N26 is ridiculously overvalued 😳; Middle East & Africa’s payments market is a massive digitization opportunity 💸; Starbucks keeps doing what it does best - NFTs 😎

FinTech is Eating the World, 19 April

Hey Everyone,

Happy Wednesday! Today’s issue is undoubtedly the best one yet 💣. We’re going to look at N26 which is ridiculously overvalued (you will learn why + lots of bonus reads), the Middle East & Africa’s payments market, which is a massive digitization opportunity (you can’t ignore this!), and Starbucks which keeps doing what it does best - NFTs (+ a bonus on their brilliant Web3 strategy). Let’s jump straight into the awesome stuff 🌶

N26 is ridiculously overvalued 😳

The news 🗞 German insurance giant Allianz is looking to sell its 5% stake in digital bank N26 at a sharp discount, Financial Times reported.

This is a pretty big deal, so let’s take a brief look at it.

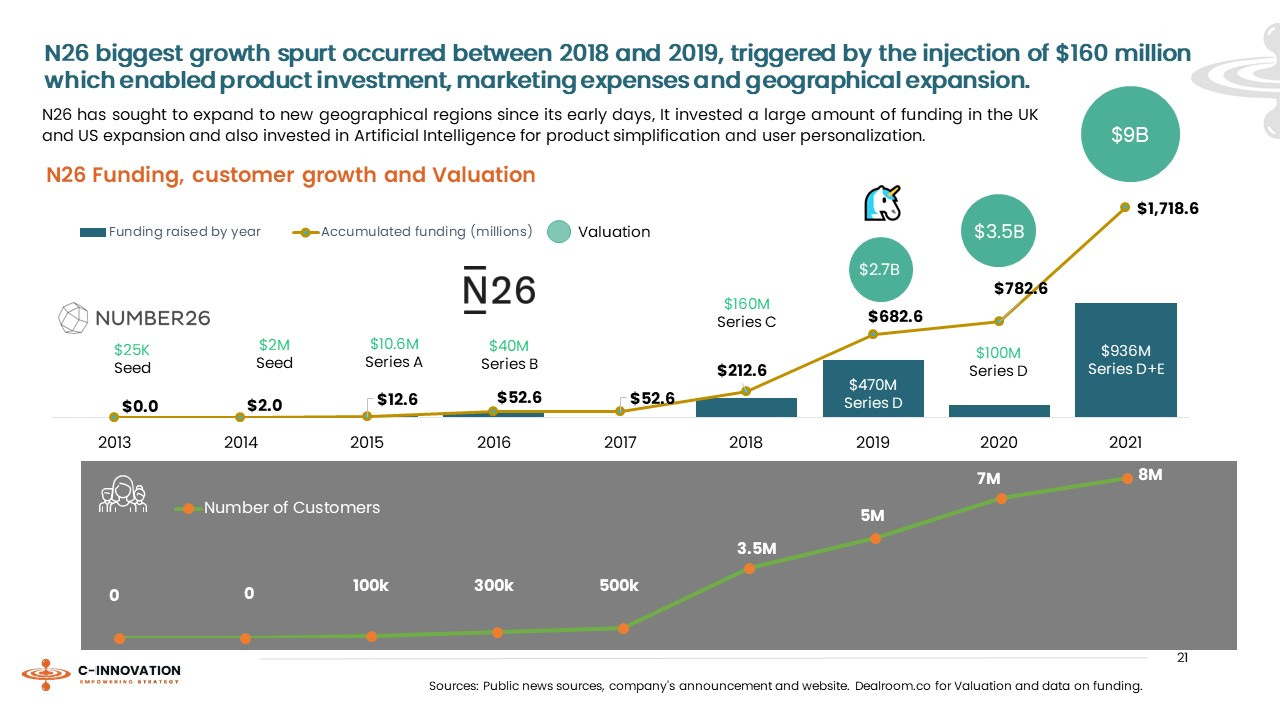

More on this 👉 The venture capital arm of the Munich insurance group Allianz X, one of the group’s largest external investors, has mandated an adviser to offer its stake in German FinTech champion N26. We can remember that the firm built its position in 2018 when it invested alongside China’s Tencent Holdings, taking part in a Series C funding round that raised about $160M at a valuation of less than $1B.

Now the insurer's venture capital arm is selling its stake at a $3 billion valuation, down from N26's $9 billion price tag at its latest funding round in October 2021. That implies a discount of about 68% 🤯

A step back 🐾 Launched in Germany and Austria in January 2015, N26 began as a current account with a Mastercard MA 0.00%↑. It has since moved into areas such as crypto and stock trading, attracting more than 7 million customers in two dozen countries.

The 2021 investment was framed as a “pre-IPO round”. Yet, after tech valuation plunged around the world when interest rates started to rise, N26 pushed back its ambition to list on the stock market.

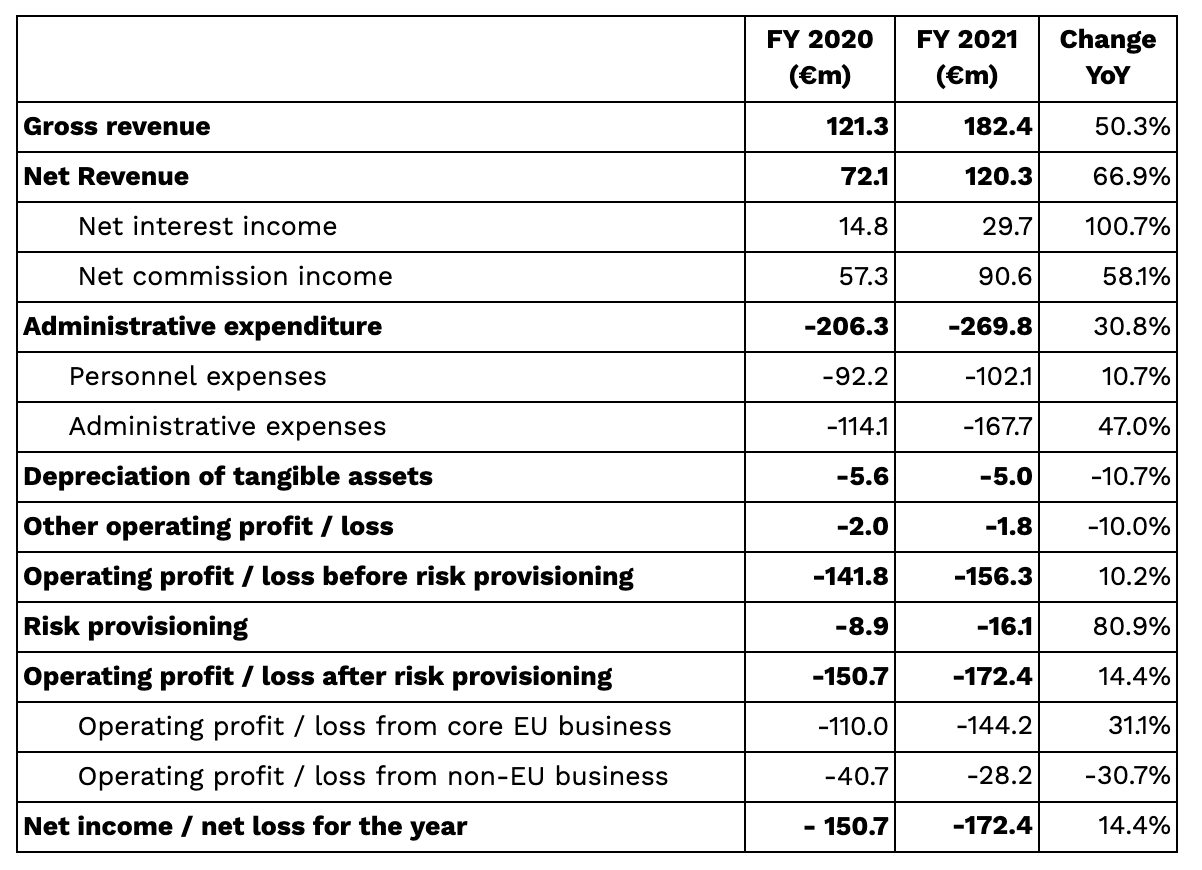

On top of that, the company has faced some stiff headwinds over the last couple of years and in October reported a net loss for the year of €172.4M, 14.45% up on the previous year. That’s bad.

In addition to the C-suite falling apart, the firm is also dealing with a cap imposed by German regulators on the number of new customers it is allowed to onboard each month. The cap was imposed, alongside a fine, in 2021 for lax money laundering controls.

ICYMI: N26 widening losses show what happens when you don't prioritize compliance🚨

✈️ THE TAKEAWAY

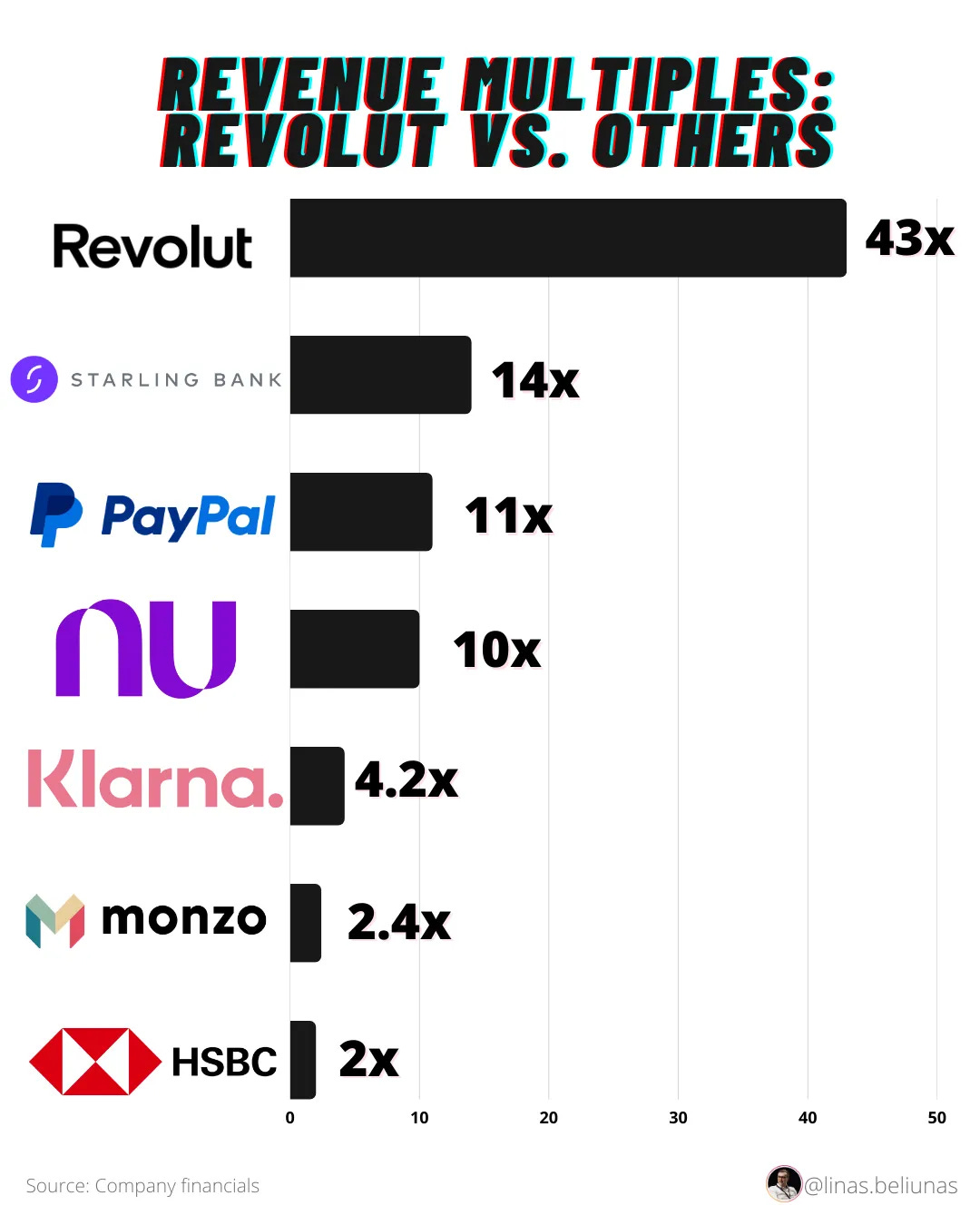

A massive correction is underway 👀 The fresh news about N26 is yet another illustration of the speed at which high-growth startups have fallen out of favor with investors. And it makes a ton of sense as N26 is massively overvalued. If earlier we questioned whether Revolut is worth $33B (spoiler alert: it’s not), it’s pretty obvious there’s no way N26 is worth $9 billion. No way. Just look at the multiples. With a revenue multiple of 43x, Revolut felt outrageous:

N26’s revenue multiple (based on the latest available data) is 45x 🤯 Therefore, a 70% is not only healthy - it’s inevitable.

ICYMI: There’s no way Revolut is worth $33B 🙅🏽♂️ [with lots of bonus reads]

On a positive note…