Apple is building JPMorgan 2.0 😳; FinTech is finally disrupting the capital markets 💸; B2B payments are getting an instant reboot ⚡️

FinTech is Eating the World, 18 April

Hey Everyone,

Happy Tuesday! Yesterday was hot, but today… 😳 We’re looking at Apple which is building JPMorgan 2.0 (why it’s huge + lots of bonus reads), FinTech that's finally disrupting the capital markets (& why infrastructure FinTechs matter), and B2B payments that are getting an instant reboot (& how AmEx is building a B2B payments powerhouse). Let’s jump straight into the fascinating stuff 🌶

Apple is building JPMorgan 2.0 😳

It’s finally here!🔥 Apple AAPL 0.00%↑ has finally launched its long-trailed Apple Savings account.

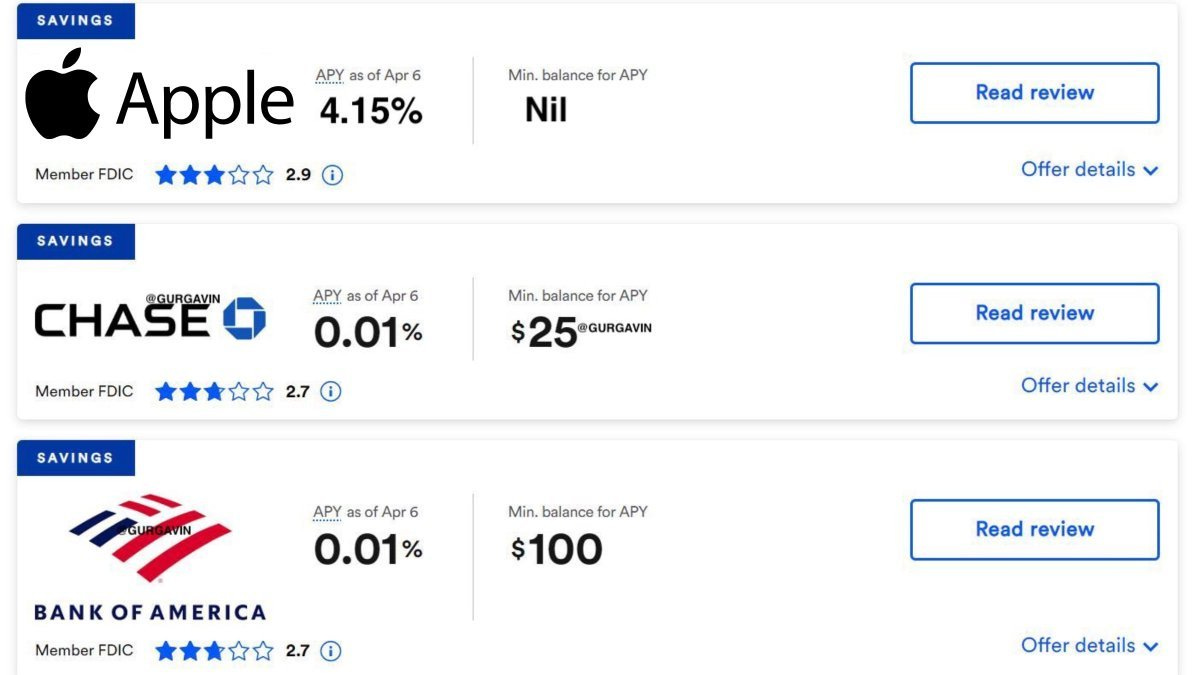

A high-yield Savings account from the tech giant is paying 4.15% APY, which is 10x the national average. This marks yet another stepping stone for Apple that's on its way to becoming the largest bank in the world 😳

More on this 👉 Apple Savings account is done via a partnership with Goldman Sachs GS 0.00%↑. It offers:

The rate that is more than 10x the national average (the average savings account interest rate in America is only 0.35% APY).

No fees, no minimum deposits, and no minimum balance.

Has slick UX/UI and takes <1 minute to set up.

FDIC for a max balance of $250,000

How it works 💸 American users can set up and manage a savings account directly from Apple Card in Wallet.

All Daily Cash rewards earned through the Apple Card will be automatically deposited into the savings account. Users can deposit additional funds through a linked bank account, or from their Apple Cash balance.

Once set up, Apple Card users can keep track of money in Wallet through a Savings dashboard, which shows their account balance and interest accrued over time.

Ties with Goldman 🏦 Goldman has been Apple's partner on the credit card since its launch in 2019. Hence, it’s not surprising the tech giant is launching Savings with them too. What’s interesting is that Goldman itself is paying its customers only 3.9% APY in their high-yield savings account. The fact that Apple managed to get 4.15% APY is yet another reminder of what a massive negotiating power it has and how badly GS wants to tap into Apple’s clientele.

As for Apple, this should serve as a good pilot testing their userbase appetite for a savings product. If it goes well, it might only be a matter of time before Apple buys Goldman Sachs altogether. This seems like a no-brainer to me 🤷♂️

ICYMI: The deal Apple needs to make: acquiring Goldman Sachs' Consumer Division would be the M&A of the century 🤯

On top of that, we must remember that since the 2019 deal, the tech giant has made some moves to ensure independence in the financial services arena. Apple was long-rumored to be using Goldman Sachs for the loans for its new BNPL play. However, Goldman is only facilitating the service as the technical issuer of the loans and the official BIN sponsor, with Apple making the loans directly through a new subsidiary.

ICYMI: Apple Pay Later is finally live 🍎💳

✈️ THE TAKEAWAY

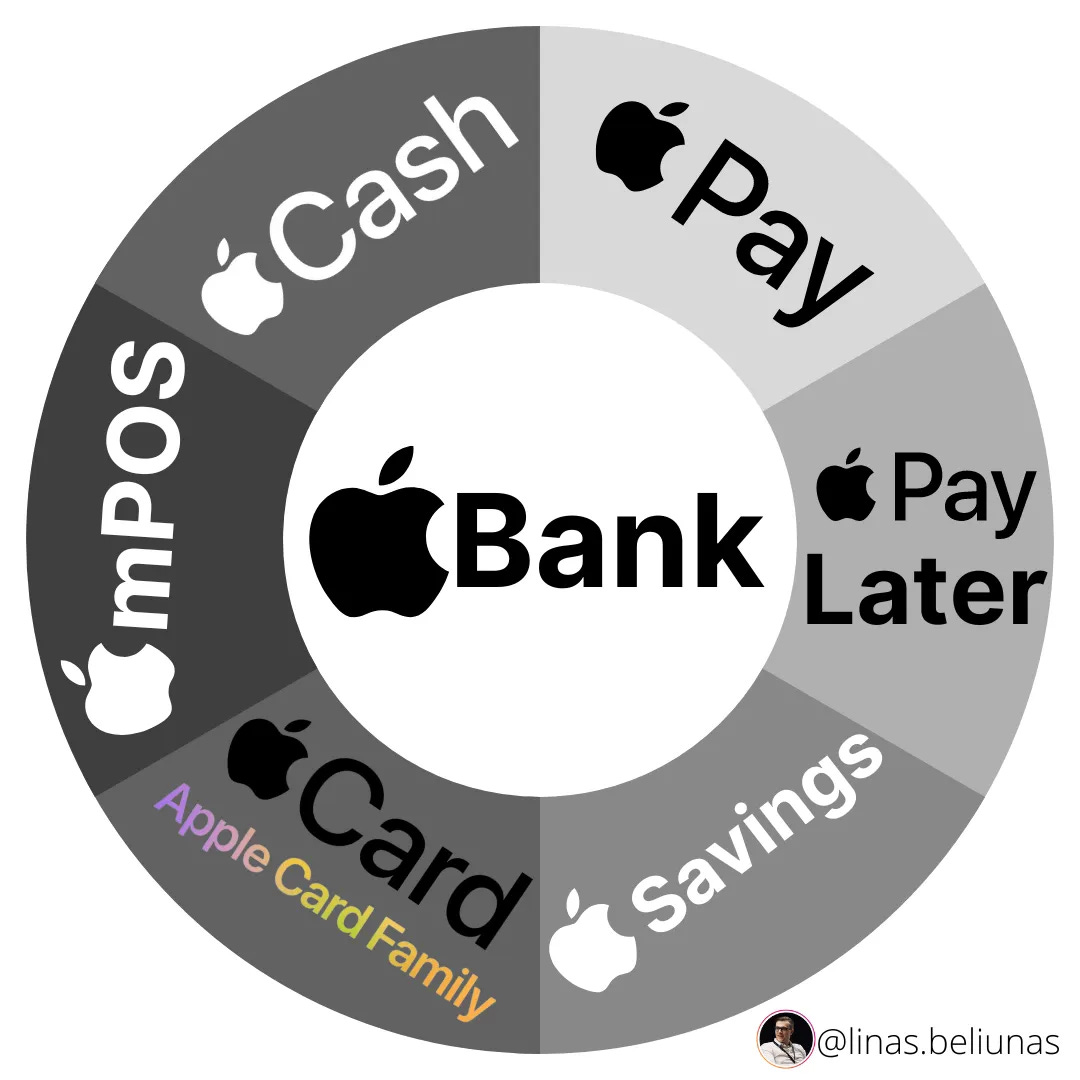

What does this all mean? 🤔 Let’s take a quick step back. Once we do that, we realize that Apple’s 4.15% APY is less than money market funds and 1% lower than the 3-Month Treasury Bill Yield of 5.21%. But most people don't know that and that doesn't matter. What matters here is convenience and brand trust. Apple is miles away in this and that's exactly why it will see a significant demand for this product. Apple Pay, Apple Cash, mPOS, Apple Card, Apple Pay Later, and now Apple Savings. Block by block the tech giant is building the Apple Finance empire that's about to disrupt the financial services space as we know it.

In other words, Apple is building JPMorgan 2.0. And it’s already making a difference - depositors pulled nearly $60 billion from three US banks (Charles Schwab, State Street, and M&T) in the first quarter:

This will only rise and it’s one of the reasons why in his shareholder letter, the CEO of JPM 0.00%↑, Jamie Dimon called out Apple by name as one of their biggest competitors.