Affirm’s growth is slowing down 📉; EU probe into Apple Pay is a big headache for Apple 😓; FinTechs that are raising right now should expect 50% to 70% correction 😳

FinTech is Eating the World, 15 May

Hey Everyone,

Good morning! We’re starting a new week with a bang 💣 On today’s radar we’ve Affirm whose growth is slowing down (what to expect next + their profitability strategy you should steal), EU probe into Apple Pay, which is a big headache for the tech giant (to worry or not?), and FinTechs that now should expect 50% to 70% correction if they were to raise today (+ a bonus read). Let’s jump straight into the hot stuff 🌶

Affirm’s growth is slowing down 📉

The news 🗞 Buy Now, Pay Later (BNPL) pioneer Affirm AFRM 5.88%↑ reported its fiscal Q3 (ended March 31, 2023) earnings that came in a bit better than expected.

Let’s take a look.

More on this 👉 Affirm’s Q3 at a glance:

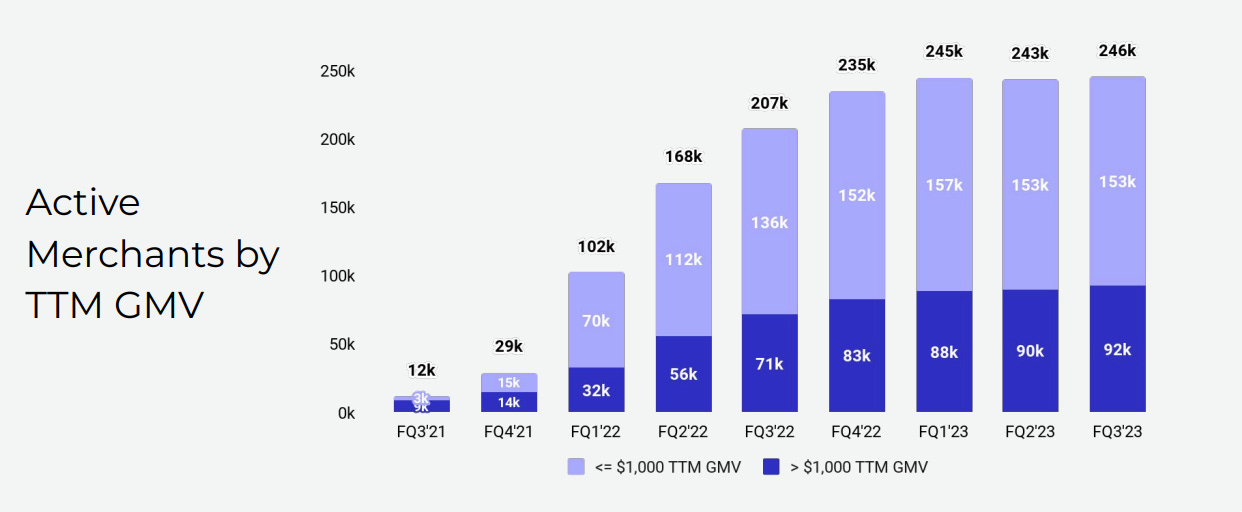

Affirm’s gross merchandise volume (GMV) increased 18% year over year (YoY) to reach $4.6 billion. While this is still impressive growth, it’s a major slowdown from the 73% YoY surge during the same period last year.

Active consumers grew 26% YoY to hit 16 million users, another marked slowdown from a year ago (137%).

The company’s revenues inched up 7% YoY growth to reach $381 million, versus 54% YoY last year.

When it comes to categories, travel, and ticketing, which makes up 16% of its gross merchandise volume, shot up 62% YoY in Q3. But consumer electronics declined 8% YoY, and the home and lifestyle category slumped 10% YoY.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, it might seem that the future outlook for Affirm doesn’t seem to be very bright. Especially when you also take into account greater scrutiny from regulators and growing competition. Nevertheless, the BNPL market is expected to continue growing (88.2M US consumers are expected to use BNPL in 2023, up 33.9% YoY) and Affirm is the category leader remaining the most frequently used BNPL app in the US for a few years now. More importantly, the team is now more nimble (remember that Affirm started Q3 by laying off 19% of its staff, and shutting down its cryptocurrency business) and much better positioned to hit profitability by the end of fiscal 2023. Read more here & steal their strategy:

Bonus: Affirm offers a profitability strategy that other BNPL FinTechs should steal 👏