Coinbase in 2025: crypto’s toll booth operator is building a highway, but the traffic is cyclical 📈📉; Turns out, the real moat in AI Agents isn’t the model. It’s the insurance policy 🤖🛡️

FinTech is Eating the World, 19 February

Hey Everyone,

Good morning & happy Thursday! Today, we’re diving deep into digital asset pioneer Coinbase, which is building a crypto highway, yet the traffic is too cyclical (deep dive into their latest financials, breaking down the most important facts & figures, understanding what they mean, and whether COIN 0.00%↑ is worth your time and money in 2026 and beyond + bonus dive into their biggest competitor Robinhood inside), and ElevenLabs that became the first company to insure their AI Agents (how this changes the paradigm, what this means for Finance/FinTech, Insurance, etc. firms deploying agents & Agentic AI in general + ElevenLabs pitch deck teardown inside). So without further ado, let’s jump straight into the fascinating stuff 🌶️

Coinbase in 2025: crypto’s toll booth operator is building a highway, but the traffic is cyclical 📈📉

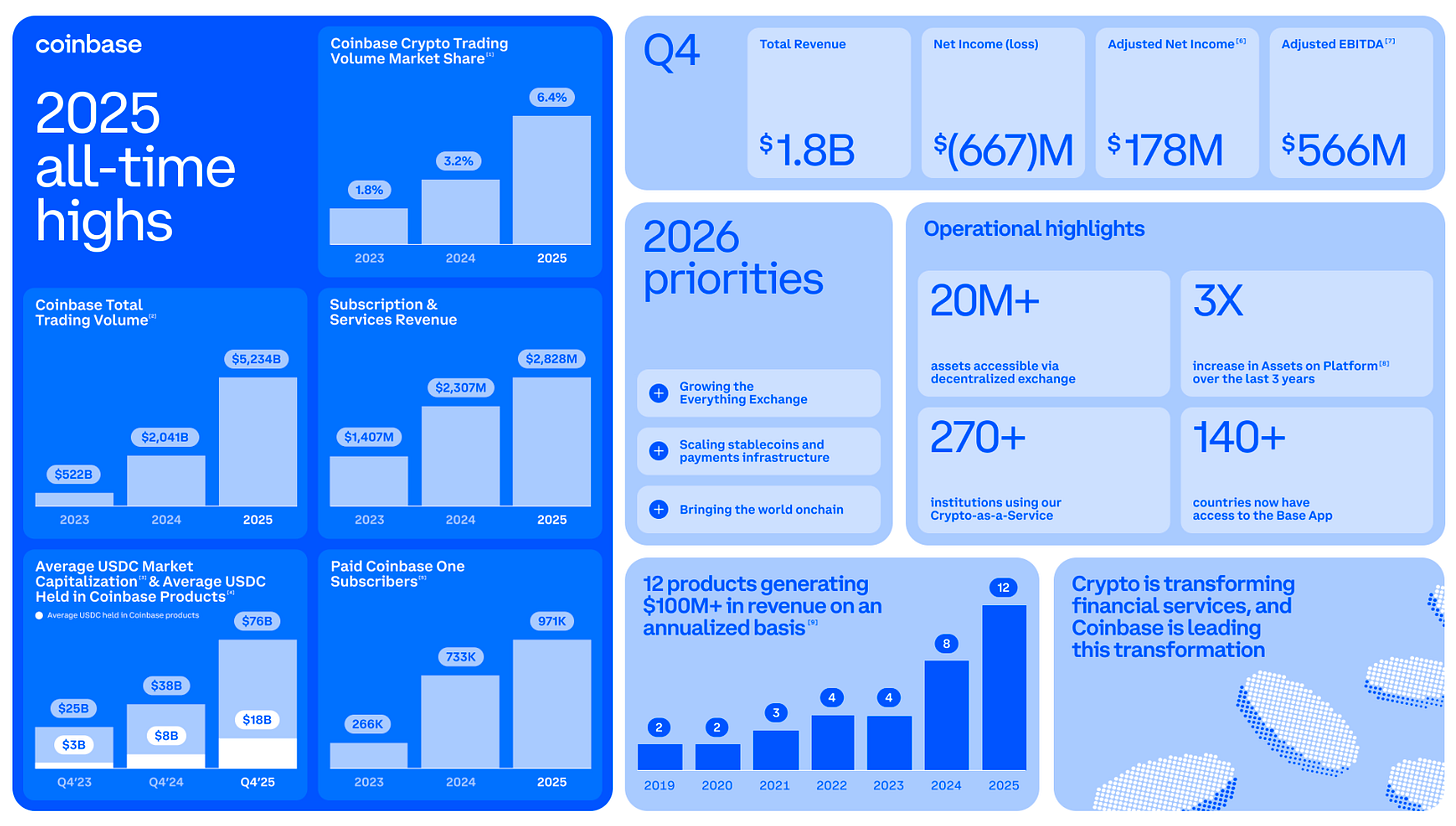

Earnings time 💸 Digital asset pioneer Coinbase COIN 0.00%↑ recently delivered a respectable FY2025 with $7.2B in total revenue (+9% YoY) and $2.8B in Adjusted EBITDA, proving its business model is more resilient than prior cycles suggested.

But the Q4 GAAP net loss of $667M, expanding opex, and the recent ~50% decline in total crypto market capitalization from the early-October peak expose an unchanged core vulnerability: this remains a business whose fortunes track crypto asset prices and speculative retail sentiment 🤷♂️

Let’s dive deeper into their latest financials, uncover the most important facts & figures, understand what they mean, and see whether COIN 0.00%↑ is worth your time and money in the coming years.