Here's how India is disrupting the entire global payments space🇮🇳💳; When you thought you've seen it all, this happened... 🤯; Silvergate Bank is the mirror of the struggling crypto market 📉

FinTech is Eating the World, 20 January

Hey Everyone,

TGIF! I couldn’t have wished for a better issue to end such as hot week than this one. It’s the real icing on the cake 🧁 We’re going to see how India is disrupting the entire global payments space (it’s a tremendous one!), look at the April Fool’s day in January (no kidding!), and Silvergate Bank, which is the mirror of the struggling crypto market (+ a solid bonus read on it). Let’s jump straight into the amazing stuff.

Here's how India is disrupting the entire global payments space🇮🇳💳

The (BIG) news 🗞 The Indian government will spend a whopping $318.4 million to promote homegrown card network RuPay and the Unified Payments Interface (UPI), India’s mobile bank-to-bank instant payments system, according to TechCrunch.

The goal of this is to encourage more banks to offer customers RuPay cards and increase small-value consumer-to-business (C2B) UPI payments.

The impact is the disruption of the entire global payments space. Let’s take a look.

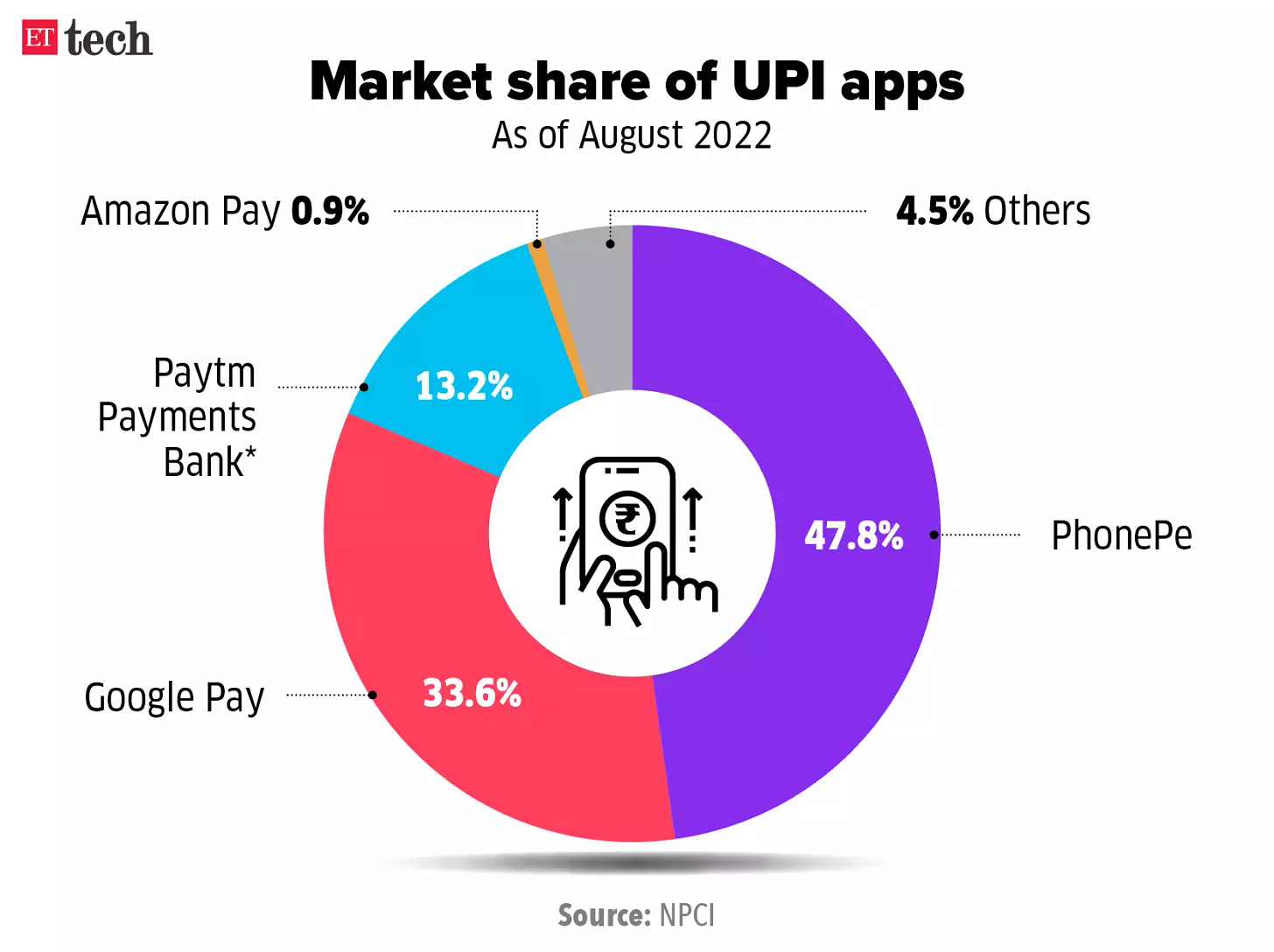

The USP 🥊 Unified Payments Interface aka UPI is an instant real-time payment system developed by the National Payments Corporation of India (an umbrella organization for all retail payment systems in India). The interface facilitates inter-bank peer-to-peer and person-to-merchant transactions. It is used on mobile devices to instantly transfer funds between two bank accounts. Here’s how it works:

The impact ⚡️What M-Pesa did in Kenya with mobile payments has pretty much the same (or even bigger) impact as what UPI with P2P payments did in India. In fact, both UPI and RuPay have played a major role in fueling digital payments adoption across the continent. Data backs it up elegantly:

UPI has become one of the most-used payment methods in India since its 2016 launch: UPI reached a record 7.829B payments totaling INR 12.820T ($163.1B) in December alone, according to NPCI data.

As for RuPay, it dominates India’s debit card market but lags behind Visa V 0.00%↑ and Mastercard MA 0.00%↑ in the credit card sector.

Once you know the context, let’s look further at the impact and the massive disruption at stake.