Is Binance having an FTX moment? 🤯🤯🤯; Galileo's latest feature proves what many still ignore about BNPL🚨; PayPal + MetaMask 🦊 = 🚀

FinTech is Eating the World, 16 December

Hey Everyone,

TGIF! Today's issue is as hot as it could get🔥 We’re going to see whether Binance is having an FTX moment? (is it FUD or real risk?), Galileo's latest feature which proves what many still ignore about BNPL (I hope you won’t), and PayPal + MetaMask 🦊 = 🚀 (will look at both the good and the bad). Let’s just jump straight into the intriguing stuff:

Is Binance having an FTX moment? 🤯🤯🤯

BREAKING: Binance?🔥 Since FTX went out of business, more and more attention and public spotlight have been put on Binance, the dominant (a monopoly?) crypto exchange in the world. Even with FTX in place, it was already big, but now it’s an absolute beast.

So what’s happening with Binance? Are fears that it might follow the path of FTX rational? What’s up with all the FUD? Let’s take a look at it and find out.

More on this 👉 Here are the most important developments and revelations about Binance that happened in circa one week.

Let’s set some context first. Since FTX filed for bankruptcy, over 80% of Bitcoin trading volume has consistently occurred on Binance. That’s how massive it is.

Former paid spokesperson of FTX, Kevin O’Leary, blamed Binance for the collapse of FTX. That’s clear BS.

PoR. Last week, to calm the market Binance released the long-awaited proof of reserves. It was performed by the global financial audit, tax, and advisory firm Mazars and showed that Binance's reserves are overcollateralized. Yet, today the same firm Mazars has deleted the proof of reserves from its website. In addition to that, Mazars is pausing all work with Binance and its other crypto clients. Seems like a major red flag to me 🚩

See how their site looked before and after the nuke:

Although on-chain analysis indicates that the PoR data might be correct…

You should still be cautious and take it with a grain of salt. Because at the end of the day, without proof of liabilities, this is rather meaningless. Michael Burry has a good analogy here:

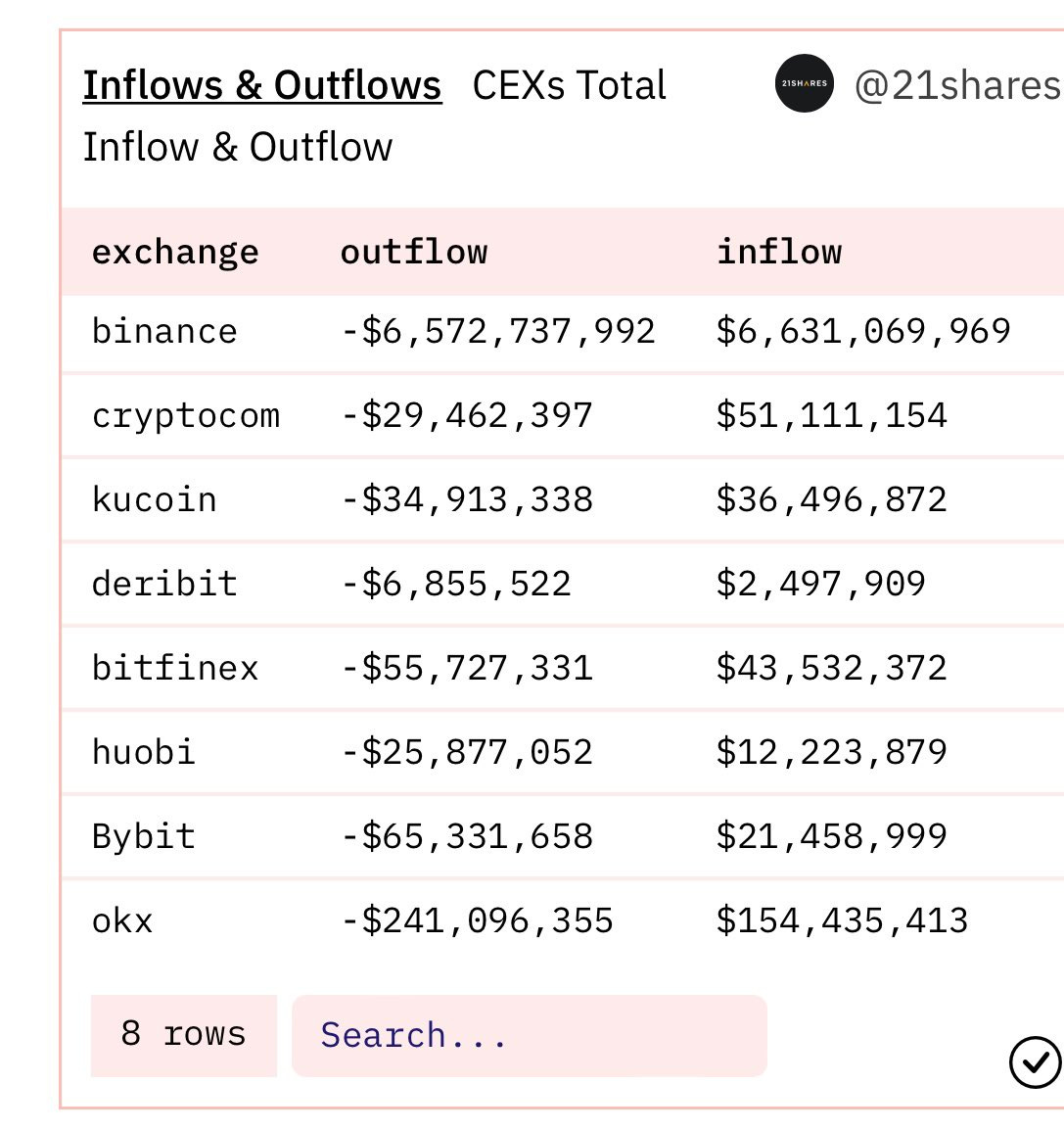

Withdrawals. Because of the above, lots of Binance users started to take their money off the exchange. Many speculated it could cause a bank run on Binance. But let’s look at the data.

A few days ago, has been processing $6B in withdrawals per day. They also processed $6B in deposits from their wallets to pay everyone. Now that number is reportedly $8-10B:

If that wouldn’t be enough, on Monday, Reuters reported that U.S prosecutors are considering criminal charges against crypto exchange Binance and individual executives, including founder and CEO Changpeng Zhao.

The Department of Justice has also discussed possible plea deals with Binance's lawyers, the report added.

Finally, Binance CEO CZ has been acting quite strangely on TV and on Twitter, showing similar traits to FTX’s SBF and Alex Mashinsky of Celcius. Here’s one interview that didn’t go very well:

✈️ THE TAKEAWAY

What does this tell us? 🤔 Let’s be honest - there are a ton of red flags out there, and given all the circumstances and surprises that 2022 has brought us, you can never be too safe. Especially right now. So if there’s any advice I can give you it’s this - take your crypto off the exchange. Doesn’t matter which one is it, but you better be safe than sorry. Zooming out, we must note that Binance has just dealt with circa $10B withdrawal stress test in about a week and is still operating. This amount would have certainly put every single exchange out of business. That tells you something. BUT… When you really think about it, this situation still seems like a classic scenario for crypto exchanges: everything is fine, users and assets are safe until they are not. So, let’s watch this closely and be very careful. If Binance survives this (and I really hope so as they have onboarded more people to crypto than anyone else out there), they will definitely become even stronger.