BREAKING: FTX was actually a real estate company 🏡; Web3 funding is losing steam 💨; Crypto infrastructure is drawing in big bucks 💸

FinTech is Eating the World, 19 January

Hey Everyone,

Happy Thursday! Today’s issue is super hot, the best one yet, and laser-focused on crypto and web3. We’re looking at FTX which was actually a real estate company (+ some crazy new data + 7 reads to go deeper), Web3 funding which is losing steam (new data + what’s next + how to triple your chances of getting funded), and crypto infrastructure which is drawing in big bucks (you can’t ignore this!). Let’s jump straight into the amazing stuff.

BREAKING: FTX was actually a real estate company 🏡

Fresh stuff 🥬 It’s been more than a few months since the fraudulent crypto exchange FTX imploded and yet it still keeps on giving. Recently released court findings reveal some fascinating things you just cannot miss. So let’s take a look.

More on this 👉 According to recent court findings, FTX had $1.6 billion in crypto assets at the time of the bankruptcy petition. However, the total value of all assets recovered by the FTX Debtors was $5.5 billion. That included cash, crypto, and illiquid securities.

Given $5.5B in total assets were recovered with only $1.6 billion linked to FTX.com, it resulted in a shortfall being declared by investigators. In addition, roughly $1.9 billion in crypto was attributed to Alameda between hot wallets and BitGo custody.

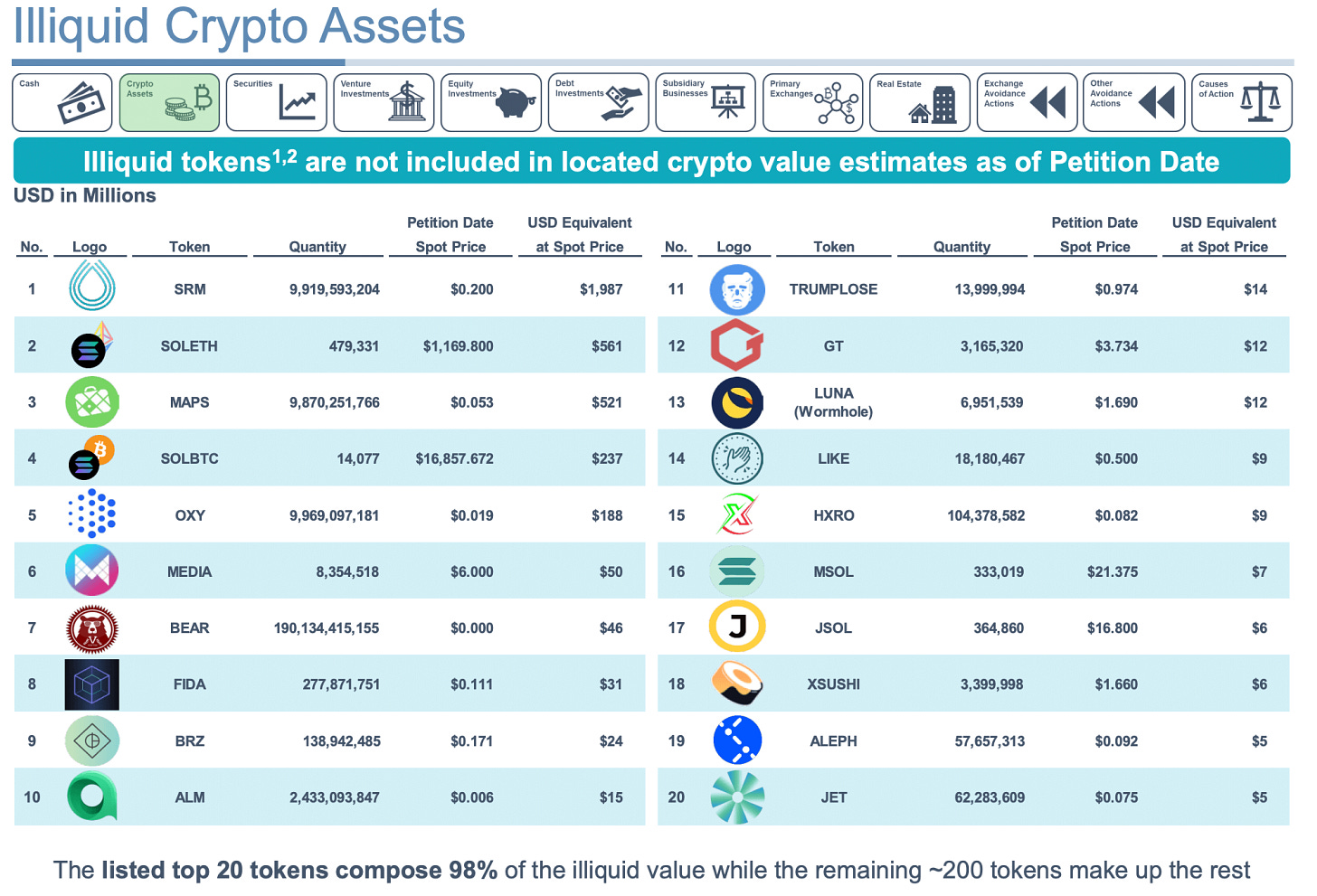

A slide from the deck revealed that FTX held billions of ‘illiquid’ crypto assets, The largest holding of such tokens was Serum (SRM), with a value of $1.9 billion. The next most significant holdings were SOLETH and MAPS at $561 million and $521 million, respectively.

But real estate is where things get really interesting.

As you can see above, FTX had quite some real estate properties out there, including 36 properties in the Bahamas that were acquired for a total of $253 million. These properties ranged from exclusive penthouse accommodation to villas valued at up to $12.9 million and were allegedly used as personal premises.

Moreover, several transactions are currently under review, including $93 million in political donations, a $2.1 billion payment to Binance for FTT tokens, $2 billion in insider loans, $446 million in transfers to Voyager, an investment of $400 million from Modulo Capital, and a large number of Robinhood shares.

What does it mean? 🤔 It’s simple, complicated, and disappointing at the same time. Here’s the takeaway: