Robinhood: the $4.5 billion revenue dark horse Wall Street still underestimates 🤷♂️📉; Shopify is the commerce OS that prints cash while building the rails for AI’s shopping revolution 🤖🛍️

FinTech is Eating the World, 13 February

Hey Everyone,

Good morning & happy Friday! Another amazing fintech week is about to end, and we’re finishing it off with a cherry on the cake 🍰 Today, all eyes are on two category-defining companies - we’re looking into Robinhood to see why it’s still being underestimated by Wall St. (deep dive into their Q4 & full year 2025 financials, what stands out, and why I’m still really bullish), and Shopify, which is the commerce OS that prints cash while building the rails for AI-driven shopping of the future (breaking down their latest most important financial facts & figures, understanding what they mean, and why Shopify should continue growing + deep dive into their UCP co-developed with Google & a competing protocol from Stripe & OpenAI). So let’s jump straight into the underrated stuff 🌶️

Robinhood: the $4.5 billion revenue dark horse that Wall Street still underestimates 🤷♂️📉

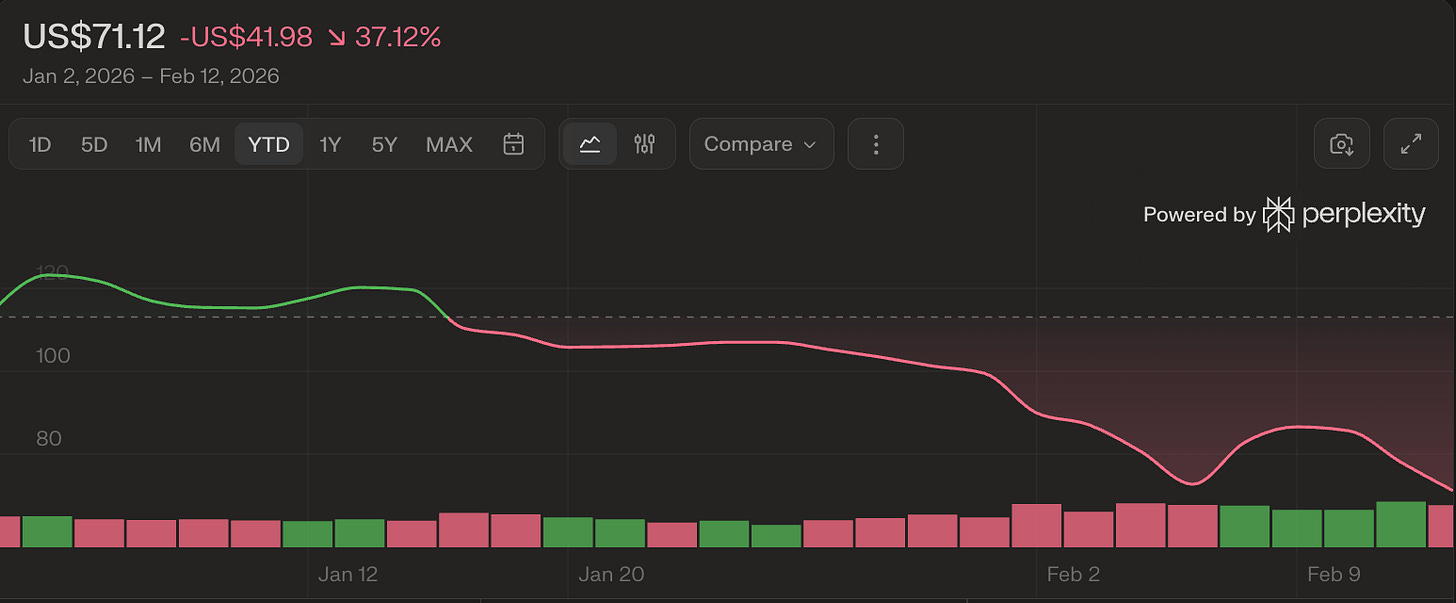

Earnings time 🤑 Robinhood’s HOOD 0.00%↑ stock is down more than 37% year-to-date, over 50% off its October 2025 high of $152. A Q4 revenue miss ($1.28 billion versus the $1.34 billion consensus), a 38% YoY drop in crypto trading revenue, and a broader Bitcoin selloff have cratered sentiment. Analysts are now slashing price targets. The narrative has flipped back to crypto-dependent casino 🥶

And yet: this is a company that just posted $4.5 billion in full-year revenue (+52% YoY), $2.5 billion in adjusted EBITDA at 56% margins, and $1.9 billion in GAAP net income. Most importantly, Robinhood Markets has completed a transformation that most of Wall Street hasn’t fully priced in. The meme-stock-era retail brokerage is now a diversified financial services platform with 11 revenue lines above $100 million. Let that sink in! 🤯

So let’s dive deep and unpack their Q4 2025 and full-year results, and see whether HOOD 0.00%↑ presents a compelling risk/reward profile at these levels.