Shotgun wedding: UBS buys Credit Suisse for $3.2 billion 🤯; Microsoft just entered the crypto wallet space 😳; First Republic Bank: SVB 2.0? 🤔

FinTech is Eating the World, 20 March

Hey Everyone,

Happy Monday! What a weekend it has been… 😮 On today’s radar we have a shotgun wedding, or UBS buying Credit Suisse for $3.2 billion in the most historic banking marriage since 2008 (unpacking it, looking at winners & losers, and more!), Microsoft which just entered the crypto wallet space (it’s a big one!), and First Republic Bank that could be SVB 2.0 (what’s happening & what it tells us?). Let’s jump straight into the hot stuff 🌶

Shotgun wedding: UBS buys Credit Suisse for $3.2 billion 🤯

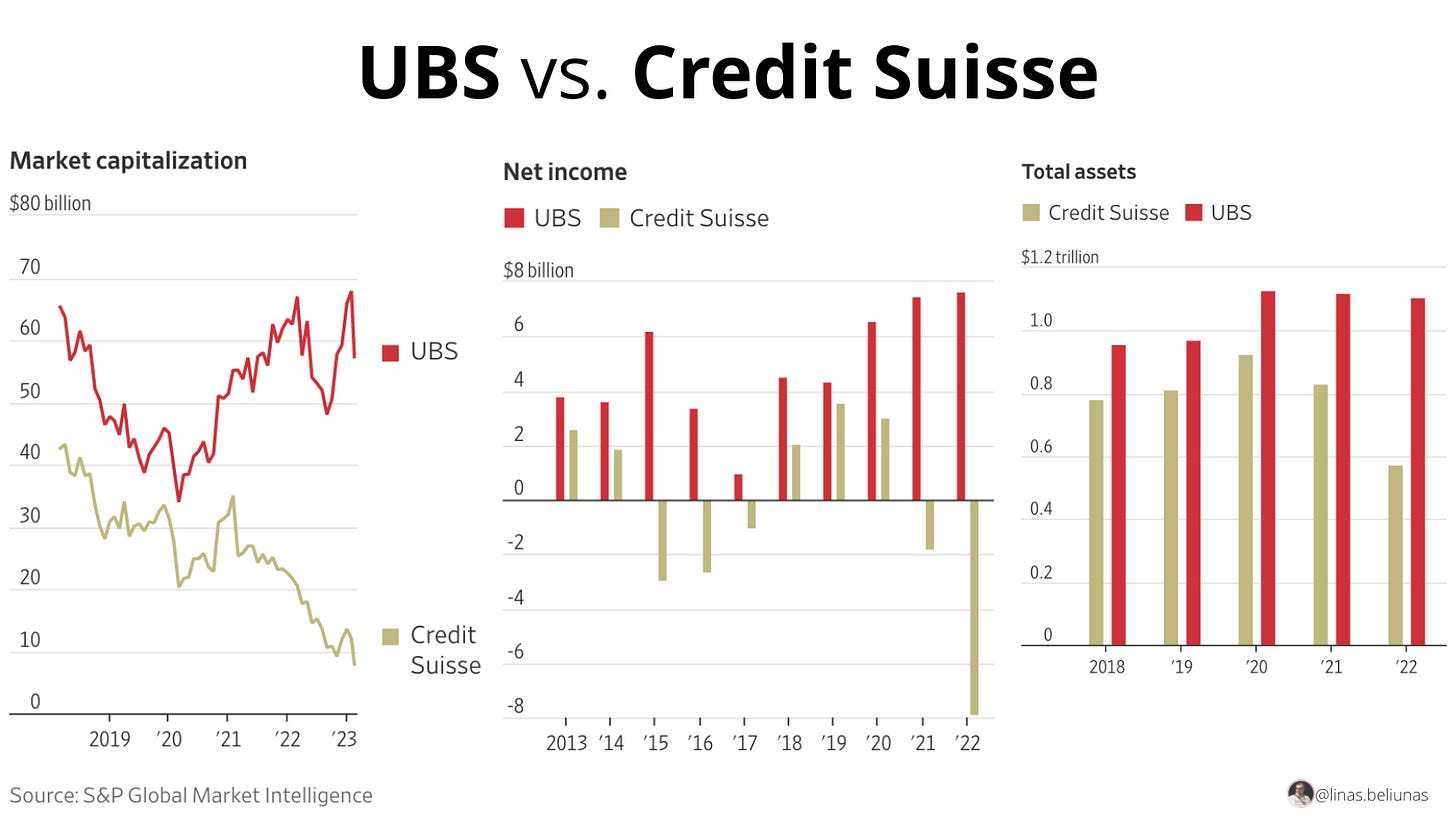

A lot can happen over a weekend 😳 IT finally happened. UBS UBS 0.00%↑ agreed to take over its longtime rival Credit Suisse CS 0.00%↑ for more than $3 billion marking the biggest banking deal in years as regulators were eager to halt a dangerous decline in confidence in the global banking system.

Credit Suisse ended Friday with a market value of around $8 billion. This means that its biggest rival is valuing its equity at a whopping 62% discount 😳 A lot can happen over a weekend…

A refresher ♻️ For the perspective, back in 2007, Switzerland's second-biggest bank had a market cap of over $90 billion and was even bigger than Apple.

Initially, Credit Suisse was offered $1 billion and has obviously pushed back as it believed the offer was too low and it would hurt shareholders and employees who have deferred stock. Then the offer was increased to $2 billion while the final price tag was agreed to be at over $3 billion. Still a solid discount! 👀

Now comes the crazy part.

Swiss authorities had to change the country’s laws to bypass the usual 6-week shareholder vote on the transaction as they rushed to finalize a deal before Monday.

It's a classical example of a shotgun wedding, and it just shows how bad the situation is.

More on this 👉 The deal between the two Swiss finance giants is the first megamerger of systemically important global banks since the 2008 financial crisis.

As part of the deal, the Swiss government will also provide more than $9 billion to backstop some losses that UBS may incur by taking over Credit Suisse. The Swiss National Bank also provided more than $100 billion of liquidity to UBS to help facilitate the deal.

Swiss authorities were under massive pressure to make the deal happen before Asian markets opened for the week since a regulator-led winddown of Credit Suisse could have proven more prolonged and painful for the financial system. First the Europan one, then - the global one. And nobody wanted that.

By the way, here’s something interesting: UBS calls this deal an “acquisition” while Credit Suisse calls it a “merger” 🤷♂️

✈️ THE TAKEAWAY

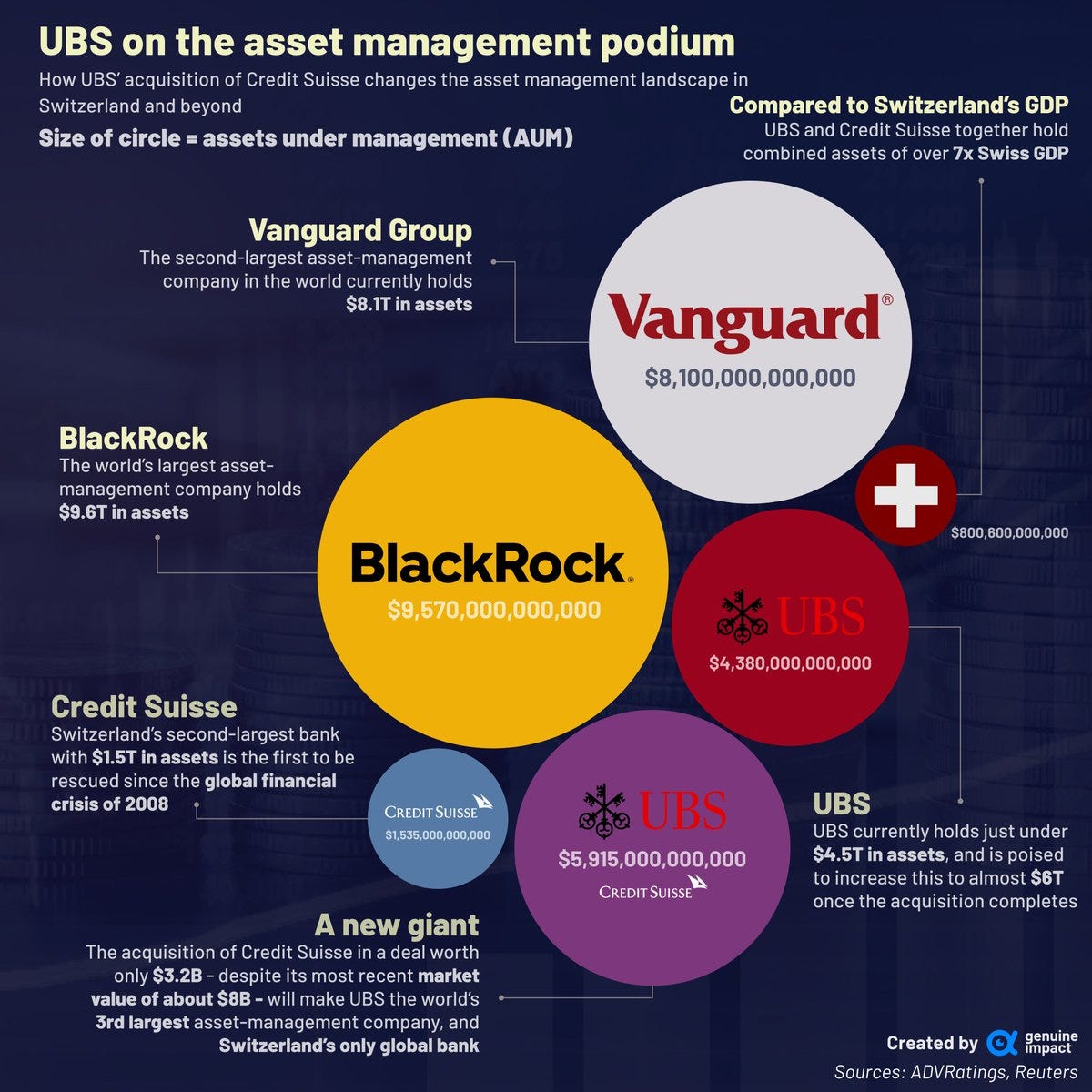

Now what? 🤔 Let’s be clear - a forced marriage of the two titans of Swiss banking was something UBS had never wanted. Yet, it happened and potentially stopped the banking contagion that was initiated by the collapse of Silicon Valley Bank. So who are the winners and losers? The most obvious and biggest winner in all of this will definitely be UBS. Credit Suisse had a $0.5 trillion balance sheet and around 50,000 employees at the end of 2022. After swallowing Credit Suisse, UBS’s balance sheet will hence rival Goldman Sachs Group and Deutsche Bank in asset size. That’s solid!

And that’s it. Now come the losers, and there are quite a few of them. First comes the shareholders - the biggest one is Saudi National Bank (SNB) which already lost $1.5 billion in the last 15 weeks alone. Then, there are AT1 bondholders as all of them have been written to zero in the deal. We must note that the total write-down marked the biggest loss yet for Europe’s $275 billion AT1 market. Finally, regulators lost here too. Finma became the first financial regulator to watch a bank considered systemically important have to be rescued since the financial crisis. The most crucial question then becomes will it be the last one?

Go deeper & discover more here: History in the making: UBS could acquire Credit Suisse 🤯🇨🇭[+2 more deeper dives]