Institutions are now driving the crypto adoption boom 🚀; FinTech investing just became a hell of a lot more difficult for everyone 😳; FinTech Winter, or a warning sign from FIS 🥶

FinTech is Eating the World, 25 November

Hey Everyone,

And happy Friday! Today’s issue is perfectly suited to end a super intense week. Today we’re going to look at the Institutions that are now driving the crypto adoption boom (& why this specific development is big), FinTech investing that just became a hell of a lot more difficult for everyone (if you are a VC, LP or a fund manager, read this), and FinTech Winter, or a warning sign from FIS (to worry or not?). Let’s jump straight into the interesting stuff:

Institutions are now driving the crypto adoption boom 🚀

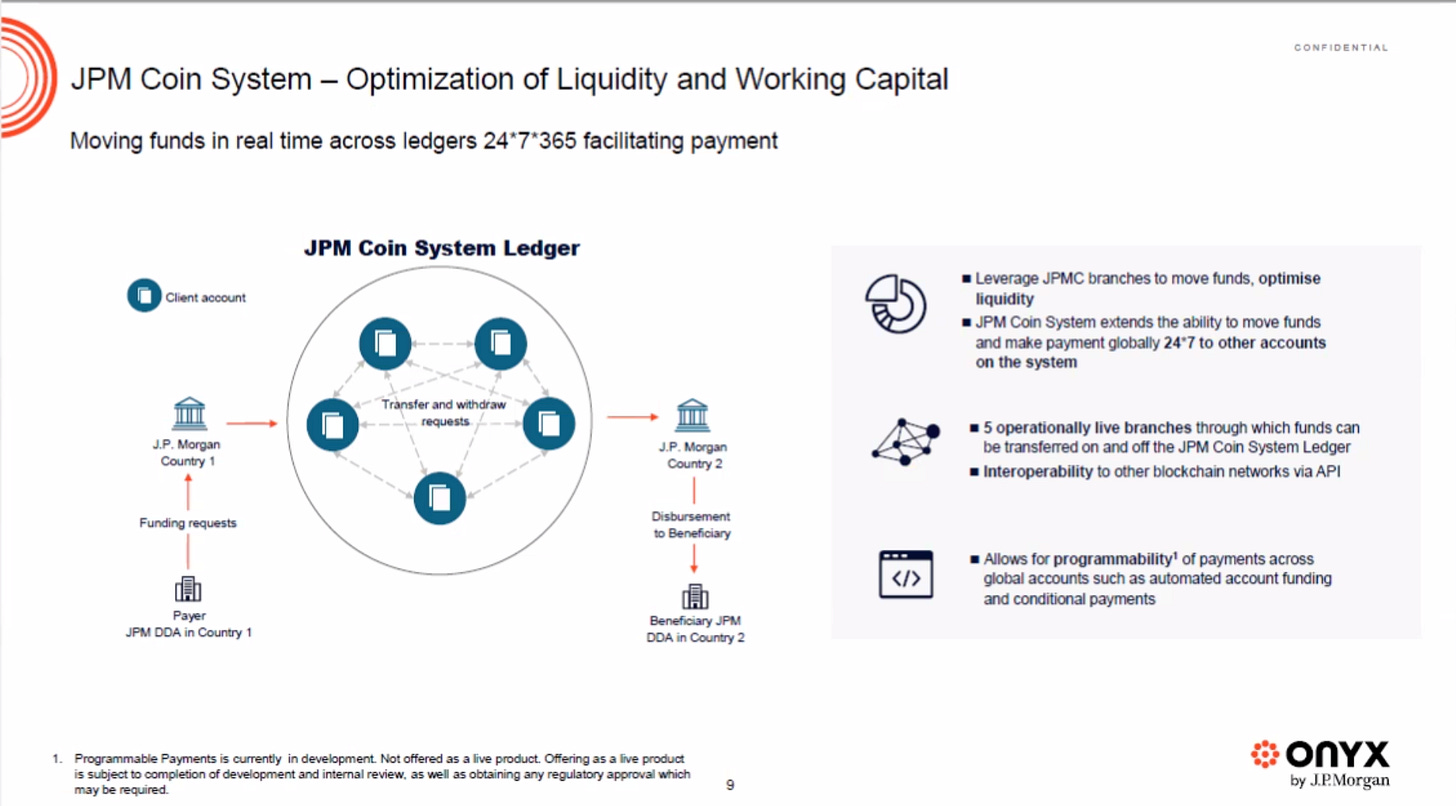

The news 🗞 DBS has become the first bank in Asia to conduct an intraday repo transaction on JPMorgan's JPM 0.00%↑ blockchain network Onyx.

Using the US banking giant’s JPM Coin digital token the Asian bank was able to complete instant settlements and maturity of the transactions within hours instead of the current industry norm of one to 2 working days.

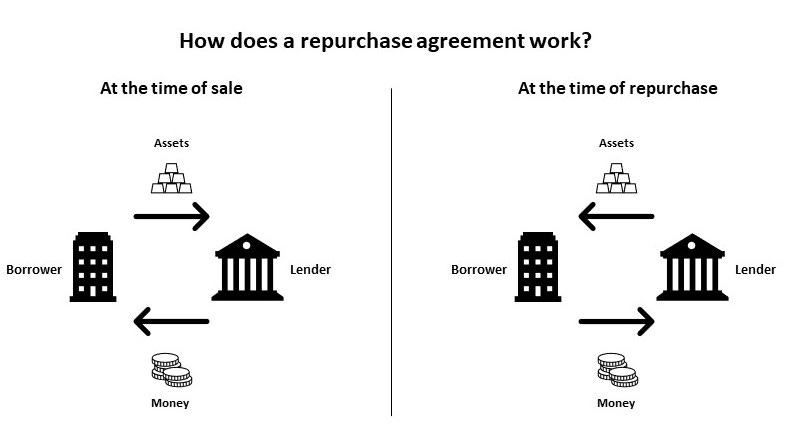

More on this 👉 Repurchase agreements or repos are a traditional and well-established method of raising financing, but infrastructural and technical inefficiencies meant the minimum term has usually been one day.

In the past, banks around the world had to explore alternative routes for intraday financing requirements. Crypto and blockchain are changing that.

By the way, for the live transaction on Onyx, JPMorgan acted as both a triparty agent and collateral token agent.

Why does this matter? 🤔 This is yet another sign that despite the bear market institutions are now the ones driving the crypto adoption boom. Here’s more on that + the takeaway (& why it’s huge):