Wise is one of the most underrated FinTechs right now 😳; How struggling is Robinhood? 🤔; Crypto is having a momentum right now 📈

FinTech is Eating the World, 27 June

Hey Everyone,

Happy Wednesday! Due to travels, we’re running a bit late. But it’s definitely worth the wait as in today's issue we’re focusing on Wise, which is one of the most underrated FinTechs right now (& why you should be bullish too), see how struggling is Robinhood (why layoffs & recent acquisition could be a big win), and crypto that’s having a momentum right now (BIG moves are being made by the Giants). Let’s jump straight into the interesting stuff 🌶

Wise is one of the most underrated FinTechs right now 😳

The news 🗞 Shares in British FinTech star Wise soared by more than 18% this week following the news that the money transfer app saw its full-year pre-tax profits triple, boosted by rising interest rates.

Let’s take a brief look at why Wise is one of the most underrated FinTechs.

More on this 👉 Here are the latest full-year key numbers from Wise:

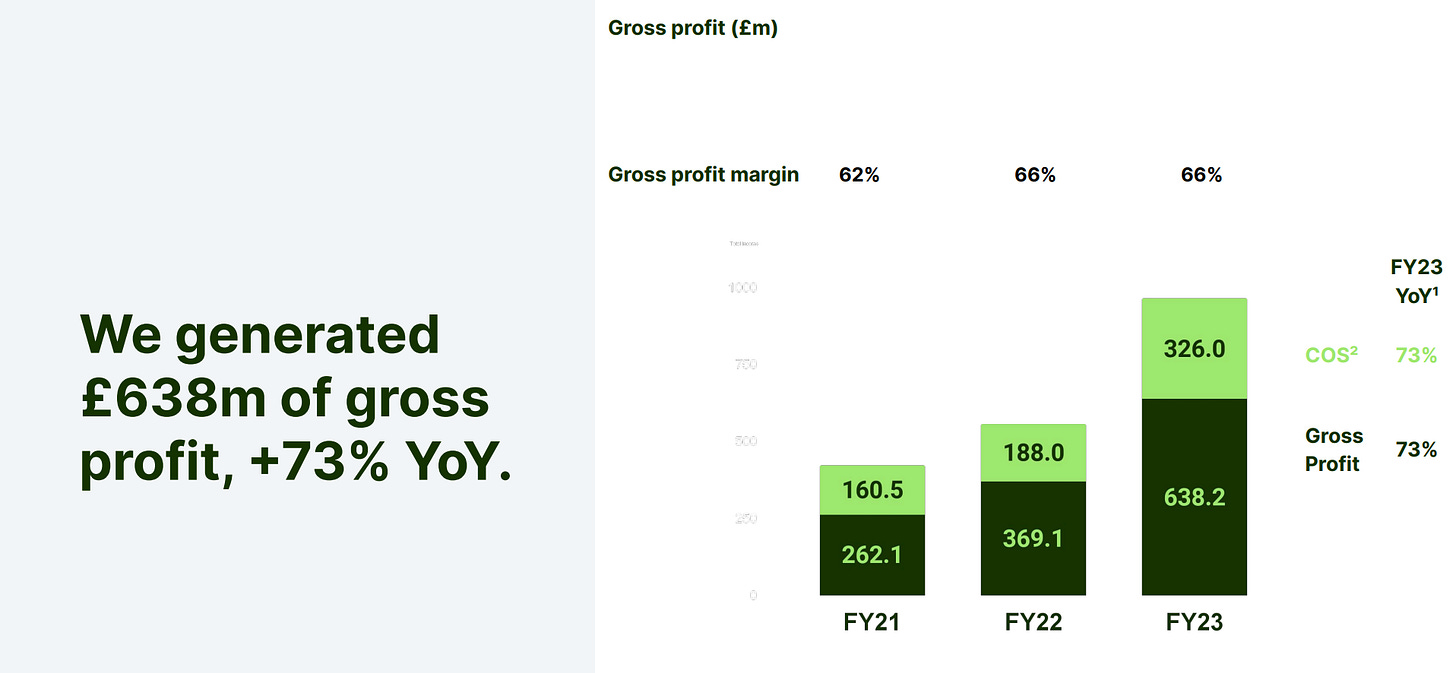

The UK-based firm posted pre-tax profits of £146.5 million for the year, up from £43.9 million (more than 3X!) the year before. Revenue was up 51% to £846.1 million. This is nuts 🤯

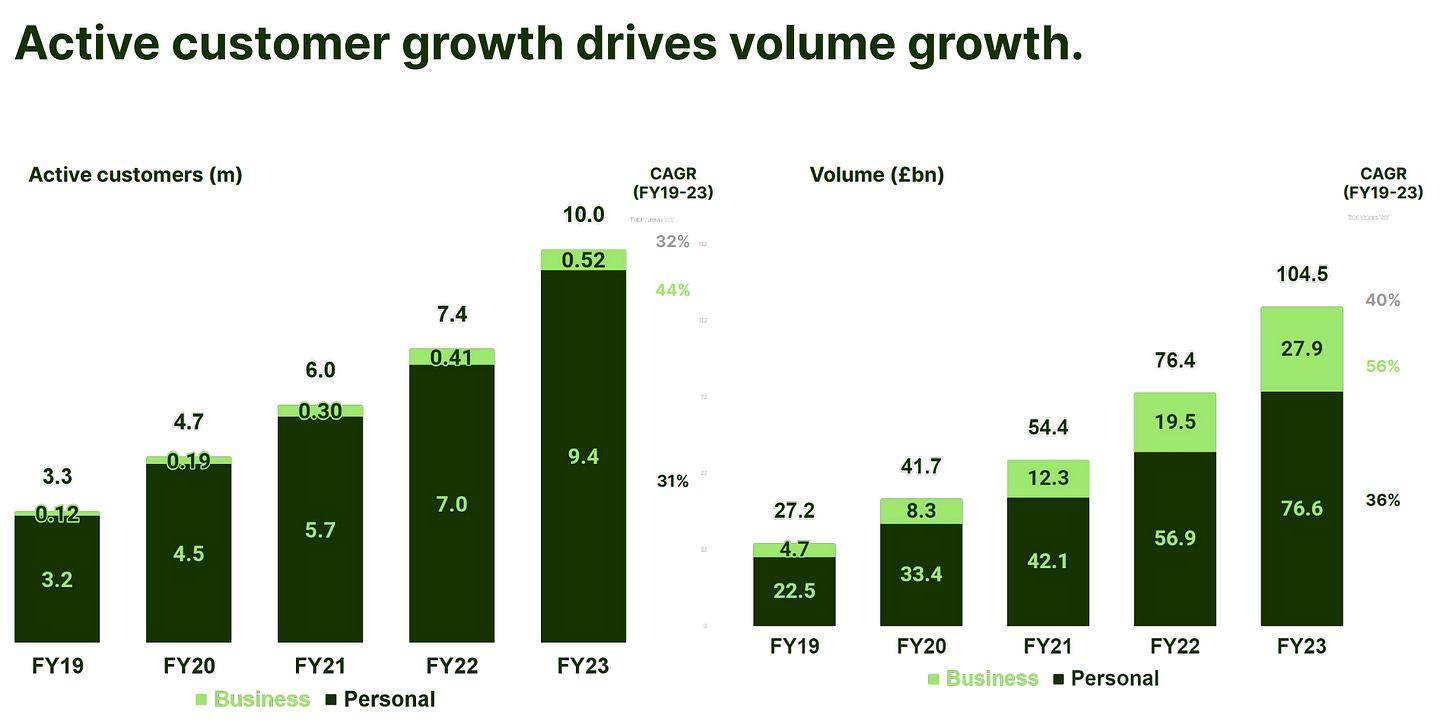

The company also hit 10 million active customers, a 34% year-on-year rise, with volumes of £104.5 billion.

Soaring interest rates mean that Wise is also expecting income to grow by between 28% and 33% in full-year 2024.

Following great results, Wise shares hit £6.20 on Tuesday afternoon, up about 18% but still below its 2021 IPO price.

✈️ THE TAKEAWAY

Undervalued 👀 Wise continues being among very few profitable and very healthy growing FinTechs. That said, it’s pretty surprising to see they have lost around 35% in market capitalization since going public. Given that they have a very active and loyal customer base that loves their product (66% of customers join by word of mouth), a pretty diverse business (Wise Account, Wise Business, and Wise Platform), strong global presence (hold 69 licenses across 45 countries) and expect their profits to grow by between 28% and 33% in the next year, this seems like a very undervalued stock and a solid business to back right now. I’m bullish.

Disclaimer: I’m a shareholder of Wise.

Dive deeper: Wise is now about all things money 💸 [+4 more reads]