2023 Outlooks & Updates from Top Investment Banks & Investment Managers

FinTech is Eating the World, 24 April

Hey Everyone,

Good morning! Today’s issue is both a bit different and somewhat special. The best part - it’s open for everyone to read.

I have collected the most recent market outlooks and updates from top investment banks and investment managers. In addition to that, I’ve shared the most interesting takeaway that I found from each of the reports.

Whether you’re an investor (individual or retail), a startup founder, or a business leader, this should serve as a good compass to navigate and plan for the rest of 2023.

So without further ado, let’s jump straight into the interesting stuff 🌶

BlackRock. 2023 Global outlook Q2 update.

The most interesting takeaway:

JPMorgan Asset Management: Guide to the Markets.

The most interesting takeaway: where inflation is eating your lunch the fastest.

Allianz. Spring Economic Outlook.

The most interesting takeaway: negative confidence effects from the near-death experience in the US banking sector and the unresolved energy situation in Europe will shape the rest of the year.

Goldman Sachs. ALL ABOUT BANK(PANIC)S.

The most interesting takeaway: GS expects 25bp ECB hikes in May and June for a 3.5% terminal rate, due to likely persistent high core inflation.

Charles Schwab. 2023 Quarterly Market Outlook: Fed on the Brink?

The most interesting takeaway: it's important during this period of transition to focus on higher-quality factors - such as stable earnings and reasonable valuations - when choosing stocks. This is not a time to take undue risk, in our opinion. Your portfolio also should contain a mix of investments - including various types of stocks (large-cap, small-cap, domestic, and international), bonds, and cash investments - in appropriate amounts based on your goals, investing time horizon, and risk tolerance.

Goldman Sachs Asset Management. April 2023 Market Pulse.

The most interesting takeaway: we believe the significant improvement in China’s services sector will frontload the reopening impulse. GIR has revised on an annual basis its 2023 GDP growth forecast up from 5.5% to 6.0% and lowered its 2024 GDP growth forecast to 4.6%. In the Euro area, tightened bank lending standards may also weigh on growth. GIR modestly revised its 2023 GDP forecast down to 0.7%.

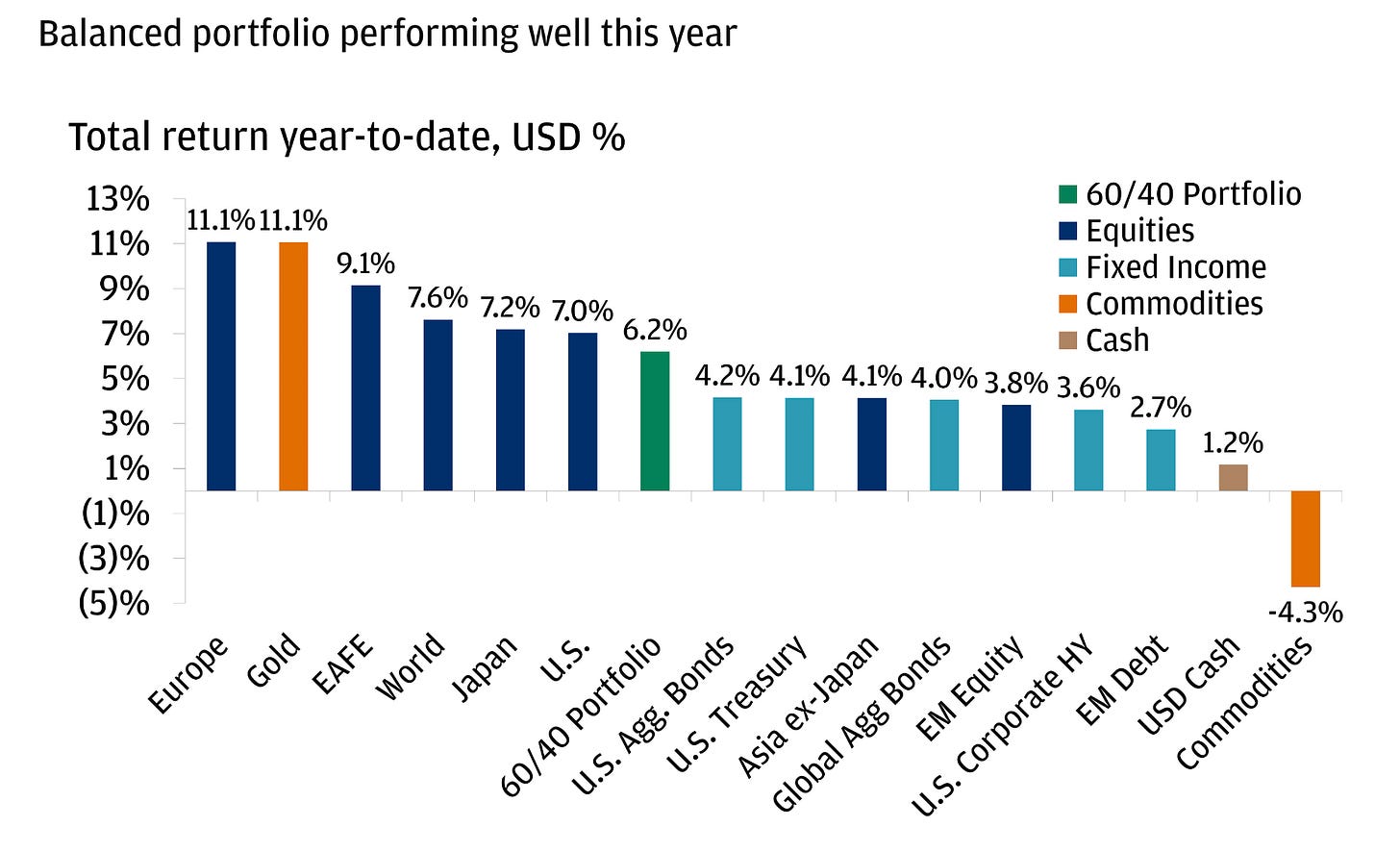

JPMorgan Private Bank. 2023 report card: Portfolios show resilience amid bank struggles.

The most interesting takeaway: the bad news - we think a recession is likely in 2023. The good news is: Central banks should stop hiking and inflation will likely fall.

Fidelity International. Q2 2023 Investment Outlook.

The most interesting takeaway:

Deutsche Bank Wealth. CIO Insights.

The most interesting takeaway: spring may be here, but sticky inflation and shifting monetary policy expectations – prompted for example by earlier-thanexpected rate cuts – could continue to trigger short-term volatility in bond and equities markets. This will be a case of recovery constrained. Structural economic and market changes add further to the need for portfolios to be managed with great care and attention.

RBC Wealth Management. Global Insight - April 2023.

The most interesting takeaway: the 1-year yield rose above the 10-year yield decisively last July. The negative gap has widened further over the intervening seven months. The history of this indicator suggests the U.S. economy will be in recession by the summer of 2023.

Have other interesting reports that are not covered here? Share them in the comments below 👇🏼

-

👋 That’s it for today! Thank you for reading and have a productive week ahead! And if you enjoyed this newsletter, invite your friends and colleagues to sign up: