The aftermath of the FTX collapse could be bigger than the earthquake 🌋; Elon Musk will turn Twitter into a Bank? 🤯; Winter is ON, but PayPal for Crypto raises fresh funding 💸

FinTech is Eating the World, 14 November

Hey Everyone,

Happy Monday! Today’s issue is just burning 🔥 We’re obviously looking at FTX and how it can (& will?) trigger an earthquake (its tentacles are looong 🐙), Twitter that Elon Musk wants to turn into a bank (& why Super App is underway), and a breath of fresh air as PayPal for Crypto nets fresh funding (builders build!). Let’s jump straight into the hot stuff:

The aftermath of the FTX collapse could be bigger than the earthquake 🌋

Always breaking🔥 Since the time Binance has officially walked away from taking over struggling FTX a lot has happened and been revealed. We haven’t seen so much breaking news every day in a while now.

In fact, this story is getting crazier every day. So, let’s do a quick recap of what matters the most and then look at the big picture.

More on this 👉 These are the key developments and important moments for all things FTX:

Shortly after Binance canceled the deal, FTX filed for bankruptcy.

A day before this, co-founder and CEO Sam Bankman-Fried desperately tried to raise money. FTX reportedly has nearly $9B in liabilities and about $900M in liquid assets on its balance sheet. Nobody was willing to take the risk.

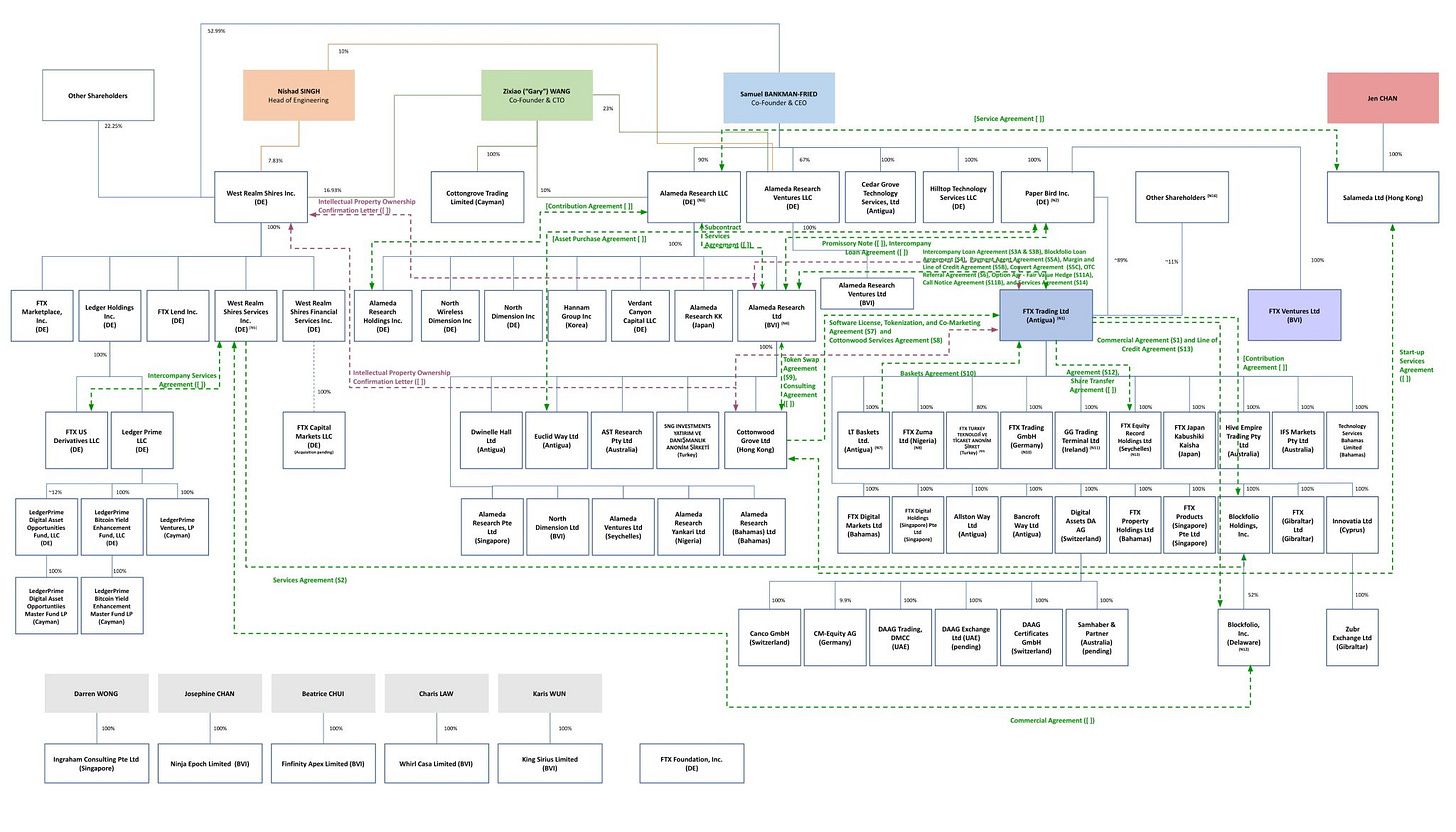

FTX bankruptcy reveals the company had 134 affiliates (more on that - below) spread across the globe and may have liabilities of up to $50B. For the perspective, Enron had liabilities of $23B. So FTX may be worse than Enron 😳

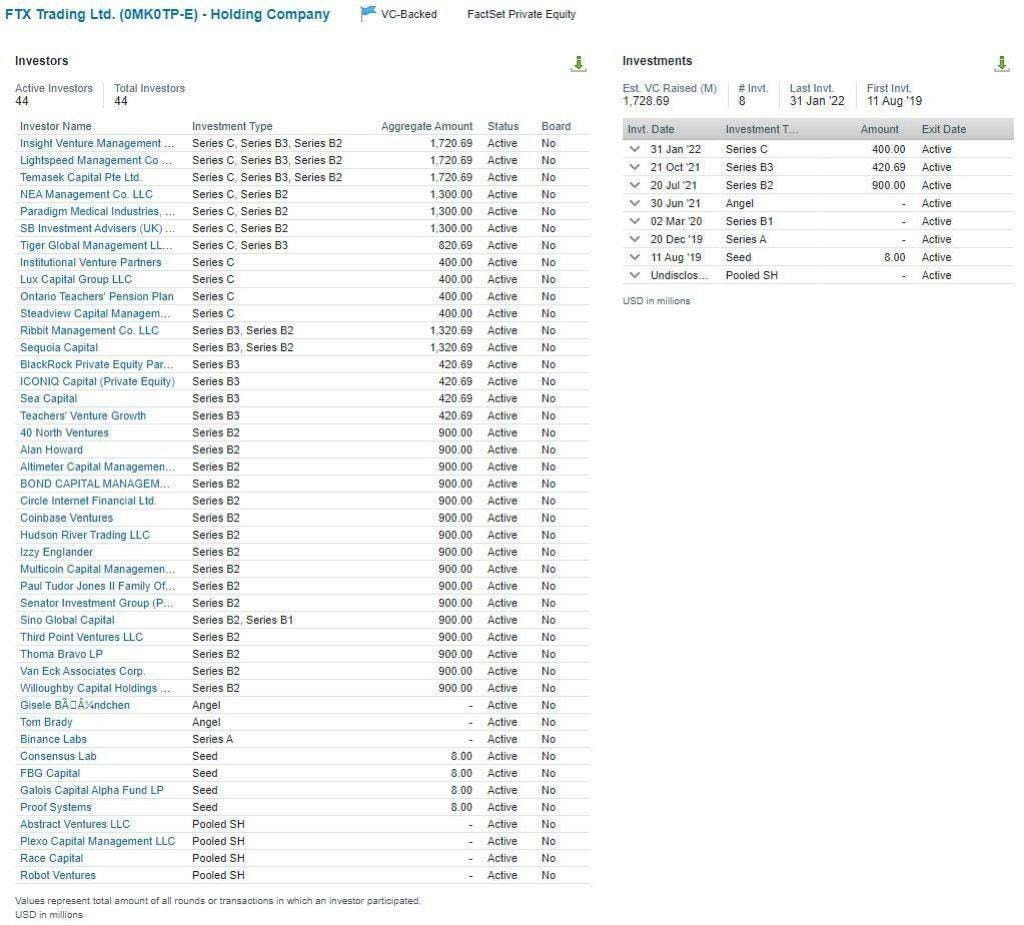

Despite raising $2B, SBF was the majority owner of the company. But the crazy fact is that no investors joined FTX's board of directors, which was made up of SBF, an FTX employee, and a lawyer, according to WSJ.

FTX organizational chart is so complex it looks like a maze. But it’s probably not surprising given SBF's father was an expert in tax shelters and a professor at Stanford Law School:

Sequoia, which had an epic and pretty embarrassing piece on SBF (now deleted), has written down its investment into FTX to $0. Here’s a full list of everyone who lost money in FTX:

FTX reportedly lost $10B in customer deposits. How? By basically running a Ponzi scheme.

SBF had built a backdoor in the FTX accounting software that let him move billions of dollars out without triggering any audits on other staff and auditors. The same backdoor also set Sam to alter old FTX financial records without alerting anyone according to Reuters.

If that wasn’t enough, FTX was buying tokens before they were listed on their platform just to dump on their users. FTX was basically front-running and insider trading. That’s just plain criminal.

Finally, despite all the altruism, FTX purchased $300M in real estate including in the "playground of the rich" in Albany, Bahamas. This is where SBF and his inner circle were spending their days.

Why this matters? 🤔 One of the biggest crypto collapses ever is already causing waves in the markets. Soon it could transform into an earthquake. Here’s more on this + the takeaway: