BREAKING: Silvergate is shutting down operations & liquidating its bank 🤯🏦; Investors are devaluing Revolut and Varo as confidence in neobanks weakens 😳; Wix + Stripe = 🚀

FinTech is Eating the World, 8 March

Hey Everyone,

Good morning! Today’s issue comes with a slight delay but it’s absolutely worth the patience. We’re looking at the breaking news of Silvergate shutting down operations & liquidating its bank (why it matters for the crypto industry as such + a deeper dive into Silvergate), investors that are devaluing Revolut and Varo (confidence in neobanks weakens + a deeper dive into Revolut’s latest results, the most read issue this month), and Wix partnering with Stripe (why it’s a perfect match, especially for Stripe). Let’s jump straight into the awesome stuff 🌶

BREAKING: Silvergate is shutting down operations & liquidating its bank 🤯🏦

The (breaking) news🔥 Silvergate Capital Corporation SI 0.00%↑, the holding company for Silvergate Bank, just announced it is shutting down and liquidating Silvergate Bank.

The bank will repay all deposits and “is also considering how best to resolve claims and preserve the residual value of its assets," as per their news release.

More on this 👉 Just last week I wrote about Silvergate fighting for survival. It’s now clear they have lost their fight.

The announcement comes less than 6 days after Silvergate said it would delay the filing of its annual 10-K for 2022 while it sorted out the “viability” of its business. The company disclosed that the delayed 10-K filing was partly due to an imminent regulatory crackdown, including a probe already underway by the Department of Justice. Was it though? 🙃

Refresher ♻️ We must remember that Silvergate, a California-based bank, has provided banking services to crypto companies since 2013. It helped institutional investors move dollars in and out of crypto-trading platforms through its Silvergate Exchange Network (SEN), which it stopped operating last week.

The company revealed it had nearly 500 crypto clients when it filed to go public in November 2018. Its initial public offering (IPO) was completed in 2019, trading on the New York Stock Exchange and boasting more than 750 crypto clients at the time. Solid! 😳

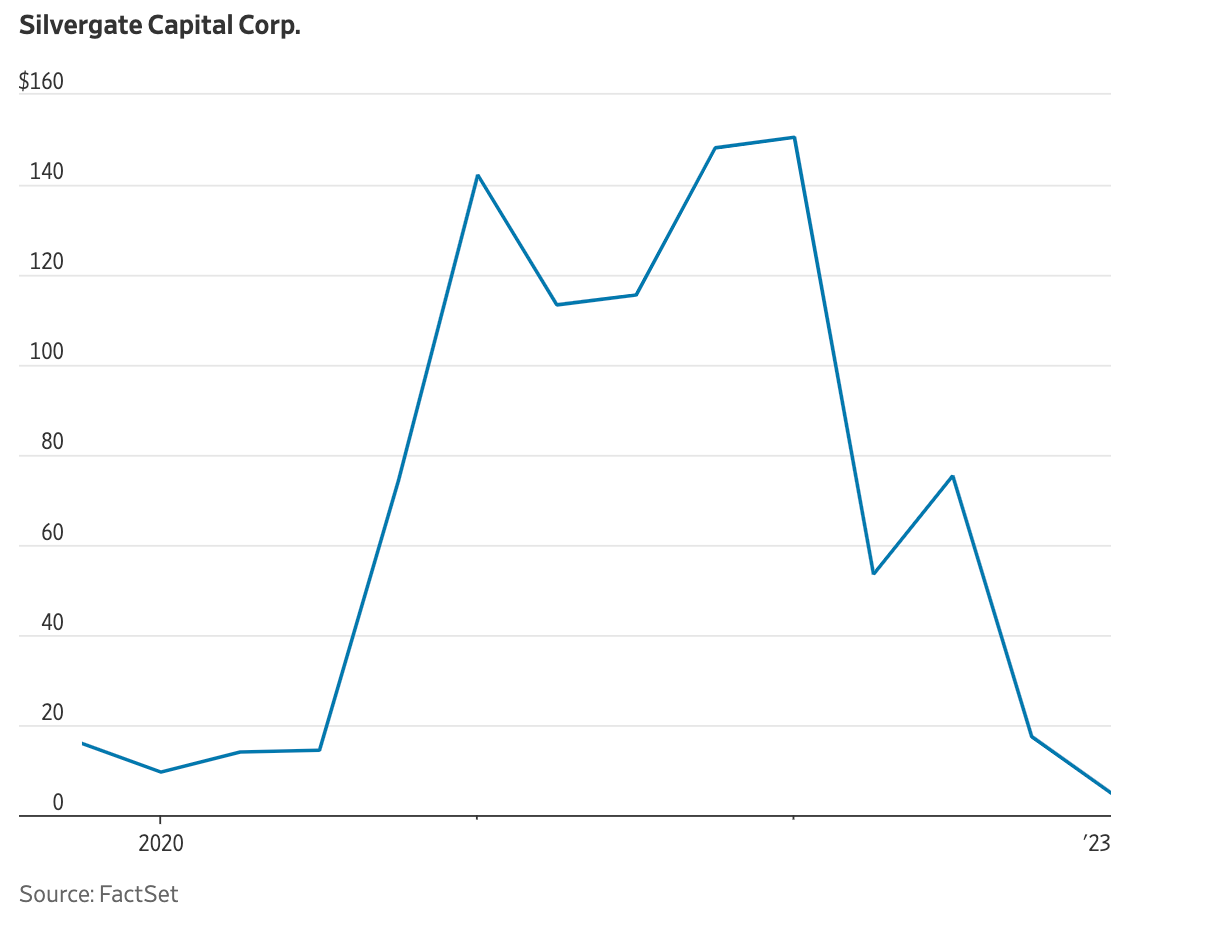

Public bloodbath 📉 Public markets have been absolutely brutal to the crypto bank. Silvergate's shares were down more than 28% in after-hours trading. It closed Wednesday at $4.91, an all-time low in data going back to November 2019, according to Dow Jones Market Data, and off 98% from its all-time high set in November 2021.

According to CNBC, investment giants Citadel Securities and BlackRock recently took major stakes in Silvergate — 5.5% and 7%, respectively. Ouch 🤕

✈️ THE TAKEAWAY

What’s next? 🤔 Silvergate was one of the two main crypto banking giants. The other (& the only) one is the New York-based Signature Bank which has more than $114 billion dollars in total assets. For the perspective, Silvergate has just over $11 billion. The bank’s implosion makes it one of the few non-crypto companies to go out of business as a result of the industry’s downturn. Why it matters? Well, the future of crypto is very much tied to the future of Silvergate. Here’s more on this + 2 deeper dives into Silvergate: