SVB 2.0? First Republic Bank is on the brink of collapse 😳; PhonePe is building Indian🇮🇳 Google 👀; Shopify’s quest to be a single-stop FinTech for merchants 🛍

FinTech is Eating the World, 26 April

Hey Everyone,

Good day! Yesterday was hot, but today - oh boy… 😳 We’re going to look at the First Republic Bank which is on the brink of collapse (SVB 2.0 in the making + what’s next), PhonePe which is building Indian🇮🇳 Google (+ 1 more bonus read), and Shopify’s quest to be a single-stop FinTech for merchants (it’s a FinTech giant you must pay serious attention to!). Let’s jump straight into the hot stuff 🌶

SVB 2.0? First Republic Bank is on the brink of collapse 😳

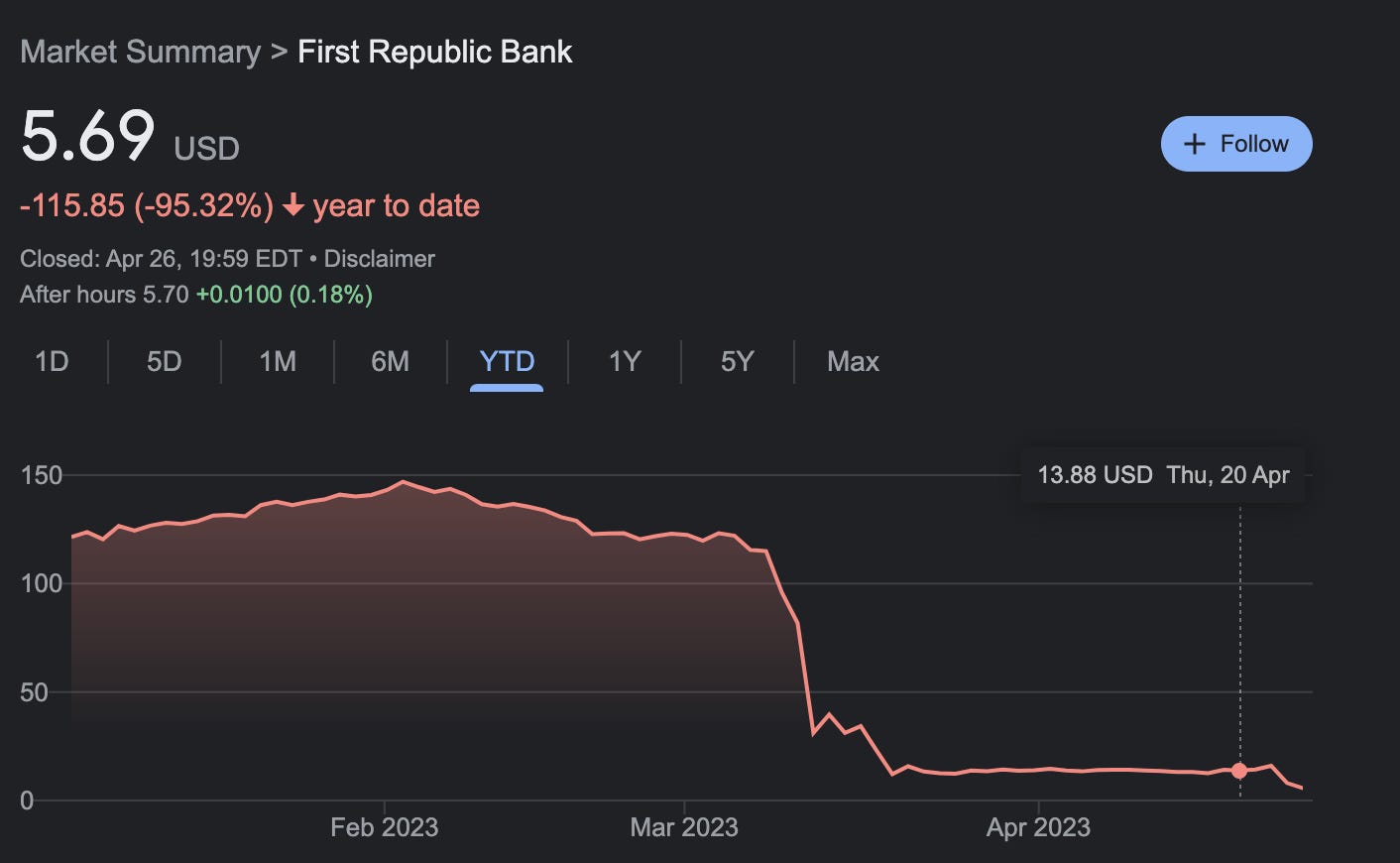

The news 🗞 First Republic Bank’s FRC 0.00%↑ market value plunged below $1 billion for the first time ever after a report said the US government was unwilling to intervene in the rescue process, hammering the lender’s stock.

First Republic Bank shares have fallen by more than 95% since the beginning of the year. Wow 🤯

How we got here? 🤔 On Monday, First Republic disclosed that it had lost about $100 billion in deposits in the first quarter, following the collapses of Silicon Valley Bank and Signature Bank. That prompted a group of 11 big banks to deposit $30 billion with First Republic last month in hopes of stabilizing it. It didn’t help.

The reason it didn’t help was that FRB’s issues are much bigger. First Republic specialized in making huge mortgages, often at low rates, to wealthy borrowers, and that business model no longer works, as per WSJ. Now the bank is sitting on a pile of loans that are mispriced for the current interest-rate environment.

And that’s a problem with no easy solution.

Zoom out 🔎 Once you zoom out, this draws one unpleasant parallel. If First Republic becomes the first bank the Fed is going to allow to fail, that’s basically the deja vu of Lehman Brothers…

✈️ THE TAKEAWAY

Looking ahead 👀 One must remember that at its peak in November 2021, First Republic had a market cap of more than $40 billion. Right now, FRB is nearly worthless in its current state and it’s hard to see any good outcome out of this. Looking at the big picture, we need to remember that Silicon Valley Bank was the 16th largest bank, and when it failed it was the second-largest bank failure in US history. First Republic Bank was the 13th largest bank with $200B in deposits, and it is about to fail. Here we go again 🤷♂️