What SoftBank’s collapse means for the future of FinTech investments 🥶; Nuri & Dozens - crypto insolvency & FinTech failure on the same day 💥; Every FinTech must have a BNPL strategy. Here’s why 💳

Good Morning FinTech, 10 August

Good day Everyone,

Happy Wednesday! Today’s issue is so hot I barely can handle it… 🥵 We’re going to look at what SoftBank’s collapse means for the future of FinTech investments (it’s going to be different now), crypto insolvency & FinTech failure on the same day (lessons from Nuri & Dozens for other FinTechs), and why every FinTech must have a BNPL strategy (that’s right, and especially in emerging markets!). Let’s jump straight into the hot stuff:

What SoftBank’s collapse means for the future of FinTech investments 🥶

When we were turning out big profits, I became somewhat delirious, and looking back at myself now, I am quite embarrassed and remorseful.

(Masayoshi Son, Chairman of Softbank)

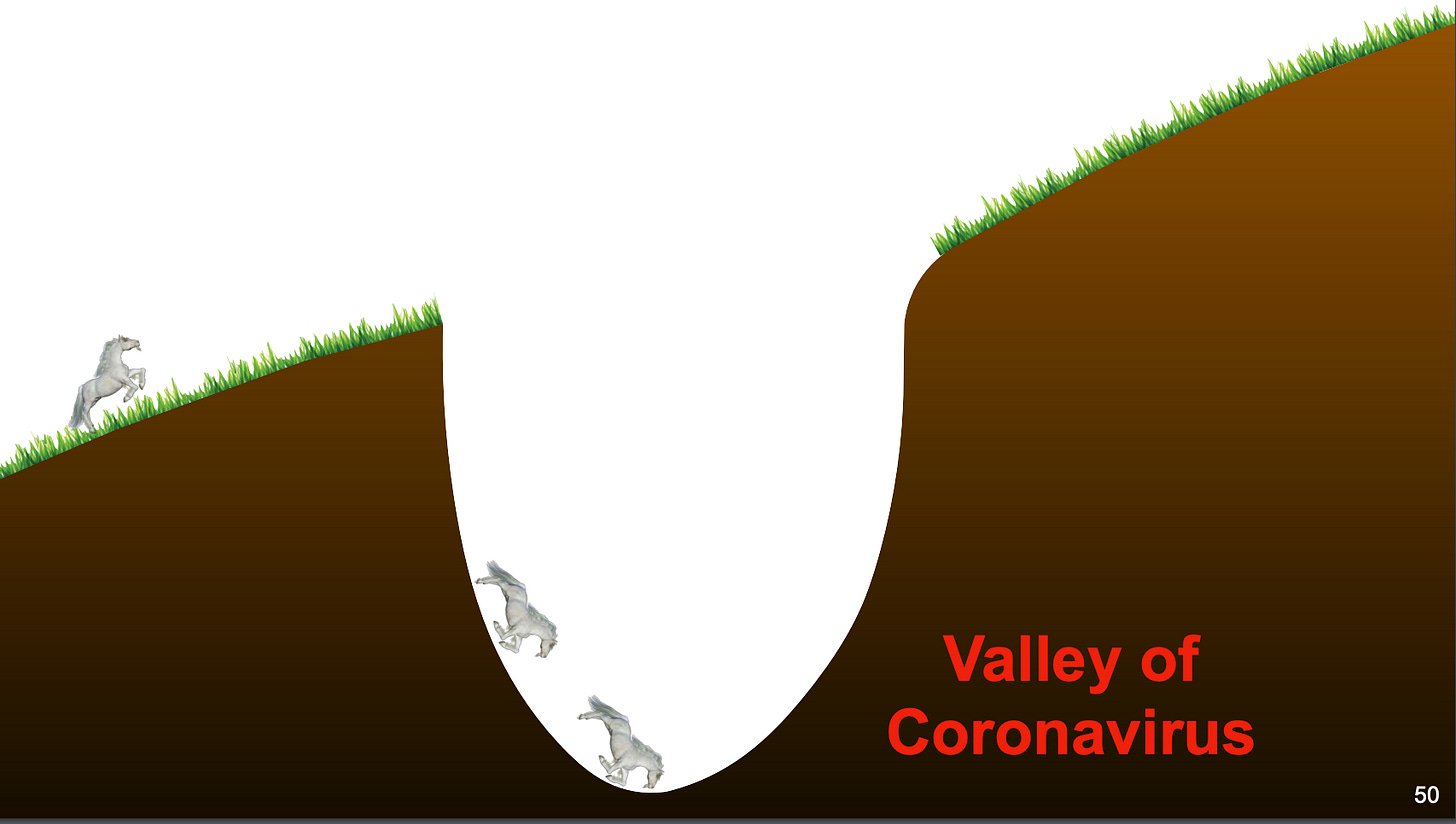

Cold investor presentation 🧊 Japanese investment giant Softbank is famous for its unique and poetic earnings decks. One that really struck me includes pictures of unicorns falling into the "Valley of Coronavirus". How epic is that?

But this one sums up Softbank's latest earnings pretty well (just look at his face):

Ok, let’s get more serious and look at the numbers.

More on this 👉 The numbers are pretty bad:

Softbank reported its largest quarterly loss ever. Its tech-centric Vision Fund lost a whopping $23 billion in Q2 as tech investments turned sour. This follows a loss of $26 billion the previous quarter.

In other words, SoftBank lost a whopping ~$50 billion this year so far. This means that all their gains since 2017 have now been wiped out…

From DoorDash to WeWork to Uber, in which Softbank was heavily invested, almost all investments didn’t pay off.

Also, losses were spread across Softbank’s portfolio of 400+ companies, including Klarna, DiDi (the Uber of China), and SEA super app, Grab.

Softbank was recently one of Europe’s most prolific FinTech investors. Their recent earnings and future outlook clearly indicate that the future of FinTech investments will be totally different. Here’s the takeaway: