Stripe gets a ridiculous valuation cut of 64% 🤯; Deal of the century? FTX may buy BlockFi for just $15M 😳; Despite upcoming Merge, weekly Ethereum staking deposits hit record low. Here’s why 💸

Good Morning FinTech, 24 August

Good evening Everyone,

And happy Wednesday! Today’s issue is for sure the most interesting one this week. We will look at Stripe getting a ridiculous valuation cut (& what that means for the payments giant and FinTech in general), the deal of the century, or how FTX could buy BlockFi for just $15M (this would be massive!), and weekly Ethereum staking deposits hitting a record low despite upcoming Merge (why is that?). So let’s jump straight into the hot stuff:

Stripe gets a ridiculous valuation cut of 64% 🤯

The news 🗞 A large investment fund has downgraded the value of its shares in payments giant Stripe by as much as 64% in the last year, suggesting the company is now valued a long way off its most recent $95 billion valuation.

More on this 👉 The T Rowe Price Group which manages over $1.3 trillion in assets revealed its revaluation in a regulatory filing, Bloomberg reported. It’s interesting to note that the US fund’s revaluation occurred on June 30th, the same time Stripe is reported to have cut its own internal share value from $40 to $29.

Based on the latter, Silicon Valley’s largest privately held company is currently valued at circa $74 billion. Still not bad!

More data 📊 But let’s not focus solely on this. Let’s zoom out a bit and look at the bigger picture and more data.

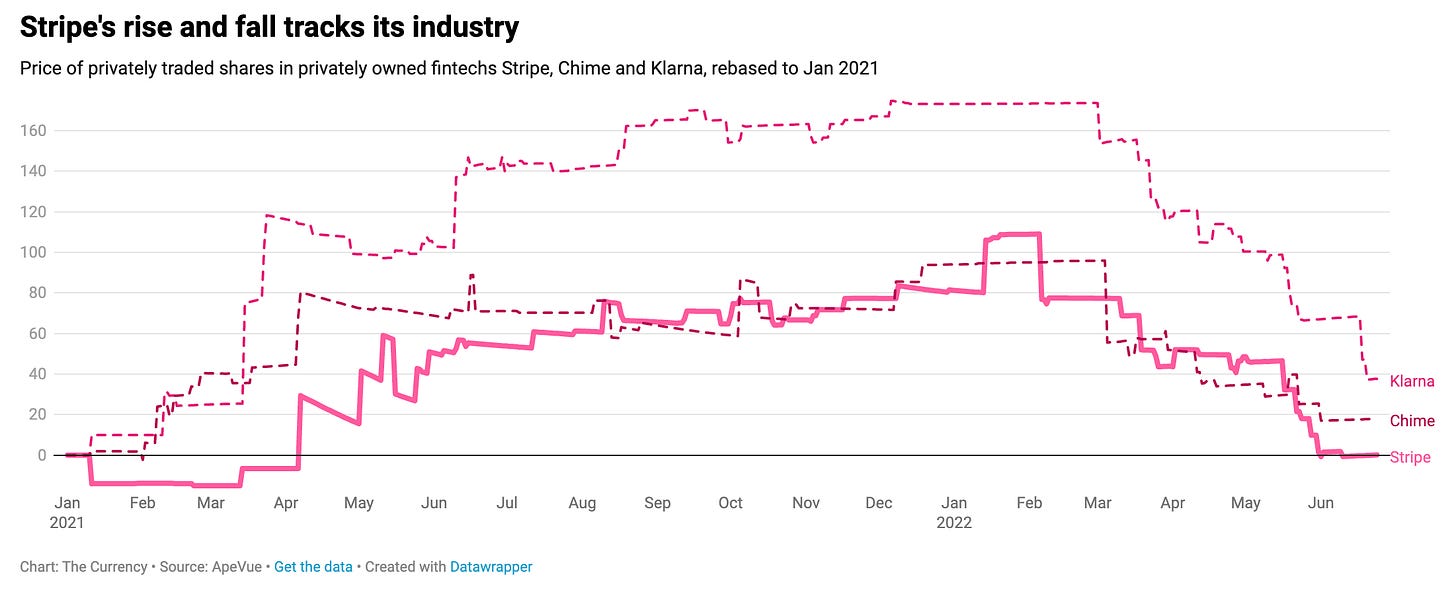

As we can see from the above chart, Stripe shares on secondary markets (where hedge funds & the likes trade) have hit the top in January and then dropped by 40% until late June. Of course, secondary markets are less liquid and much less regulated than public markets so they definitively don’t give a good indication as to what the company is worth. But it does show that the sentiment has changed.

But Stripe isn’t unique here. As you can see from the chart above, Stripe's shares are worth less in the secondary markets along with other private FinTechs like Klarna and Chime. Klarna is priced much less now after the Klarnageddon.

The public markets paint a similar picture. Shares in PayPal PYPL 0.00%↑ have fallen by over 60% in the last year, while other payments giant Block SQ 0.00%↑ has seen its stock dropping by more than 70% in the last year. Overall, the Nasdaq 100 index has seen a decline of 30% in the first half of this year. That's pretty brutal.

Why is this important? 🤔 It indicates some things (good & not that good) about Stripe as well as the broader FinTech industry. Here’s the takeaway: