Stripe losing 40% of its valuation is the least expected thing in FinTech over the last 10 years 😳; Lessons from the neobank that shouldn’t have failed💡; Cash is still king 👑

FinTech is Eating the World, 12 January

Hey Everyone,

Happy Thursday again! Yesterday’s issue was hot but today’s - oh my… 😳 We’re looking at Stripe losing 40% of its valuation (it’s the least expected thing in FinTech over the last 10 years but it’s actually good!), lessons from the neobank that shouldn’t have failed (it was a match made in heaven!), and cash that is still king (what this means?). Let’s jump straight into the intriguing stuff.

Stripe losing 40% of its valuation is the least expected thing in FinTech over the last 10 years 😳

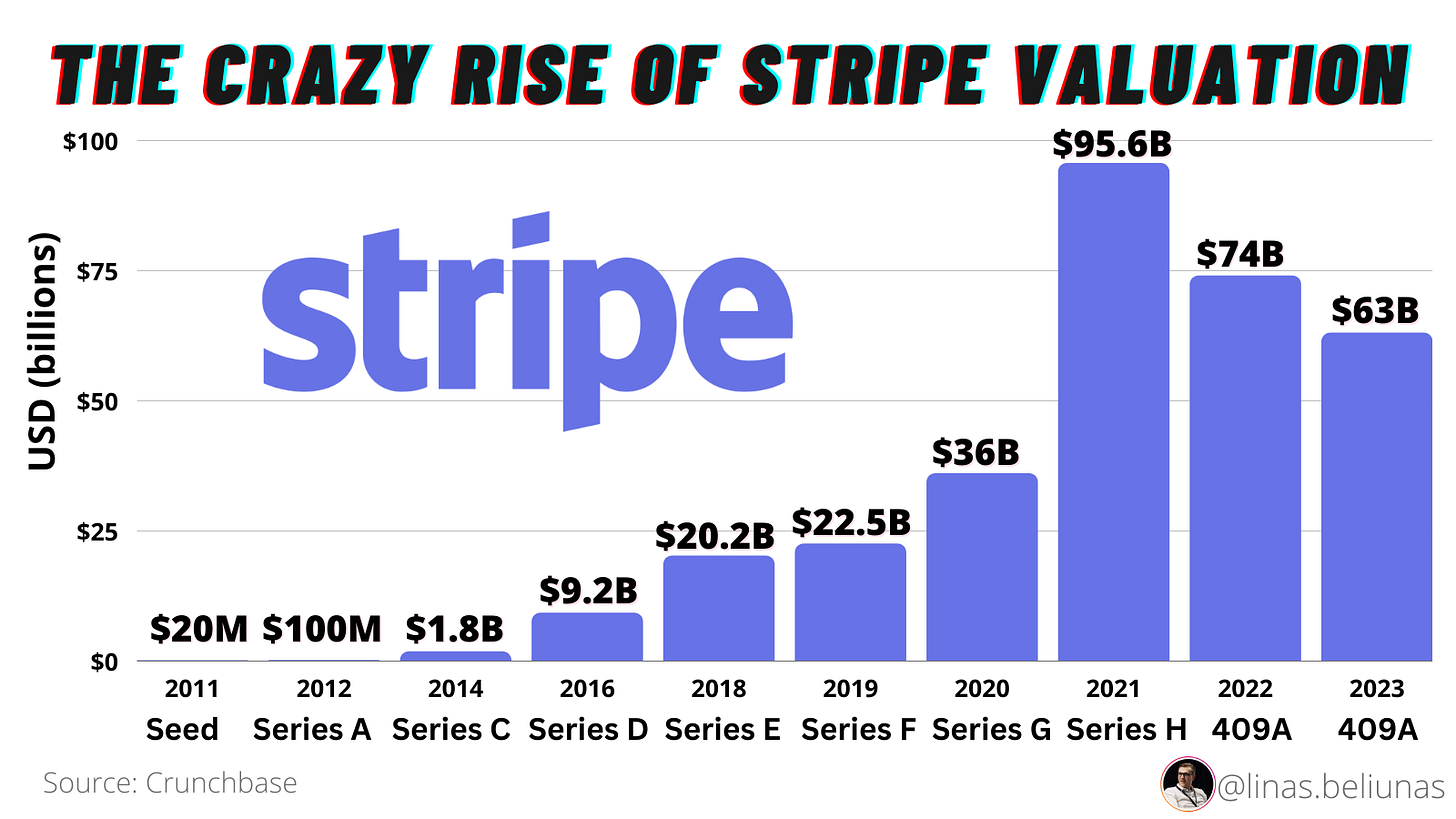

The (surprising) news 🗞 Financial Technology giant Stripe has cut its internal valuation yet again and is now valued at $63 billion (still solid!). The 11% drop comes after an internal valuation cut just 6 months ago, which valued the company at $74 billion.

We can remember that at its peak, Stripe was valued at a whopping $95 billion. This made the FinTech giant one of the most valuable private companies in the world.

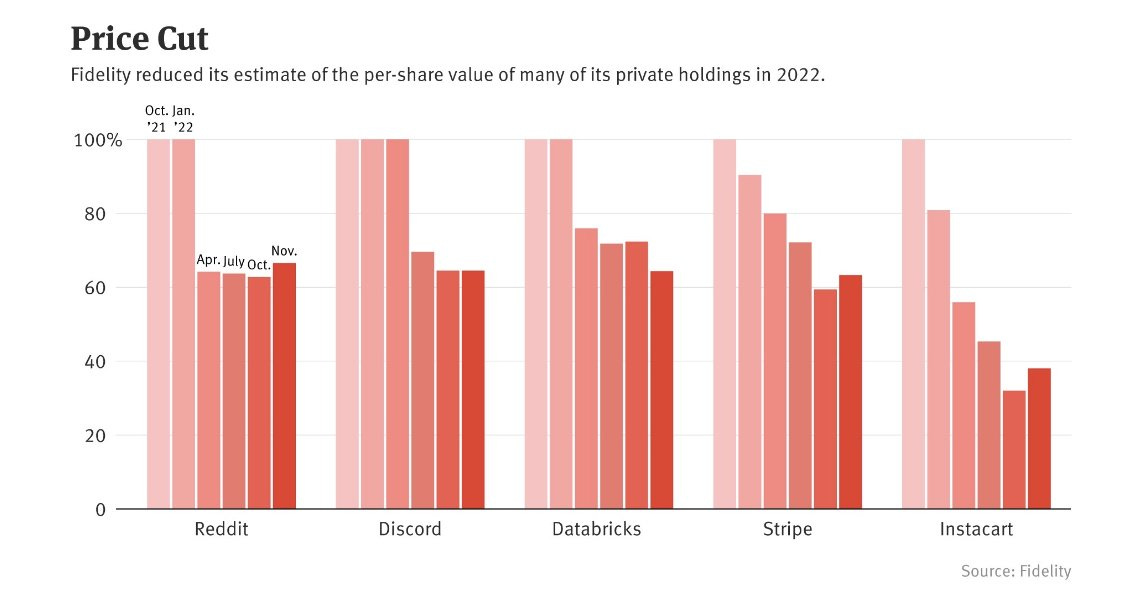

More on this 👉 What’s interesting here is that this falls pretty much in line with what Fidelity thinks about Stripe’s worth. The finance heavyweight has cut FinTech’s valuation by 36%.

Mutual funds, on the other hand, have a different view. From their POV, Stripe's valuation declined by 53.5%. Ouch 🤕

But let’s leave this for now and focus on the initial figure.

Stripe losing 40% of its valuation since peaking is probably the least expected thing in FinTech in the last 10 years 😳 But it’s a good thing. Let’s see why👇🏼 (+5 bonus reads, a breakdown of Stripe’s strategy & more)