Affirm's latest results: missed earnings, layoffs, and the biggest risk🚨; No stablecoin from PayPal, and troubles at Paxos 😳; Another Web3 music platform 🎶

FinTech is Eating the World, 13 February

Hey Everyone,

Happy Monday! I couldn’t have wished for a better issue to start the new week than this one. Today we look at Affirm's latest results (& missed earnings, layoffs, and the biggest risk it faces right now), the stablecoin that PayPal just canceled (at the core of it - troubles at Paxos), and another Web3 music platform (maybe it’s the one now?). Let’s jump straight into the hot stuff 🌶

Affirm's latest results: missed earnings, layoffs, and the biggest risk🚨

The news 🗞 Buy Now, Pay Later (BNPL) pioneer Affirm AFRM 0.00%↑ reported second-quarter earnings that fell below analyst estimates on both the top and bottom lines.

More on this 👉 Affirm’s Q2 at a glance:

Gross merchandise volume aka GMV missed guidance but hit a record $5.7B, rising 27% year over year (YoY) and 65% compounded annually over two years.

Affirm now counts 15.6M active customers (up 39%) that do 3.5 transactions (38% growth).

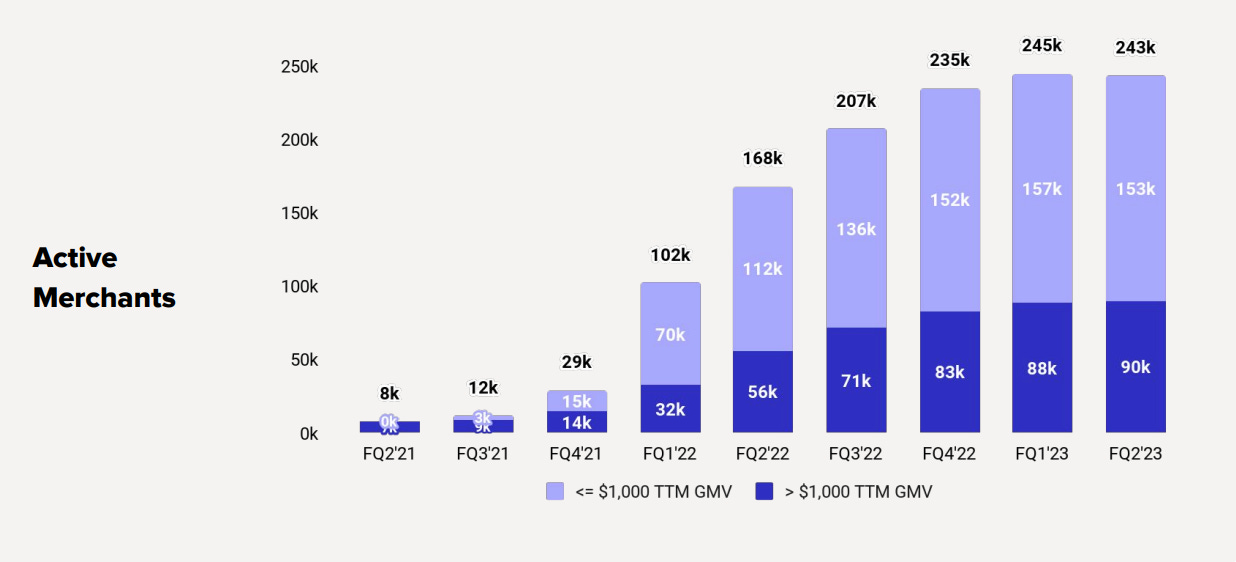

Active merchant count grew 45% YoY to over 243,000 merchants but declined sequentially on a quarterly basis due to churn among merchants with <$1,000 in trailing twelve-month GMV.

Revenues rose 11% YoY, but Affirm said an “operational misstep”, or hiking prices too late in 2022, stunted growth.

Operating loss widened from $196M a year ago to $360M.

As an effect, Affirm announced it will lay off 19% of staff (around 500 employees), shut down its cryptocurrency business (Affirm Crypto, in partnership with NYDIG, allowed people to buy and sell bitcoin without any fees or minimums), and embark on a restructuring that could cost $39 million. Ouch 🤕

What does it mean? 🤔 Last August, Affirm CEO Max Levchin confidently said that a recession would prove the company’s strength. While we can argue whether we’re in a recession or not, one thing is clear - Levchin’s words have backfired.

Let’s take a closer look at Affirm’s performance, see how we got here, identify their biggest risk and the strategy to overcome it.