Visa + M-Pesa shows rapid rise in Africa’s payment digitization 💳; Value in DeFi is falling. What this tells us abt sector’s health? 🤔; $COIN freezing hiring & rescinding offers = Crypto Winter? 🥶

Good Morning FinTech, 6 June

Good day Everyone,

Happy Monday & greetings from Amsterdam!🇳🇱 I’m in the Netherlands for Money20/20 from Monday to Friday, so there might be only a few daily issues this week (but don’t worry, there’s something else I’m working on right now). Today’s issue is super interesting and important as we’re looking at the significance of the Visa & M-Pesa partnership (for mutual growth & digital payments in Africa), the falling value locked in DeFi and what it indicates about the sector’s health, and whether Coinbase’s hiring freeze & rescinding offers is a sing of a crypto winter (you might not remember what the real Crypto Winter is!). Without further ado, let’s jump straight into the good stuff:

Visa & M-Pesa partnership shows a rapid rise in Africa’s payment digitization 💳

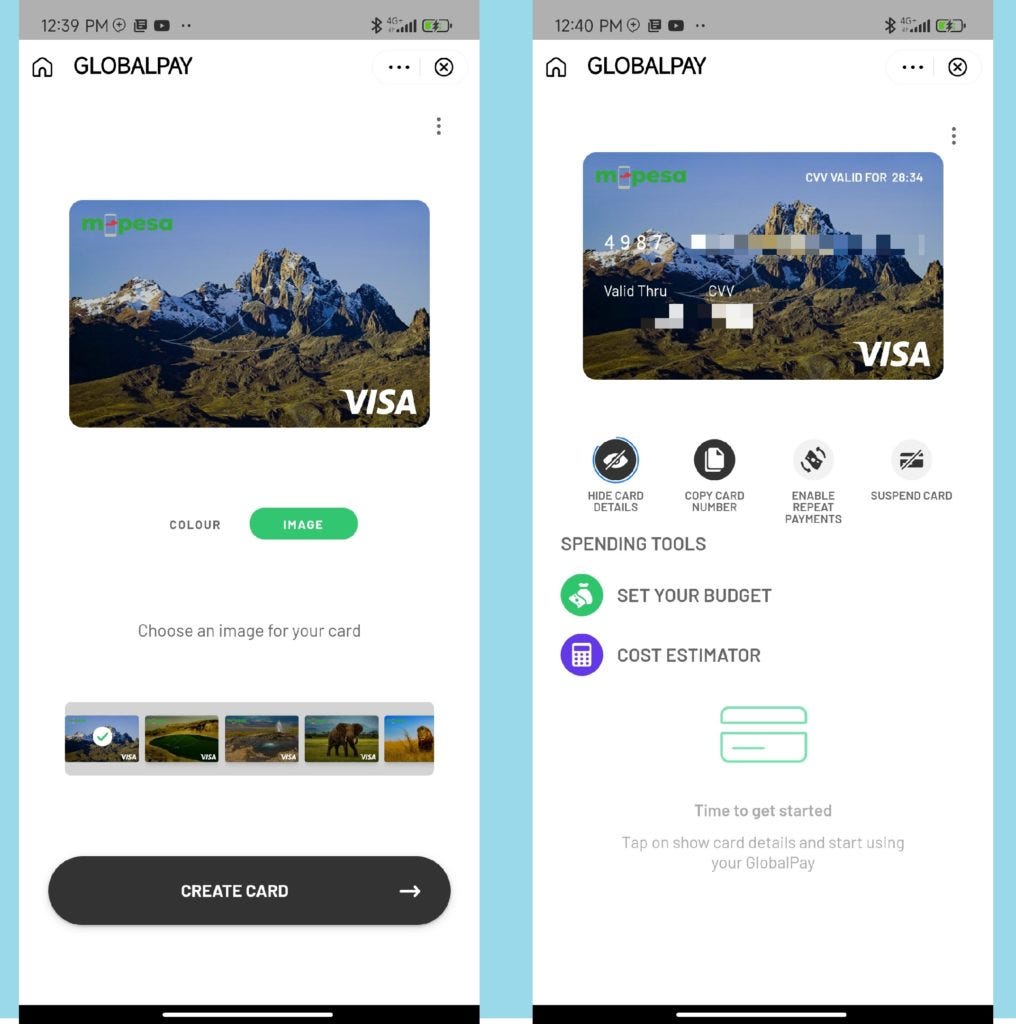

The deal 🤝 Card network giant Visa has partnered with Kenya-based mobile money platform M-Pesa (owned by telecom giant Safaricom) to launch the M-Pesa GlobalPay Virtual Visa Card, TechCrunch first reported.

The virtual card will let users make payments across Visa’s global network with the M-Pesa app or the USSD mobile payment method.

The USP 🥊 Founded in 2007, M-Pesa is a mobile money platform that offers digital payment services through a user’s SIM card. M-Pesa is hence similar to peer-to-peer payment platforms (think Venmo or CashApp here) in that it also lets users send, receive, and hold money in their accounts. Yet, it’s important to note that M-Pesa transactions are sent via SMS messages and no bank account is required to use the service.

The numbers 📊 Since its launch, M-Pesa has amassed 51M users, with 30M in Kenya alone. The system has been quite successful for Safaricom and has become the telecom’s biggest revenue source.

For the perspective, M-Pesa’s revenue increased nearly 40% annually, hitting $92M in the year that ended March 2022, as per TechCrunch.

Why does this matter? 🤔 At the core, digital payments are quickly replacing cash in Africa, which hence makes the region super attractive for digital payment powerhouses like Visa. But there’s more to that, so here’s the takeaway: