Voyager’s bankruptcy & the big revelation of FTX’s involvement🚨; Revolut to battle Square, PayPal & SumUp with their POS reader 💳; Booming creator economy & (huge) opportunities for FinTechs 🚀

Good Morning FinTech, 7 July

Good day Everyone,

And happy Thursday! Today’s issue is super interesting as we dig into the crypto mess to find more about Voyager’s bankruptcy and the big revelation of FTX’s involvement (it’s pretty nasty!), see why Revolut is going head-to-head vs. Square, PayPal & SumUp (it’s all about the biz segment!), and look at the booming creator economy with huge and still untapped opportunities for FinTechs. Let’s jump straight into the good stuff:

More crypto mess: Voyager’s bankruptcy and the big revelation of FTX’s involvement🚨

The news 🗞 Crypto lender Voyager Digital has recently filed for Chapter 11 bankruptcy protection, becoming the second high-profile crypto firm to do so in recent days. It is estimated Voyager had more than 100,000 creditors and up to $10B in assets. Not too shabby!

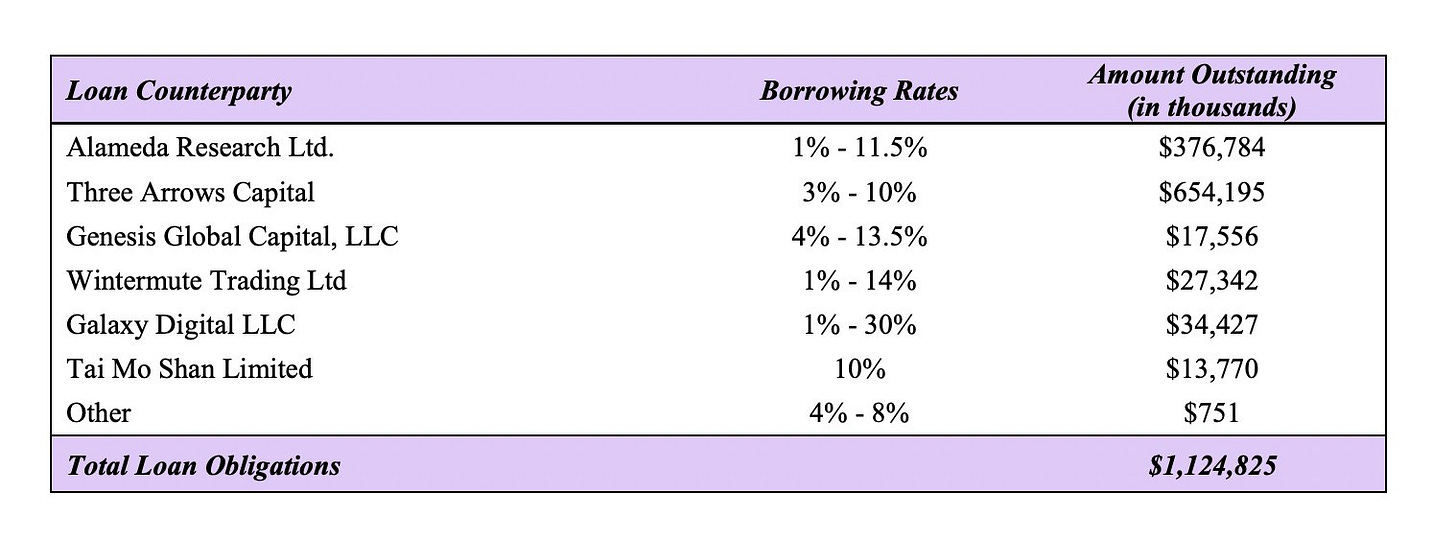

More on this 👉 Voyager’s loan book reportedly accounted for nearly half of its total assets, and nearly 60% of that loan book was composed of loans to wobbling hedge fund Three Arrows (3AC). Voyager also faces a possible delisting from the Toronto Stock Exchange as a result of the bankruptcy.

The spices🧂 The devil lies in the details, or in this case - in Chapter 11 filing. According to it, Alameda aka FTX aka SBF owes the company as much as $376M. We can remember that Alameda Research, the firm founded by crypto billionaire Sam Bankman-Fried last month extended a $500M line of credit to a crypto broker.

This raises some serious questions and concerns. Here’s the takeaway: