More Big names follow BlackRock in filing for a Bitcoin ETF 👀; Open Banking is keeping FinTech alive 💸; AI fraud prevention is the next hot thing? 🤔

FinTech is Eating the World, 26 June

Hey Everyone,

Happy Monday! I hope you had a great weekend because we’re starting a new week with a solid dose of FinTech developments 🍽️ Today we’re looking at big names following BlackRock in filing for a Bitcoin ETF (it’s getting very BIG!), Open Banking which is keeping FinTech alive (& why you should be bullish too), and see why AI fraud prevention could be the next hot thing (+ risks & a bunch of deeper dives into how AI is being leveraged in finance NOW). Let’s jump straight into the cool stuff 🌶

More Big names follow BlackRock in filing for a Bitcoin ETF 👀

The BIG news 🗞 WisdomTree and Invesco have filed applications for spot Bitcoin exchange-traded funds (ETFs) in the US, following BlackRock's BLK 0.00%↑ massive move a week ago.

ICYMI: BlackRock’s Bitcoin ETF: a game-changer or just hype? 🤔

More on this 👉 New York-based asset management firm WisdomTree has applied for a 3rd time, requesting that the SEC allows WisdomTree to list its “WisdomTree Bitcoin Trust” on the Cboe BZX Exchange under the ticker “BTCW.” The SEC previously rejected its application in December 2021, and again in October 2022, claiming concerns of fraud and market manipulation.

Meanwhile, Invesco has "reactivated" its application for its “Invesco Galaxy Bitcoin ETF.” According to the filing, the spot Bitcoin ETF will make use of "professional custodians and other service providers."

WisdomTree had $90.7 billion in assets under management as of April while Invesco, one of the largest ETF issuers in the world, had $1.4 trillion in assets under management as of April. That’s a lot of money 👀

✈️ THE TAKEAWAY

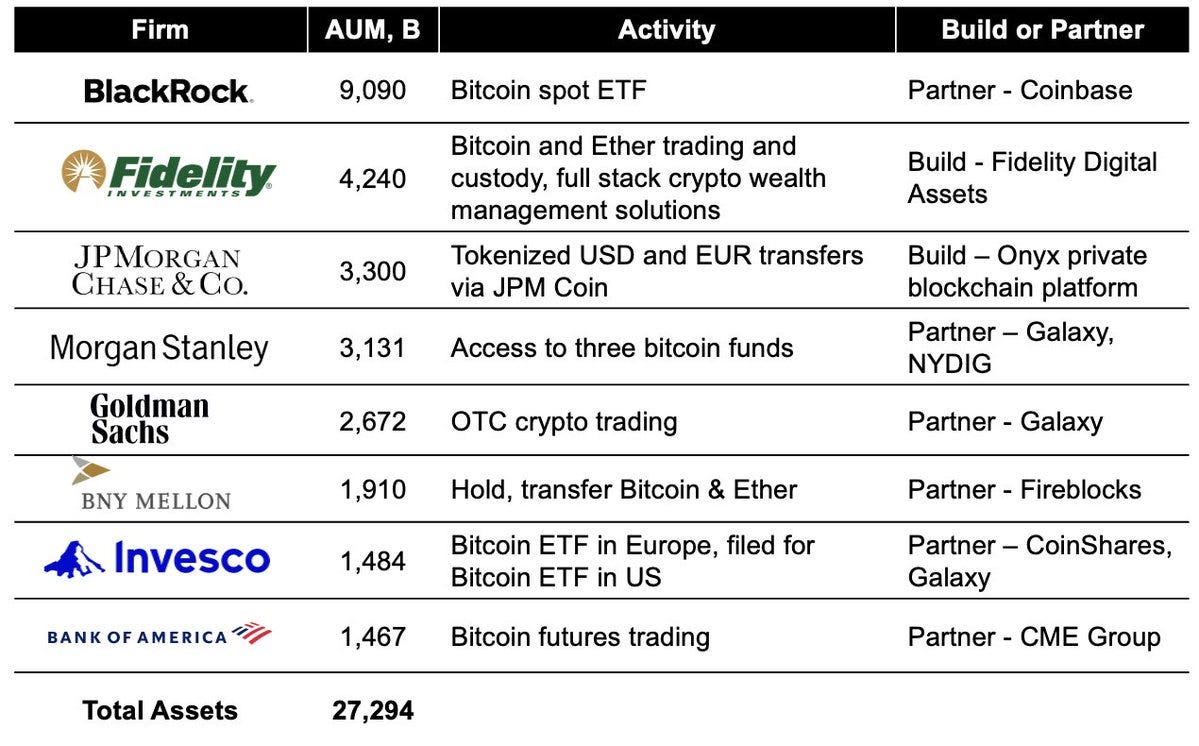

Zoom out 🔎 The two firms now join BlackRock, which surprised the market with its filing for a spot Bitcoin ETF filing about a week ago. We must note that thus far, the SEC has only approved bitcoin ETFs that are tied to U.S.-traded futures and has cited the lack of proper cross-exchange market surveillance as one reason why it won't approve a bitcoin spot ETF. Yet, once you zoom out, it's clear that this is just the beginning of a bigger wave we have started seeing as many of the largest financial institutions in the US (and globally) are actively working to provide access to Bitcoin. So far, $27 trillion of client assets are here, and that might not be the end of it.