Revolut revenue drama 🎭; Railsr is going off track and to the wall 🛤 🧱; FTX's massive shortfall is finally revealed 💸

FinTech is Eating the World, 7 March

Hey Everyone,

Good morning! I’ve been eager to publish this issue since last week (you will learn why later), so it’s definitely the best one yet (& worth the wait!). We’re going to look at Revolut revenue drama (red flags, things that don’t add up & why it’s a big deal), Railsr which is going off track and to the wall (is embedded finance over?), and FTX whose massive shortfall is finally revealed (it’s a huge huge hole!). Let’s jump straight into the hot and spicy stuff 🌶

Revolut revenue drama 🎭

The (still hot) news 🗞 FinTech giant Revolut last week has finally released its financial accounts. For 2021 🙃

I was deliberately delaying covering this story as I was expecting some solid follow-up commentary from Revolut, or at least more information.

Yet, nothing worthwhile came in, so let’s unpack this drama as it stands.

More on this 👉 Here are the key things from the much anticipated, and twice delayed, financial accounts for Revolut:

Revolut onboarded more than 5M retail customers in 2021, and the number of users on paid plans increased by 75%. Not bad!

The number of weekly active users grew by 50% with customer average spend growing by 10% per user. Revolut didn’t specify how many active users it has, which might make one assume it’s not much. Some former Revolut execs told me that number is 5-10%. That’s very small, if true.

Revolut also rolled out banking services to 18 European countries in 2021 and closed the year with almost 2M customers, 10x the number from the previous year. Solid!

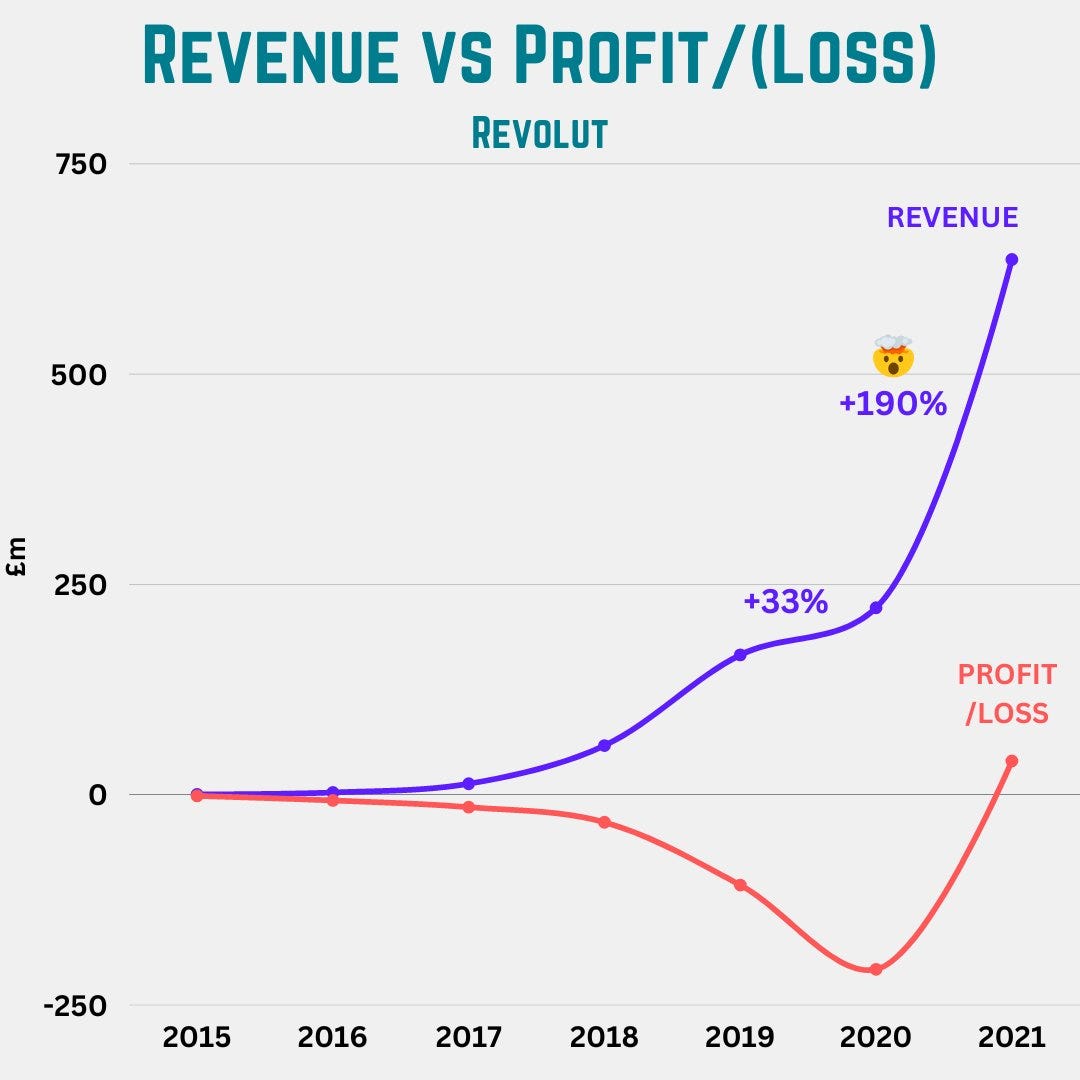

The Super App wannabe reported revenues of £636.2M ($767.1M) for the year, which is 3x of what it made the previous year. That’s nice! 👏

This swung the digital bank to a pre-tax profit of £59.1M. For the perspective, in 2020, Revolut recorded a pre-tax loss of £205M. That’s quite a pivot 👏

Below is a good visual illustration of how Revolut makes its money, in 2020 vs. 2021:

As you can clearly see, most of neobank’s revenue is from FX & wealth (that includes crypto) and cards & interchange. This is a very important thing to keep in mind.

BUT…

Houston, we have a problem🚨 Actually, it’s not we - it’s they. BDO, Revolut’s auditors, weren’t impressed by their results at all.

Not only did they QUALIFIED the audit report (this is a pretty big deal on its own). More importantly, BDO concluded that because of limitations in Revolut's control environment, they were unable to verify £477M of revenue. In other words, 75% of Revolut's revenue was impossible to be confirmed by the auditors. This basically means we're just trusting Revolut on that number 🤷♂️🚩

Here’s more on this + other things that don’t add up + why it’s a big big deal: