Klarna just lost $1 billion. But it's not bad! 🤑; Wells Fargo wants to do what other banks are still ignoring 🏦; Liquid Staking now is the second-largest crypto sector 😳

FinTech is Eating the World, 1 March

Hey Everyone,

Good Morning! My travel plans delayed yesterday’s issue but it’s absolutely worth the wait. We’re going to look at Klarna which just lost $1 billion (why it's not bad & why you probably don’t understand Klarna well enough), Wells Fargo that wants to do what other banks are still ignoring (it has to do with AI & seems promising), and Liquid Staking which now is the second-largest crypto sector (breaking down what is it, how it works and what this means for the industry). Let’s jump straight into the hot stuff 🌶

Klarna just lost $1 billion. But it's not bad! 🤑

The news 🗞 Swedish Buy Now, Pay Later (BNPL) pioneer and giant Klarna just posted their fourth-quarter results and 2022 annual report. The FinTech continues to bleed red ink but it’s not that bad.

Let’s take a closer look to learn why and see what everyone’s missing.

The numbers 📊 Here are the latest key numbers from Klarna:

Klarna has been promising investors a pathway to profitability in 2023, with Q4 figures showing steady growth in gross merchandise volume (GMV) and a 19% uplift in revenue.

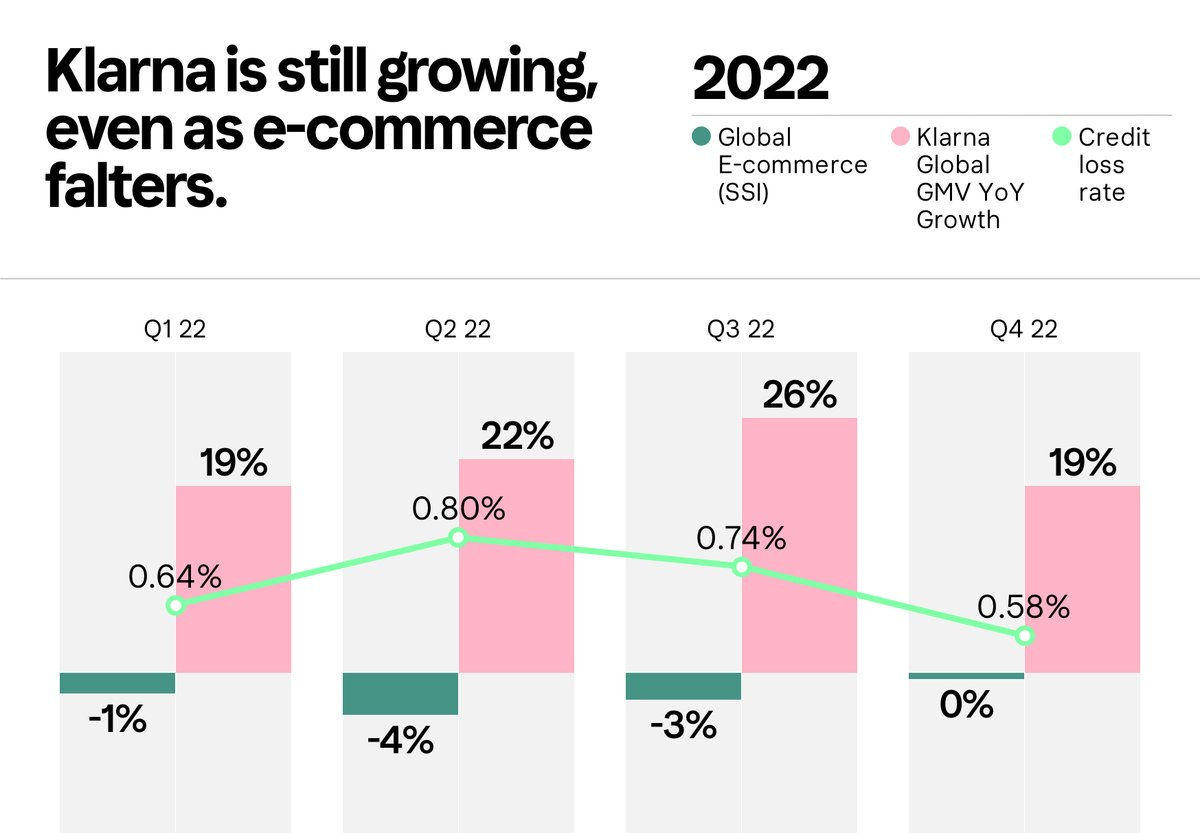

The company managed to grow even as the overall growth in e-commerce has stalled (impressive!):

Q4 figures also show an uplift as operating loss shrank and GMV climbed 19%. With credit loss rates improving, H2 2022 showed a marked turnaround in operating results with a 35% improvement compared to the first half of the year.

Klarna's long-standing ambition to crack the American market appears to be finally coming good, with the US now representing its biggest revenue-generating stream globally.

The Sweden-based FinTech now has more than 8 million monthly active app users in the US, a 33% jump from its February 2022 total. Very good! 👏

Yet, the company still posted a $1 billion loss for 2022. It’s up 47% from a $680 million loss in 2021 and marks the company’s biggest annual loss in its history.

What does it tell us? 🤔 At first glance, the results might seem disappointing and worrying (and they should be!). But if you only see Klarna as a BNPL company, you don’t understand it. Here’s why: