There's no such thing as Smart Money 🤥; Klarna wants to dethrone Google and Amazon 😳; JPMorgan + Mastercard, or why the future of Banking is Open 👐🏼

FinTech is Eating the World, 15 November

Hey Everyone,

Happy Tuesday! Today’s issue is super exciting. We’re going to look at why there's no such thing as Smart Money (& lessons to be learned), Klarna that wants to dethrone Google and Amazon (why it’s worth it + 2 bonus reads), and JPMorgan + Mastercard, or why the future of Banking is Open (if you don’t have an open banking strategy yet, you can’t miss this one + a bonus read). Let’s jump straight into the hot stuff:

There's no such thing as Smart Money 🤥

Throw it away 🗑 Among all the shared (& to be shared) lessons from the FTX collapse, there’s one that’s worth a bit closer attention that the rest. The failure of one of the biggest crypto firms has again shown us that there’s no such thing as smart money.

It doesn’t exist. And the sooner you realize this - the better.

More on this 👉 I’ve briefly mentioned Sequoia (one of the most respected venture capital firms out there) earlier but I think it’s worth another look. Just to make sure we never forget the new narrative (see above).

This isn’t comedy. This is how Sequoia has backed FTX (now deleted):

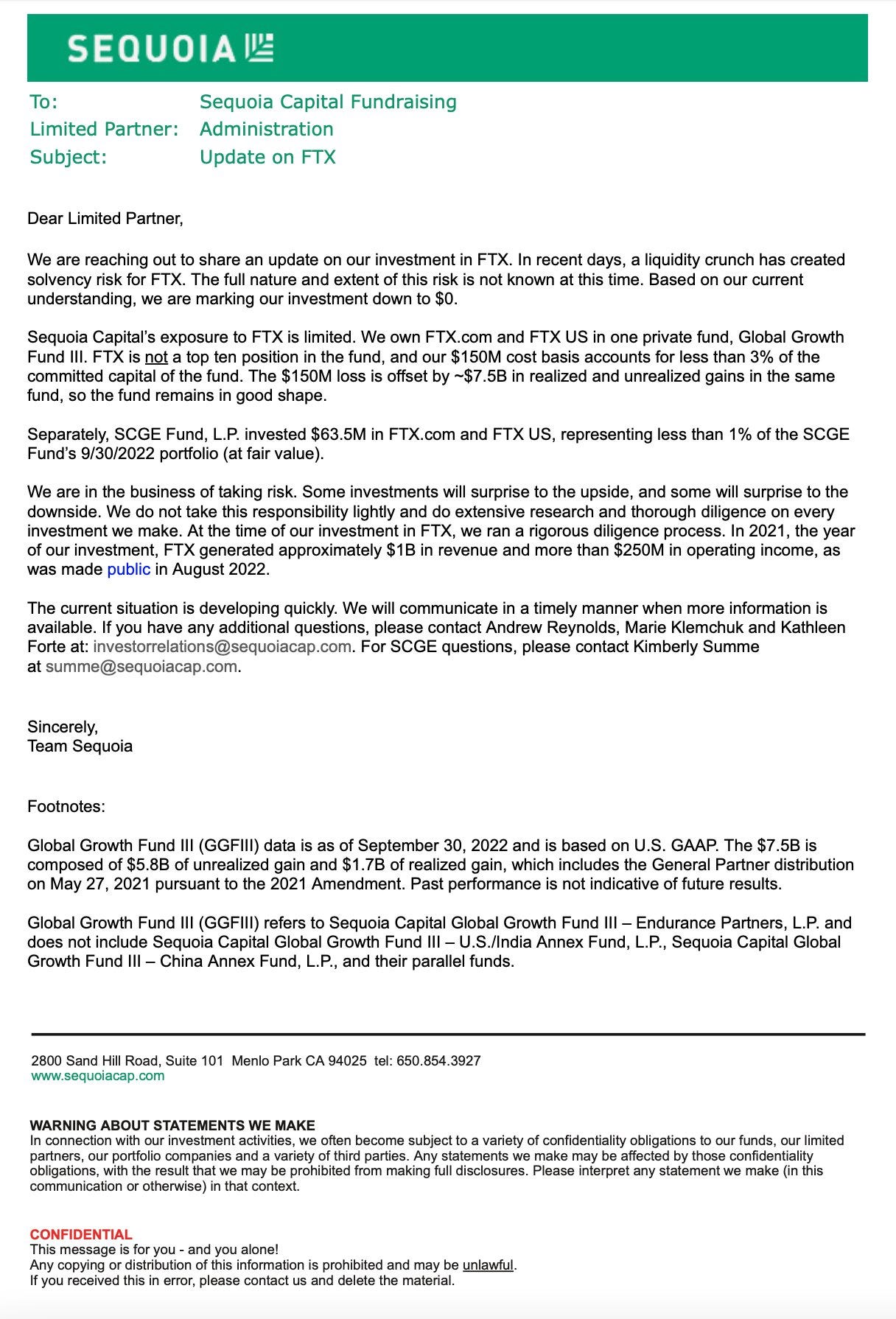

When the shit started hitting the fan, the VC firm wrote their investment down to $0. This is what they sent to their Limited Partners:

In total, Sequoia lost $213.5M on FTX. On an individual level, this seems like a huge miss. But given they have $85B under management that position is 0.25% of their investments. Hence, it doesn’t really matter to them 🤷♂️

Another one 👋 Sequoia isn’t alone here. Crypto investment firm Paradigm, one of the most active investors in crypto with a $2.5B fund launch last year, today told its limited partners that it marked down its investment in FTX to zero:

Ironic is the fact that the firm is led by former Sequoia investor Matt Huang and Coinbase co-founder Fred Ehrsam. They backed FTX and its affiliated firm FTX US putting in as much as invested $290M. And now it’s gone 🌪

Why does this matter? 🤔 Because you have been lied to - there’s no such thing as smart money. In fact, all the smart money is as dumb as you. Here’s more on that, some lessons to be learned + the takeaway: