.

If there’s one thing to take away here, it’s this…

Investors are increasingly interested in developed and mature FinTech ventures. Some of them might already be too big to fail, and stakes definitely go up with each new round of funding.

Another important thing to stress here is that the COVID-19 pandemic has undoubtedly affected the global FinTech funding, especially when it comes to the early-stage FinTechs. We have already seen examples in Australia, where Xinja had to close their banking operations while 86 400 got acquired by NAB.

The struggle to attract new funding will undoubtedly be one of the key drivers for increased consolidation among FinTechs in 2021.

However, if you are a smaller player in the financial services space it doesn’t mean you can’t and won’t get funded. With the right mindset and great market knowledge, you can do wonders (hint: I talked about it on my LinkedIn post).

The right people and who you know is very important here. Thus, in my next article, I will share a list of the most active FinTech investors, their track record and expertise as well as the main people and partners making the deals. This will be for Premium Subscribers only, so make sure you are part of the community before then.

If you found this useful, first - go Premium:

Then - share it with others and spread the word:

***

About: I am a business developer, sales professional, FinTech strategist, as well as Cryptocurrency and Blockchain enthusiast. I'm highly passionate about Financial Technology and Digital Innovation, and strongly believe that it will change the world for the better. Apart from my daily job at a global payments startup where I'm leading the company's expansion into Europe, I'm an active member of the FinTech community and a TechFin evangelist.

If you've enjoyed this piece, don't hesitate to press like, comment on what you think, and share the article with others. Let's spread the knowledge together!

For more, you can check me on LinkedIn & Twitter where I’m sharing my thoughts and insights daily!🔥🚀