Crypto just got the keys to the US banking system: five digital asset firms secure historic federal charters 🪙🏦; Visa bets big on stablecoins with launch of dedicated advisory practice 🧠💳

FinTech is Eating the World, 16 December

Hey Everyone,

Good morning & happy Tuesday! Today, all eyes are on digital assets as we’re looking into 5 digital asset firms securing historic federal charters (why Circle, Ripple, BitGo, Paxos, etc. wanted to become national trust banks, what it unlocks & what’s next + bonus deep dive into Circle’s latest financials inside), and finance behemoth Visa, which now bets big on stablecoins with the launch of dedicated advisory practice (what’s the USP here & why it’s brilliant + bonus deep dive into Visa & Mastercard & the ultimate list of stables resources inside). So let’s just jump straight into the interesting stuff 🌶️

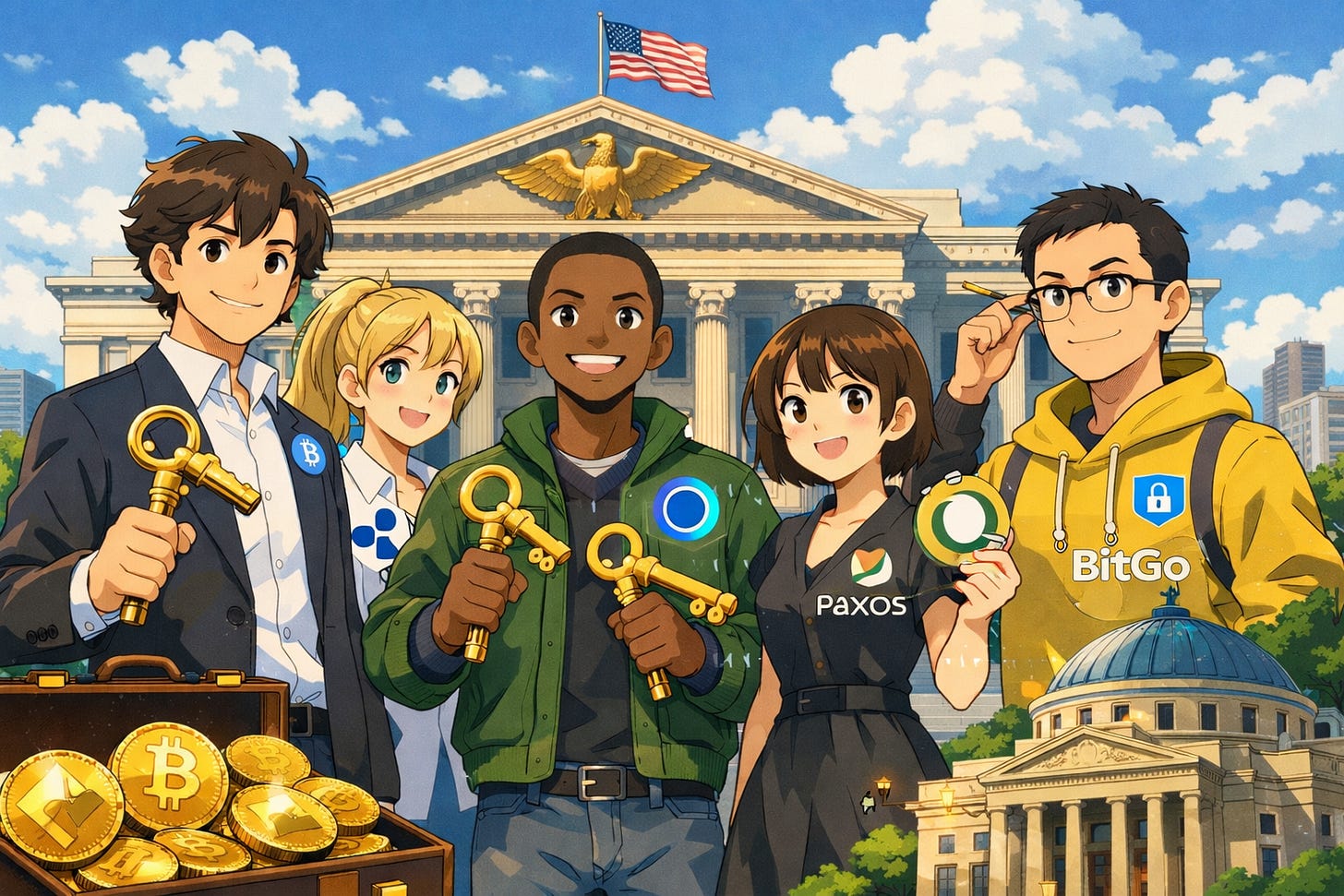

Crypto just got the keys to the US banking system: five digital asset firms secure historic federal charters 🪙🏦

The BIG News 🗞️ The U.S. Office of the Comptroller of the Currency late last week announced conditional approval for five cryptocurrency firms to operate as national trust banks, thus marking a pivotal moment in the integration of digital assets into America’s financial infrastructure.

Stablecoin giants Circle CRCL 0.00%↑ & Ripple, BitGo, Fidelity Digital Assets, and Paxos all received the approvals, with Circle and Ripple establishing new institutions - First National Digital Currency Bank and Ripple National Trust Bank, respectively - while the remaining three will convert existing state charters to federal ones.

Let’s take a look at this, understand why it matters, and what’s next.