The youngest unicorn in LatAm🦄; Growing BNPL appetite in underserved markets 🚀; The growth of narrow-focused neobanks 📲

Good Morning FinTech, December 8

Good day Everyone,

And happy Wednesday! I hope your week is going well thus far. To make it better, here’s a mix of 3 super interesting FinTech stories that I’ve prepared for you today:

The youngest unicorn in LatAm🦄

The funding 💸 The Mexico City-based spend management platform Clara announced its launch in Brazil, an occasion marked by $70M in new funding and a $1B valuation.

The funding round was led by Coatue, an investment firm that has backed tech companies like TikTok owner ByteDance, Deel, Ramp, Melio Payments, Mercury Bank, and the cryptocurrency exchange Bitso.

The crazy part 😳 That valuation comes just 8 months after Clara’s launch, making it the fastest startup to reach unicorn status in Latin America. WoW!

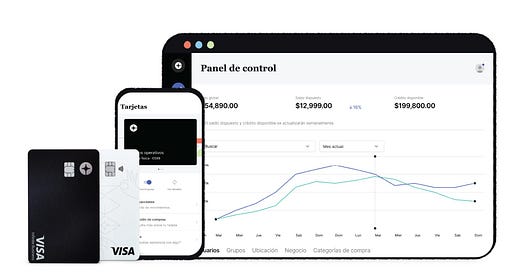

The USP 🥊 The company was founded by Diego García and Gerry Giacomán Colyer and has started operations in Mexico 8 months ago. According to the co-founders, Clara is an end-to-end spend management solution for companies.

In addition to corporate credit cards in physical and virtual formats with no annual fee and customizable limits and restrictions, the company has a platform for controlling expenses. It is used by companies such as Creditas, Casai, and Valoreo, and it saw the volume transacted through its platform increase over a hundred times in Mexico since March. Not too shabby! 😳

Covid impact 👉 It must be noted though that Clara’s growth occurs within the hard-hit Mexican banking sector, rife with branch closures and credit card cancellations.

The coronavirus pandemic has slammed banking in Mexico, shutting down 867 bank branches and axing 1M credit card contracts in Q1 2021. The upheaval also pushed Mexico’s 50 banks into cutting 6% of all points of contact for banking customers. The cuts to physical banking and existing card contracts reduce incumbent banks’ advantages over neobanks—giving digital challengers an opportunity to grow their Mexican customer bases.