Revolut takes a page out of Meta's Playbook 👀; Another domino falls - BlockFi files for bankruptcy 🫡; Bitcoin’s correlation to other assets plunges 📉

FinTech is Eating the World, 29 November

Hey Everyone,

And happy Tuesday! Yesterday’s issue was hot, but today’s - oh, boy 😳 We’re going to look at Revolut which is taking a page out of Meta's Playbook (going to dive a bit deeper into it + 7 bonus reads you cannot miss), another domino falling, or BlockFi filing for bankruptcy (focus on how it happened + some lessons to learn), and Bitcoin’s correlation to other assets that has recently plunged (is it good or bad?). Let’s jump straight into the fascinating stuff:

Revolut takes a page out of Meta's Playbook 👀

The milestone🏅 London-HQed neobanking giant Revolut, which is also one of the most valuable FinTechs globally, has recently hit the 25 million customers milestone. In addition to hitting this massive figure, Revolut also announced it is set to launch a streamlined version of its app.

Let’s take a closer look at this.

More on this 👉 Let’s talk about customer numbers first. According to Revolut, this is the number of new customers by select countries since the 20M milestone that was hit earlier in the summer:

United Kingdom🇬🇧 - 1.1 million

Poland🇵🇱 - 460,000

Romania🇷🇴 - 450,000

France🇫🇷 - 340,000

Spain🇪🇸 - 320,000

Ireland🇮🇪 230,000

But here’s a more valuable graph breaking down Revolut’s numbers:

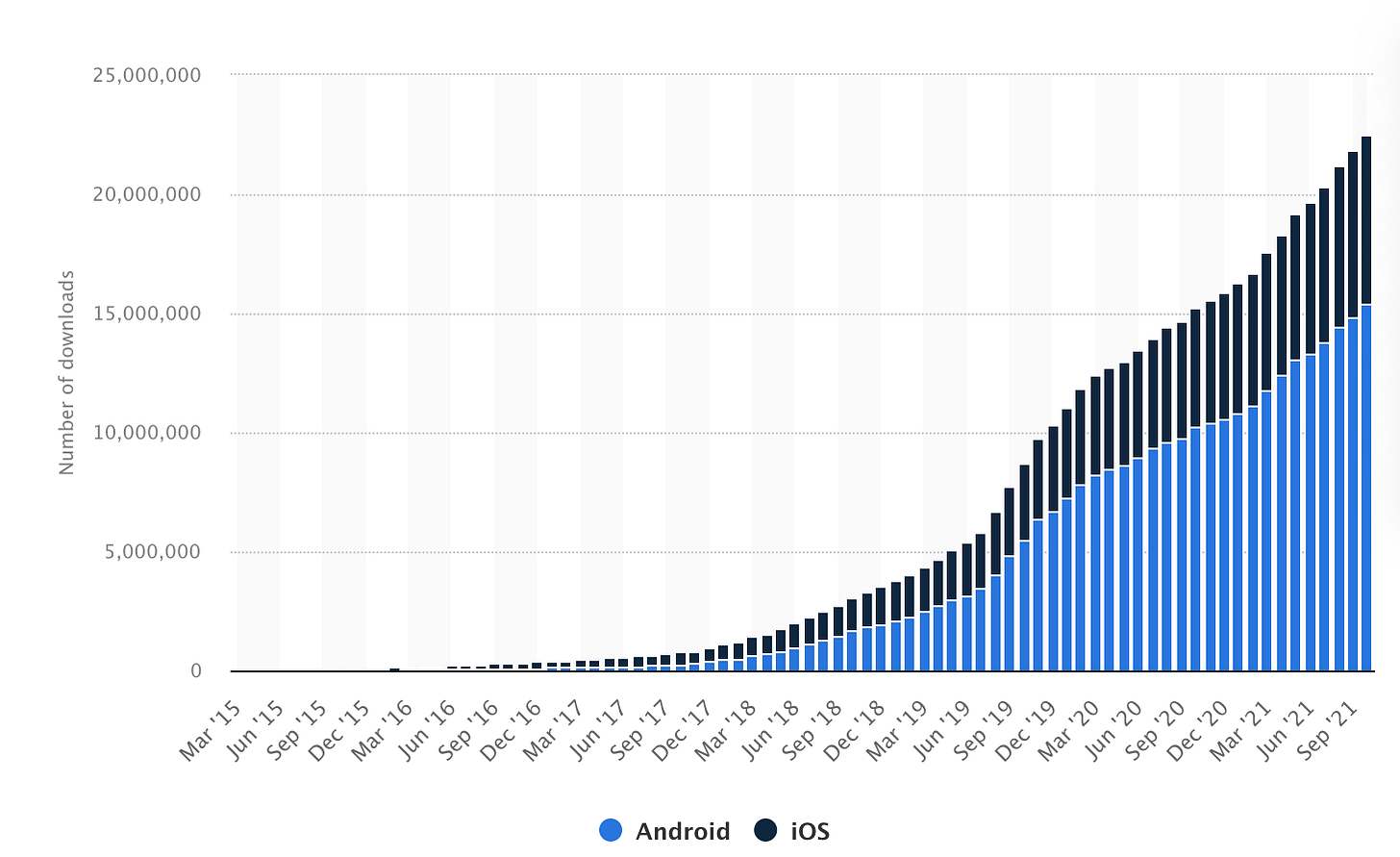

Cumulative number of Revolut bank app downloads worldwide from March 2015 to October 2021, by operating system:

Source: Statista

As you can see, the UK, Revolut’s home market, continues to be by far its biggest market. And that’s a risk. Furthermore, let’s be honest - these numbers are pretty much worthless. The number of downloads, customer accounts or signups, etc. is basically vanity metrics. What matters is how many active accounts you have (and how you definite it). In fact, the golden metric should be what % of those active accounts are making you money vs. operating at a loss. And we don’t have any clue here when it comes to Revolut. But let’s leave this for a deeper dive sometime later.

The App 📲 Taking a page out from Meta's playbook, which launched Facebook Lite in 2014 to target lower-income countries, Revolut said it is launching its 'Lite' service in Latin America, Southeast Asia, and the Middle East, as per their announcement The lightweight app will allow instant cross-border transfers for free.

Not resting on its laurels, the firm is keen to expand into India, New Zealand, Brazil, and Mexico in the coming months. Revolut has assembled a 400-man workforce in India and has unveiled plans to expand teams in Mexico and Brazil to 250. The company says the development into New Zealand is designed to “complement its existing operations in Australia.”

What does this tell us? 🤔 Copying Facebook (=Meta) is probably a smart move (though I would rather pick Cash App - will explain why!), especially given their focus on emerging markets. Yet, I’m not too sure how viable this is given Revolut has some bigger problems to solve. Here’s more on that + the takeaway (+7 bonus reads you can’t miss):