The largest bank-FinTech M&A in history: Brex just sold to the banks it once mocked 💳🏦; PayPal is betting AI Agents need a middleman 📈🤖

FinTech is Eating the World, 23 January

Hey Everyone,

Good morning & happy Friday! We’re ending another packed week in the financial technology space, diving into two of the most interesting FinTech M&As in the last 12 months 💸 So today, all eyes are on Capital One buying Brex in what is the biggest bank-FinTech deal in history (who wins the most here, why it matters & what to expect next + bonus deep dives into Brex, its biggest competitor Ramp that’s now fully AI-native, and the list of priceless M&A resources inside), and finance giant PayPal, which is now betting big that AI agents need a middlement (breaking down their acquisition of Israeli AI startup Cymbio, how it brilliantly fits into PayPal’s Agentic Commerce strategy, what’s next + bonus deep dives into PayPal’s AI plays, the ultimate AI Agent stack, and the top 10 AI startups to watch in 2026 inside). So let’s jump straight into the paradigm-defining stuff 🌶️

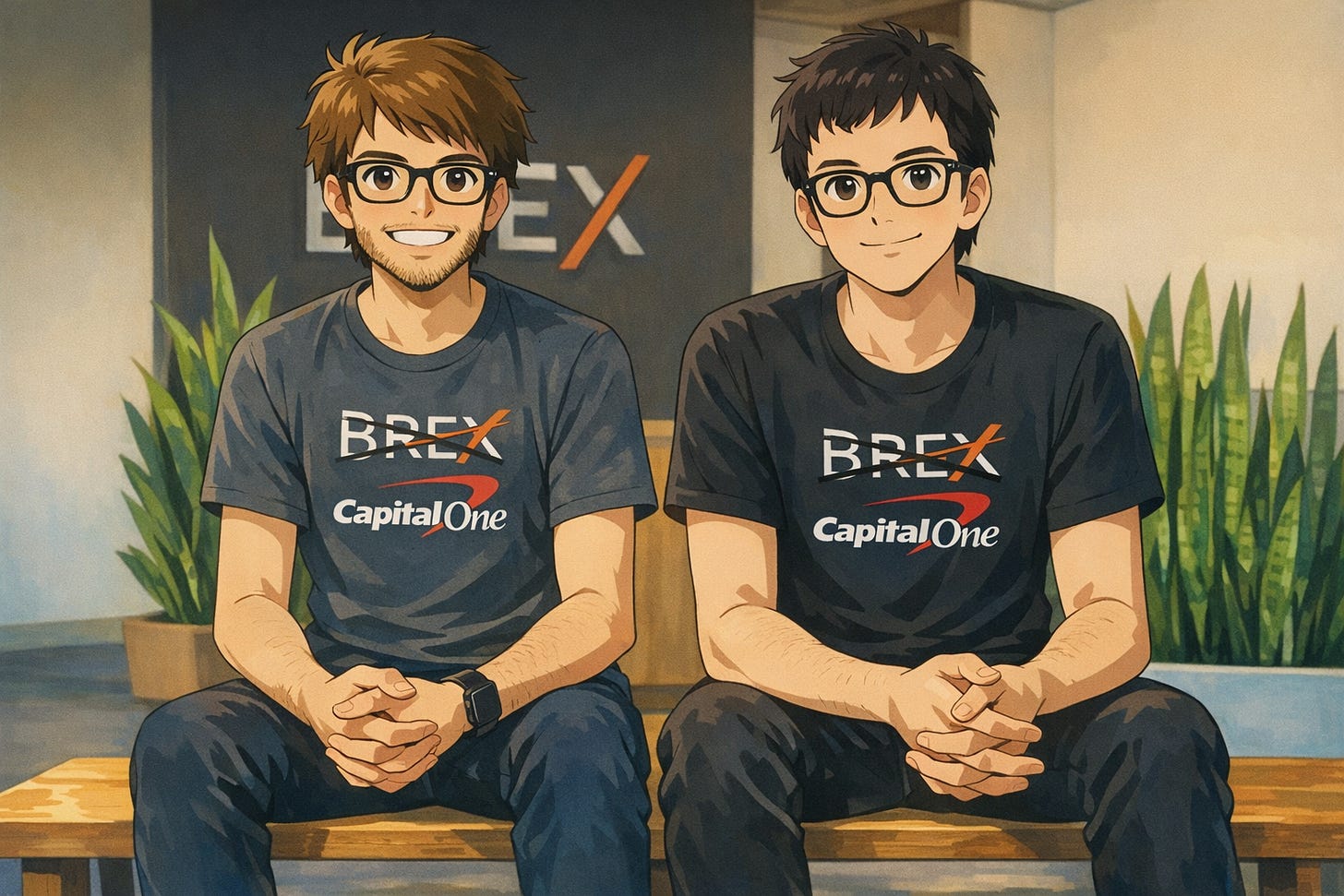

The largest bank-FinTech M&A in history: Brex just sold to the banks it once mocked 💳🏦

The BIG News 🗞️ FinTech giant Brex, the company that built its brand on “startups deserve better than banks,” just sold to Capital One COF 0.00%↑ for $5.15 billion, less than half its 2022 peak valuation 😳 The FinTech correction now has a poster child.

Let’s take a closer look and break down the largest bank-FinTech M&A in history.