The US banking system isn’t “sound and resilient” 😬; Petal is what the future of FinTech is all about 🚀; The biggest Seed round in Europe ever? 🤯

FinTech is Eating the World, 12 May

Hey Everyone,

Happy weekend! We’re finishing off this week on Saturday but it’s totally worth the wait. On today’s menu we have the US banking system which isn’t “sound and resilient” (data proves it + what’s next), Petal which shows us what the future of FinTech is all about (steal their strategy because you can’t ignore it), and the biggest (?) Seed round in Europe ever (hint: it’s RegTech, and it’s going to be big!). Let’s jump straight into the awesome stuff 🌶

The US banking system isn’t “sound and resilient” 😬

The news 🗞 The US Federal Reserve has stated that the country's banking system remains "sound and resilient" despite warnings of potential credit squeezes and slower economic activity.

Let’s take a look.

More on this 👉 According to the Fed's Financial Stability Report, persistent inflation, tighter monetary policy, banking-sector stress, and real estate pressures are the biggest risks to financial stability.

The central bank also found that lenders plan to tighten lending standards over the rest of 2023, citing concerns about bank funding costs, liquidity, and deposit outflows. Smaller banks are most at risk, listing liquidity and funding costs as reasons for cutting lending, indicating concerns about regional bank failures.

The Fed remains confident in the system, which has held up relatively well compared to 2008, with ample liquidity and limited reliance on short-term wholesale funding. The banking sector turmoil could spread, and the Fed has singled out sectors with "structural vulnerabilities" that could be hit by economic problems.

✈️ THE TAKEAWAY

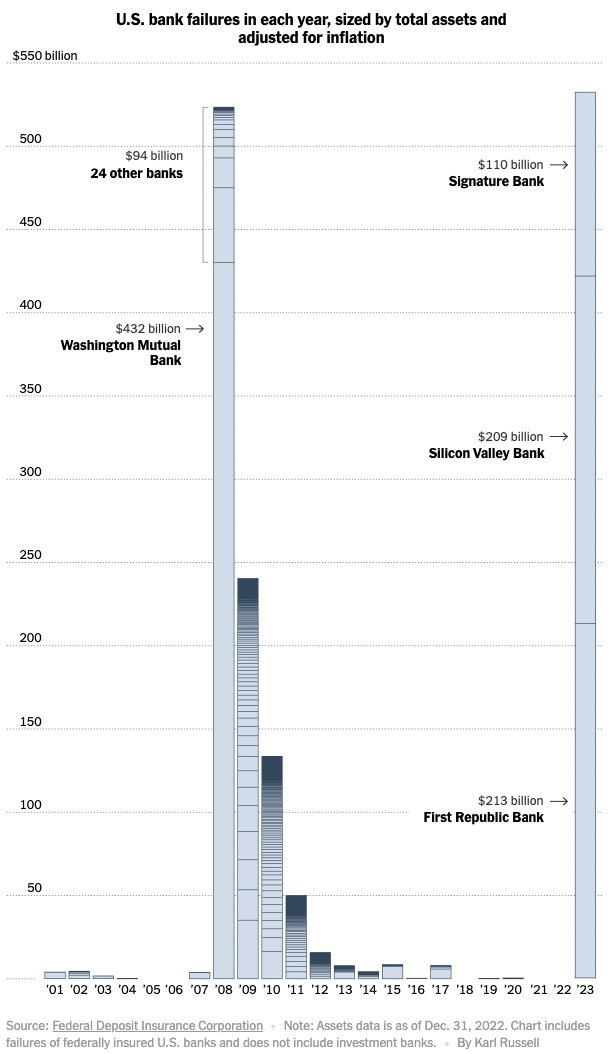

Are you sure? 🤔 “Banking system is sound and resilient". Meanwhile, the system goes Bingo:

Also, this (probably nothing):

And this:

So no, the system is definitely not sound and resilient 🙃 On a more serious note, tighter oversight and new legislation may protect regional banks in the future, although this could intensify the lending squeeze. Furthermore, the Fed's recent rate hike and hints that a series of increases could be coming to an end may offer banks breathing room and help prevent further deposit flights. So watch this out very closely.