Brutal Robinhood layoffs & yet another red flag for stock trading FinTechs 🚩; JPMorgan is building a travel agency 🤯; Massive payments consolidation continues as Global Payments buys EVO for $4B 😳

Good Morning FinTech, 3 August

Good day Everyone,

And happy Wednesday! Today’s issue is super hot as we are looking at brutal Robinhood layoffs, which is yet another red flag for stock trading FinTechs (if you’re currently building or operating a stock trading app, don’t miss this), JPMorgan building a travel agency (it’s setting up an AmEx challenger & it makes a ton of sense!), and continuing massive payments consolidation as Global Payments buys EVO for $4B (what’s the catch & why more megamergers might come in 2022). Let’s jump straight into the hot stuff:

Brutal Robinhood layoffs & yet another red flag for stock trading FinTechs 🚩

The news 🗞 Once a stock trading champion, Robinhood yesterday announced that the FinTech firm will reduce its headcount by approximately 23%, or by more than 700 people. The layoffs will be primarily in operations, marketing, and program management, the press release said.

Robinhood laid off 9% of its workforce in April, which means that more than 1,000 people have now been let go since then. That’s brutal.

How we got here 👉 HOOD 0.00%↑ has been struggling lately. Hence, it’s not surprising that they announced the layoffs on the same day Robinhood released its second quarter financials. Here are the key metrics:

Robinhood revealed a 6% increase in net revenue of $318M on a net loss of $295M.

However, that revenue number was still well below the $565M reported in the second quarter of 2021.

Transaction-based revenue was down 7% to $202M while cryptocurrencies increased 7% sequentially to $58M.

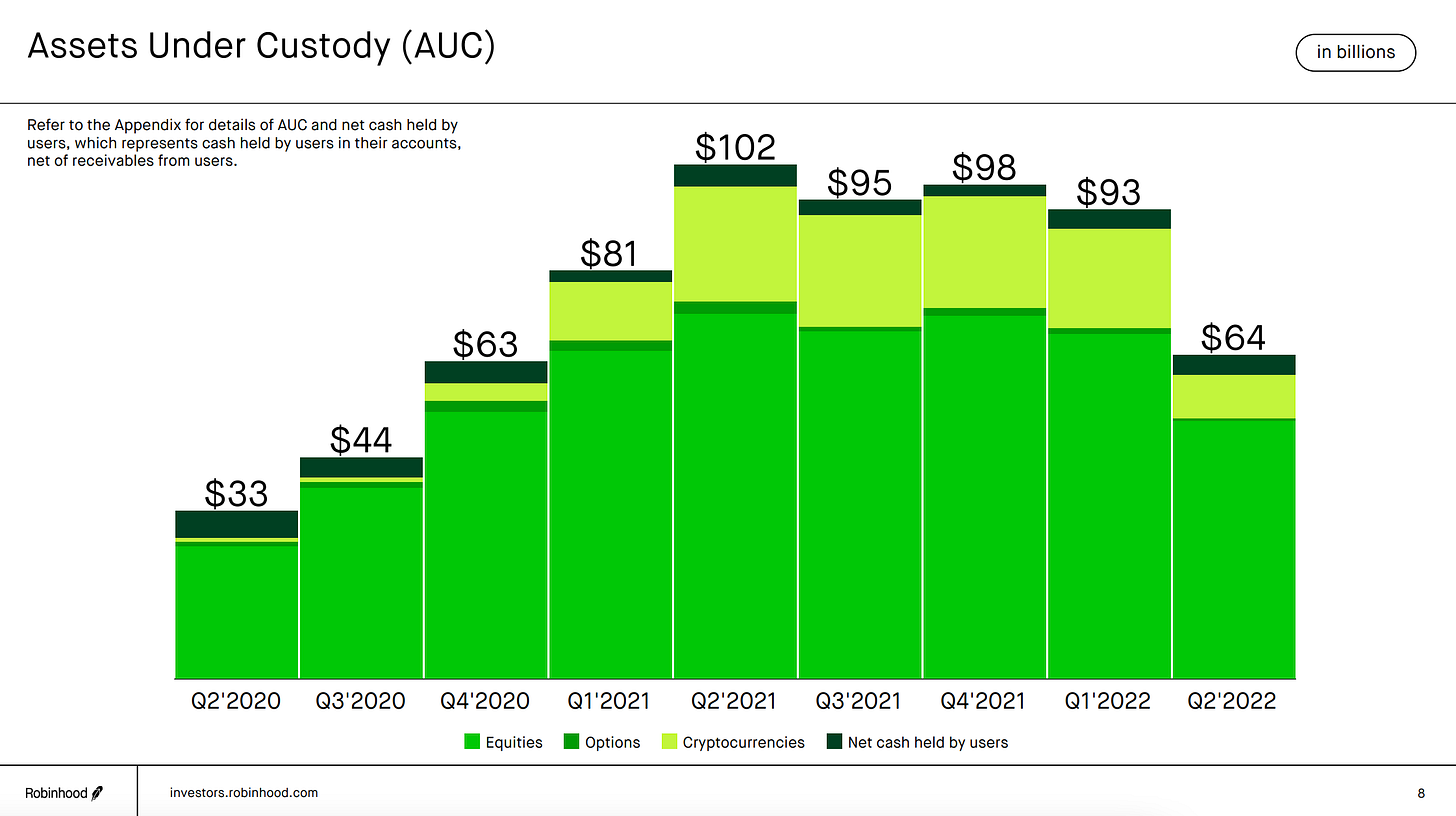

But the key thing is that Robinhood is losing its users (their most valuable asset). The report showed a decline in monthly active users and assets under custody:

What does this mean? 🤔 This is yet another red flag for stock trading FinTechs and a warning sign for a completely different future ahead. Here’s the takeaway: