Robinhood to allow retail traders to invest in top AI startups 🤖💰; SoFi becomes first nationally chartered bank to launch crypto trading 🤑📈; Coinbase walks away from $2B stablecoin M&A 😳🪙

FinTech is Eating the World, 12 November

Hey Everyone,

Good morning & happy Wednesday! Today’s issue is especially hot as we’re looking into Robinhood, which is about to crash the private AI market party and allow retail traders to invest in top AI startups (what’s the value proposition here & why it’s interesting + bonus deep dive into Robinhood’s latest earnings), FinTech giant SoFi that just become the first nationally chartered bank to launch crypto trading (what’s the USP here & why it makes sense + bonus deep dive into SoFi’s latest 3Q 2025 earnings), and Coinbase that walked away from $2 billion stablecoin M&A (why it abandoned BVNK purchase & what to expect next + bonus dives into Coinbase & co inside). Let’s just jump straight into the fascinating stuff 🌶️

Robinhood crashes Private AI Market Party: retail investors to get access to top AI startups 🤖💰

The news 🗞️ FinTech giant Robinhood is making a bold push to democratize access to private artificial intelligence investments through its newly announced Robinhood Ventures Fund I.

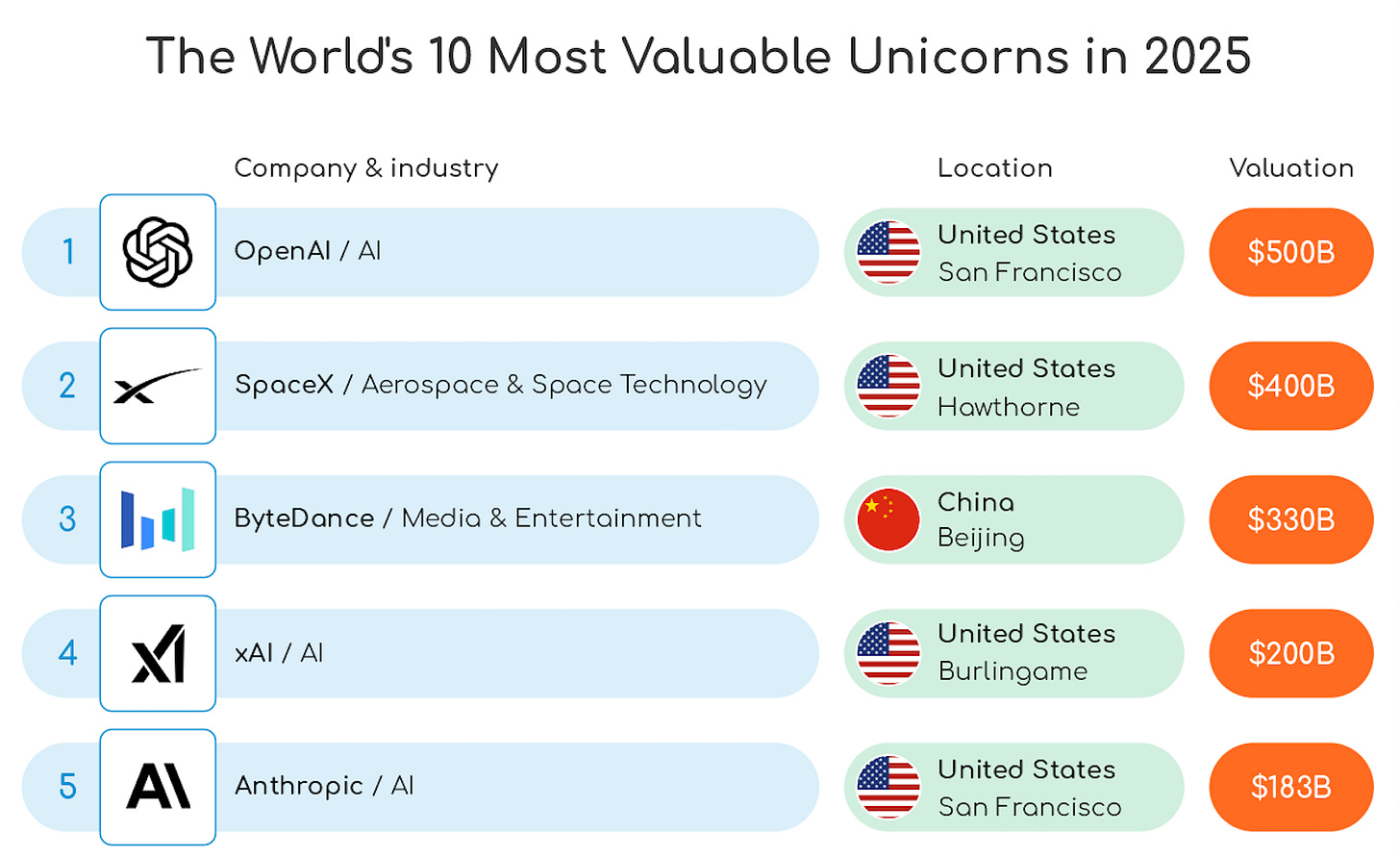

The closed-end fund will offer retail investors exposure to a concentrated portfolio of at least 5 private companies, with particular emphasis on high-growth AI firms like OpenAI and Anthropic that have collectively added nearly $1 trillion in private market valuation over the past year.

Let’s take a look at this, understand why it matters, and what it means for the future of FinTech.