Credit card debt remains at a record high 😳; Ripple wants to dominate the Enterprise 😎; ChatGPT for Personal Finance is finally here, and it’s a game-changer 🤯

FinTech is Eating the World, 17 May

Hey Everyone,

Happy Thursday! Due to an intense schedule and travel, the latest issue is coming in late. Yet, it’s absolutely worth the wait as today we’re looking at the credit card debt that remains at a record high (why it matters & what's next), Ripple that wants to dominate the Enterprise (it’s one of the biggest moves from Ripple), and ChatGPT for Personal Finance that’ finally here (why it’s a game-changer & 4 more reads on AI + Finance). Let’s jump straight into the spicy stuff 🌶

Credit card debt remains at a record high 😳

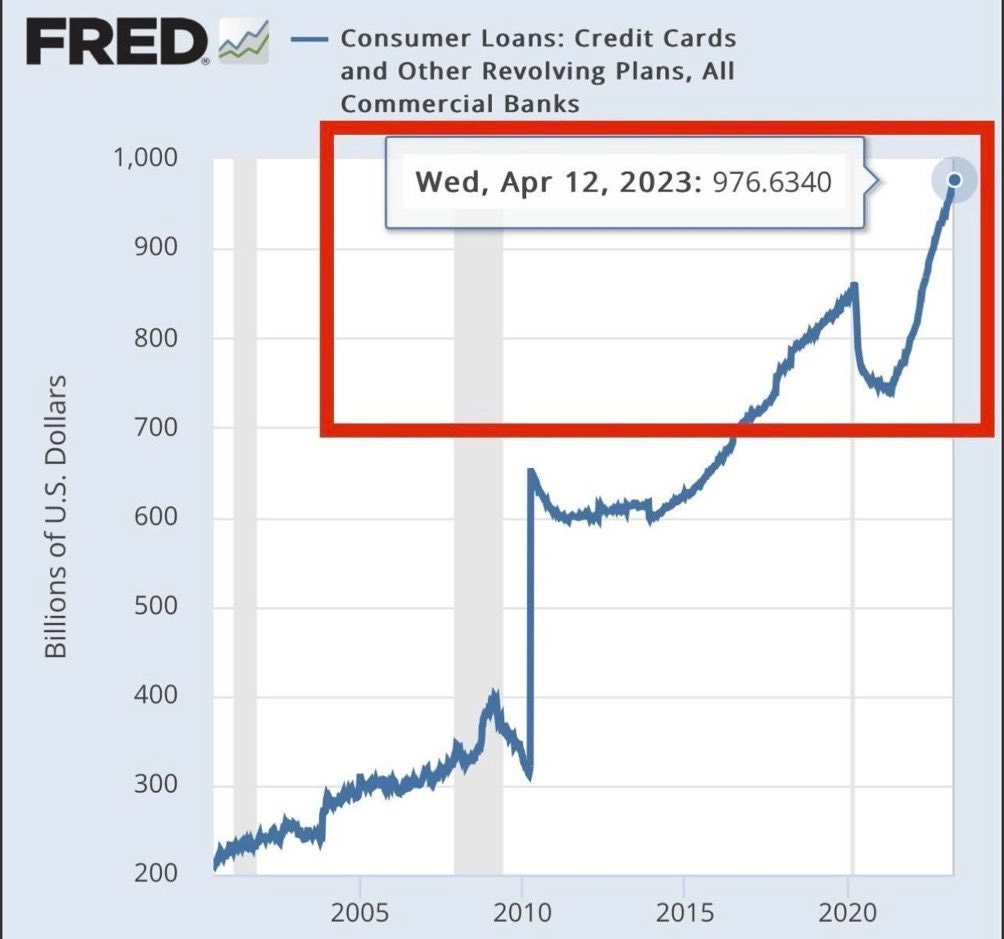

The news 🗞 According to the Federal Reserve Bank of New York's Quarterly Report on Household Debt and Credit, US household credit card debt remained unchanged at $986 billion in Q1 2023 compared to Q4 2022.

However, it marked a significant increase of $145 billion year over year (YoY). The serious delinquency rate (90 days or more) for consumers rose to 4.57%, up from 3.04% the previous year.

Let’s take a closer look at this and why it matters.

How we got here 👉 Credit card debt has reached a record high level. While consumers made progress in paying off debt during the early stages of the pandemic, they have faced challenges due to inflation putting strain on their budgets. Although April's consumer price index reading of 4.9% is an improvement from the peak of nearly

9% in June 2022, it still exceeds the Federal Reserve's target of 2%. Additionally, the average interest rate for credit cards has risen to around 21%, the highest rate in three decades, making it more costly for consumers to repay their debts. Notably, this is the first quarter in at least 20 years that credit card balances did not decrease following holiday spending.

What’s the impact here? 🤔 The consequences of this situation are significant. A study from PYMNTS and Sezzle reveals that 31% of the US population experienced some form of credit insecurity in the past twelve months. Even credit-secure consumers are not immune to the risks, as 57% of them faced financial setbacks, such as missed payments and reduced credit scores, due to life events over the past year.

✈️ THE TAKEAWAY

What’s next? 🤔 Looking ahead, consumers, particularly those who spend heavily, may seek alternatives to credit cards to avoid further accumulation of credit card debt. One possible option is turning to buy now, pay later (BNPL) plans, which offer short-term funding with lower or no interest. Another alternative is the use of personal loans provided by platforms like SoFi, which can help consolidate credit card debt and allow repayment at more affordable interest rates. Watch this more closely from now on!

ICYMI: BNPL is dead. Long live BNPL! 💸 [+4 more reads]