Nubank + Uber = 🚀; Game-changer: the world’s first banking-specific large language model 😳; Another challenger bank hits profitability 👏

FinTech is Eating the World, 2 June

Hey Everyone,

Happy Weekend! We’re finishing the week on Saturday but it’s definitely worth the way 🤯 Honestly, today’s issue is the best one yet as we’re looking at Nubank + Uber = 🚀 (& how Nu is building the Apple Finance for LatAm), the world’s first banking-specific LLM (it’s a game-changer + it’s implication + lots of bonus reads on Gen AI in Finance), and another challenger bank hitting profitability (& lessons to learn from the best). Let’s jump straight into the hot stuff 🌶

Nubank + Uber = 🚀

The news 🗞 Brazil’s FinTech giant Nubank NU 0.00%↑ and Uber UBER 0.00%↑ have partnered to offer customers the ability to pay for Uber trips using NuPay, Nubank's online payment method.

More on this 👉 By linking their NuPay account to the Uber app, customers can make quick and secure payments with just one click. Paying with NuPay also offers exclusive benefits, such as the possibility of receiving an additional credit limit for the transaction.

The USP 🥊 NuPay is a payment method for online purchases available exclusively for Nubank customers. When shopping at an online store that offers NuPay, Nubank customers can select the Buy with Nubank option at checkout and confirm the purchase with their 4-digit password in the Nu app. NuPay can be used for both credit and debit transactions, and service users can choose to pay in full using their available balance or split the payment into up to 24 installments.

Nubank launched the service in May 2022, and it was available at 160 merchants as of April 2023.

✈️ THE TAKEAWAY

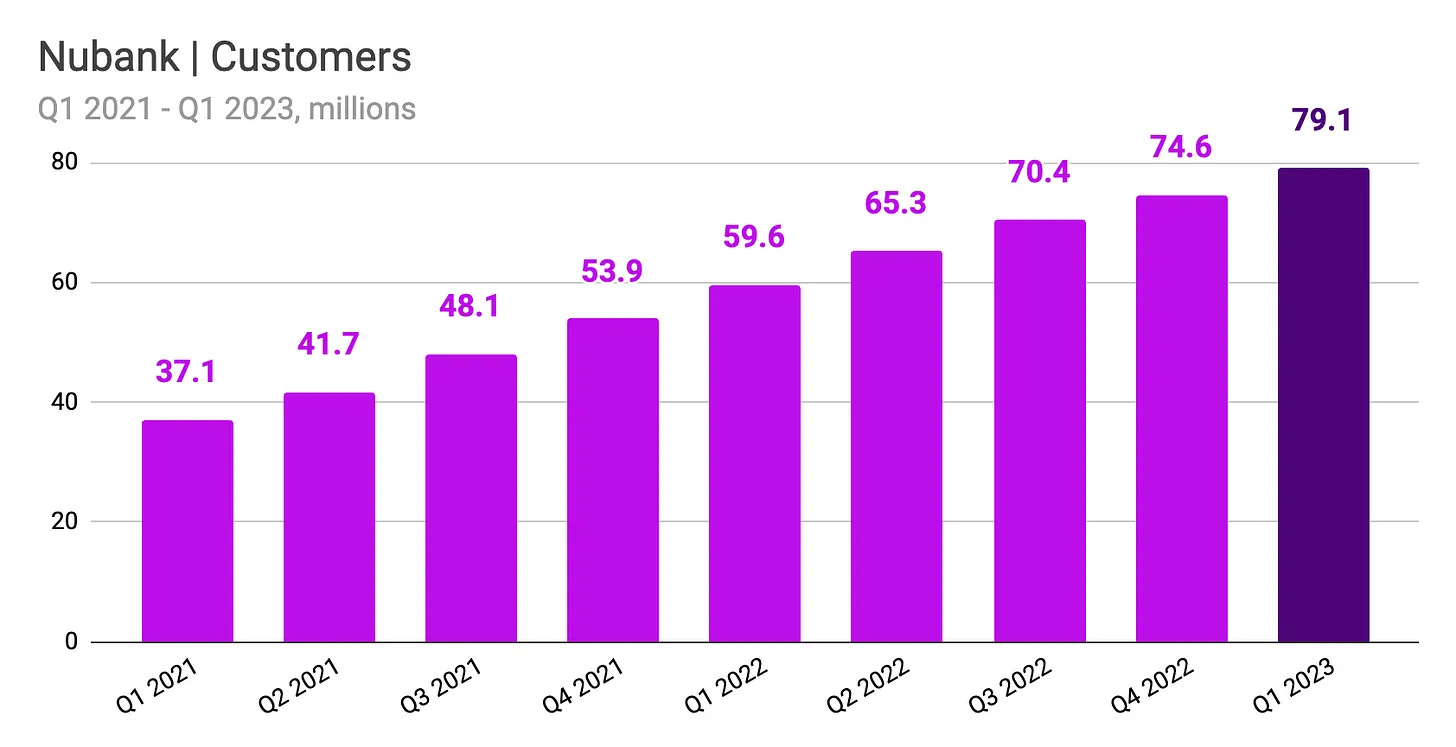

The giant 🇧🇷 The partnership with Uber is yet another move to further strengthen Nubank’s ecosystem - by expanding their services outside of Nu’s Super App ecosystem the Brazilian FinTech giant is basically building the Apple of Finance for LatAm. We must remember that Nubank recently announced reaching the milestone of 80 million customers (as seen above) across its 3 markets, Brazil🇧🇷, Mexico🇲🇽 and Colombia🇨🇴, adding 4.5 million customers just in the first quarter of 2023 alone 🤯 This just proves the scale and influence Nu has across Latin America. Furthermore, the company reported 56M customers having Nubank’s digital accounts, 35M customers using credit card products, and 6M customers taking a personal loan. The crazy part? Every active Nu user is now using nearly 4 Nubank’s products 😳. I’m now even more bullish on them.

Disclaimer: I’m an investor in NU.

ICYMI: The future is purple. Nubank Purple 💜 [a deeper dive into Nu + some more bonus reads]