Block’s new strategy: brilliant but risky 👀; Another vertical neobank shuts down. Time to worry? 🤔; Fed develops The Twitter Financial Sentiment Index 😳

FinTech is Eating the World, 30 May

Hey Everyone,

Good morning! Today’s issue is the best one yet 👏 On today’s radar we have Block’s new strategy (why it’s brilliant but risky + a bonus read on why Cash App is at the center of the financial services revolution & some deeper dives into Block), another vertical neobank shutting down (time to worry & is this just ZIRP?), and Fed that developed The Twitter Financial Sentiment Index (it’s a super interesting development that will have wide-ranging implications). Let’s jump straight into the spicy stuff 🌶

Block’s new strategy: brilliant but risky 👀

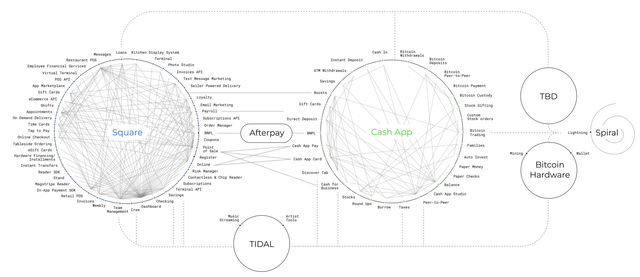

The news 🗞 FinTech giant Block SQ 0.00%↑, under the leadership of controversial CEO Jack Dorsey, aims to target an older and wealthier audience for its peer-to-peer (P2P) payment service, Cash App.

While Cash App is gaining popularity among this demographic, only 18% of upper-income adults currently use it, as per Pew Research Center. To address this, Dorsey highlighted the need for more options to enhance the app's appeal at a JPMorgan Chase JPM 0.00%↑ investor conference.

Block’s new strategy is brilliant yet risky. Let’s see why.

More on this 👉 Widening Cash App's appeal holds potential for several reasons:

Simplicity: Cash App's user-friendly interface and straightforward features can attract older users who value ease of use.

Family Accounts: The inclusion of Family Accounts, allowing parents to monitor and manage their children's card spending, may appeal to mature consumers. More importantly, this can also help to secure future users from the early days.

Bank-Like Features: Cash App's shift toward offering banking services aligns with the needs of this demographic. It now allows users to make payments outside the Square ecosystem and recently introduced a savings account.

When you put it all together, it’s clear that Block's new strategy to target higher-income groups can drive Cash App's growth and revenue. Wealthier users are likely to engage in larger transactions and utilize the app for more significant financial activities. More importantly, expanding Cash App's product suite further into mainstream financial services can attract users across different age groups (including the younger generation that could end up being life-long users of the whole Block ecosystem).

However, this is a risky move and Block will definitely face some challenges going forward.

Let’s take a look (+ a bonus read on why Cash App is at the center of the financial services revolution & some deeper dives into Block).