Sinking Robinhood reminds the importance of fundamentals & why hiring too fast is a big killer of startups 🧠; One-click Checkout Saga: could Bolt be the next Fast? 🤔; BTC loan from Goldman Sachs? 👀

Good Morning FinTech, 2 May

Good day Everyone,

And happy Monday! I hope you had some time to relax over the weekend break. If not, today’s 3 FinTech stories should definitely get you going - from sinking Robinhood to Fast 2.0 and Bitcoin-backed loans. Let’s jump straight into them:

Robinhood’s latest earnings show (again) the importance of fundamentals & why hiring too fast is one of the biggest killers of startups 🧠

The earnings call ☎️ Stock trading app Robinhood has posted its first quarterly earnings for 2022. The Q1 2022 results haven’t been great and hence their stock was down over 11% in pre-market trading after posting them.

More on this 👉 During the quarter ended March 31, the company saw decreases in trading volumes, monthly active users, and assets under custody. Here’s what you should know:

The number of Monthly Active Users (MAU) decreased 10% year-over-year (YoY), with 15.9M for March 2022, compared with 17.7M for March 2021.

It must be noted that the number of MAU has declined each quarter since hitting a high of 21.3M in the second quarter of 2021. In the most recent quarter, the number decreased by 8%, compared with 17.3M for December 2021.

Total net revenues decreased 43% to $299M, compared with $522M in the first quarter of 2021.

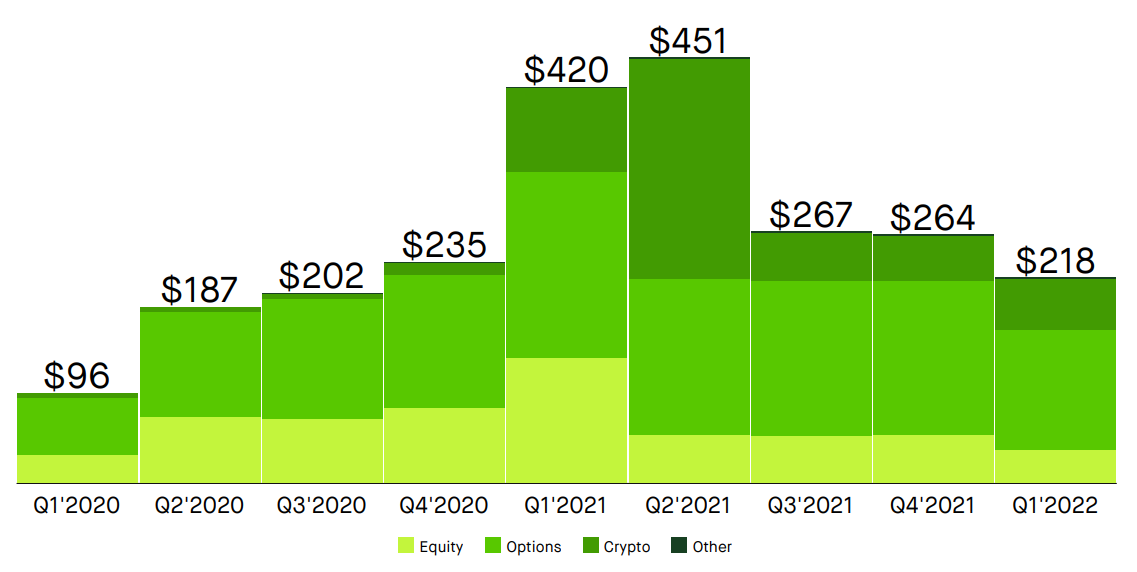

Transaction-based revenues decreased 48% to $218M, compared with $420M in the first quarter of 2021.

Net loss was $392M, or $0.45 per diluted share, compared with a net loss of $1.4B, or $6.26 per diluted share in the first quarter of 2021.

(Robinhood’s transaction-based revenues since 2020)

On top of that, the brokerage app will cut 9% percent of its employees, citing an unwieldy growth curve that resulted in the creation of "duplicate roles and job functions".

This shows us a few things, most notably - the importance of business fundamentals & why hiring too fast could be a killer for your startup. Here’s the takeaway: