PSD3 is finally here, and it can be a game-changer 🇪🇺💳; More Generative AI is coming to Finance as Ramp acquires AI startup Cohere 🤖💸; FinTech startup focused on undocumented immigrants? 🤔

FinTech is Eating the World, 3 July

Hey Everyone,

Happy Monday! I hope you had some time to relax over the weekend because we’re starting the new week with some rich brain food 🧠 On today’s plate we have PSD3, which is finally here (all you need to know about it & why it can be a game-changer), Ramp which acquired AI startup Cohere (more genAI is coming to finance + a good time to revisit 4 essential M&A templates), and FinTech startup focused on undocumented immigrants (it’s one of the very few niche FinTechs making a real difference). Let’s jump straight into the fascinating stuff 🌶

PSD3 is finally here, and it can be a game-changer 🇪🇺💳

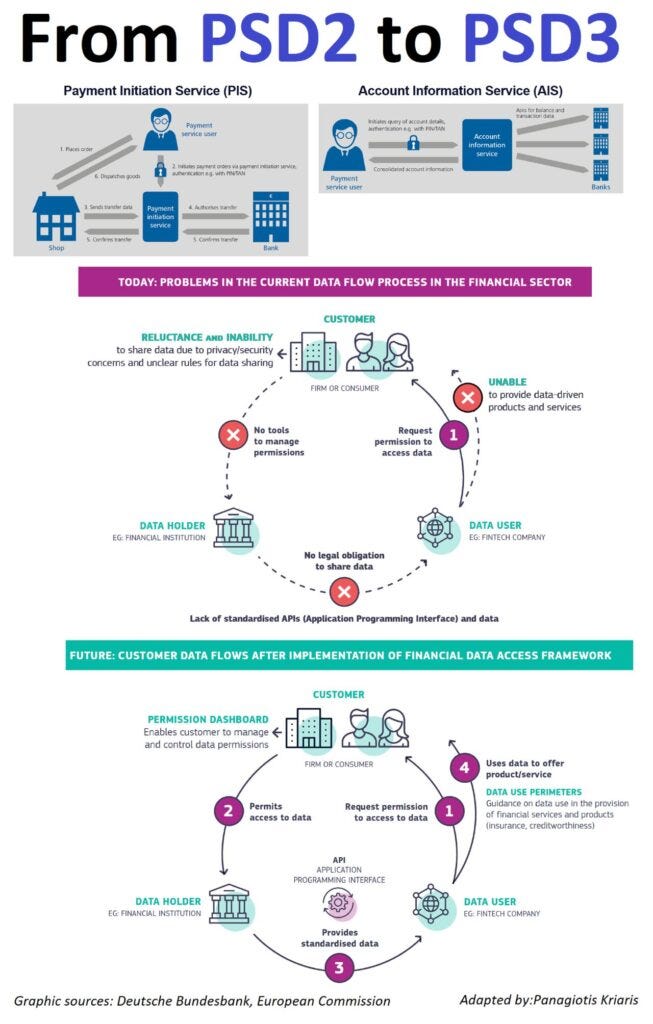

The BIG News 🗞 Last week, the European Commission introduced proposals for the Payment Services Directive (PSD3) and a Payment Services Regulation (PSR), as well as a legislative proposal for a framework for financial data access.

These proposals aim to modernize the current PSD2, ensuring that consumers can continue to make secure electronic payments within the EU while having a greater choice of payment service providers.

This is big news for FinTechs and the future of financial services. Let’s take a closer look at what this means and what might come next.

More on this 👉 We can remember that PSD2, introduced in 2015, aimed to create a more integrated and efficient European payments market, enhancing consumer protection and promoting innovation and competition.

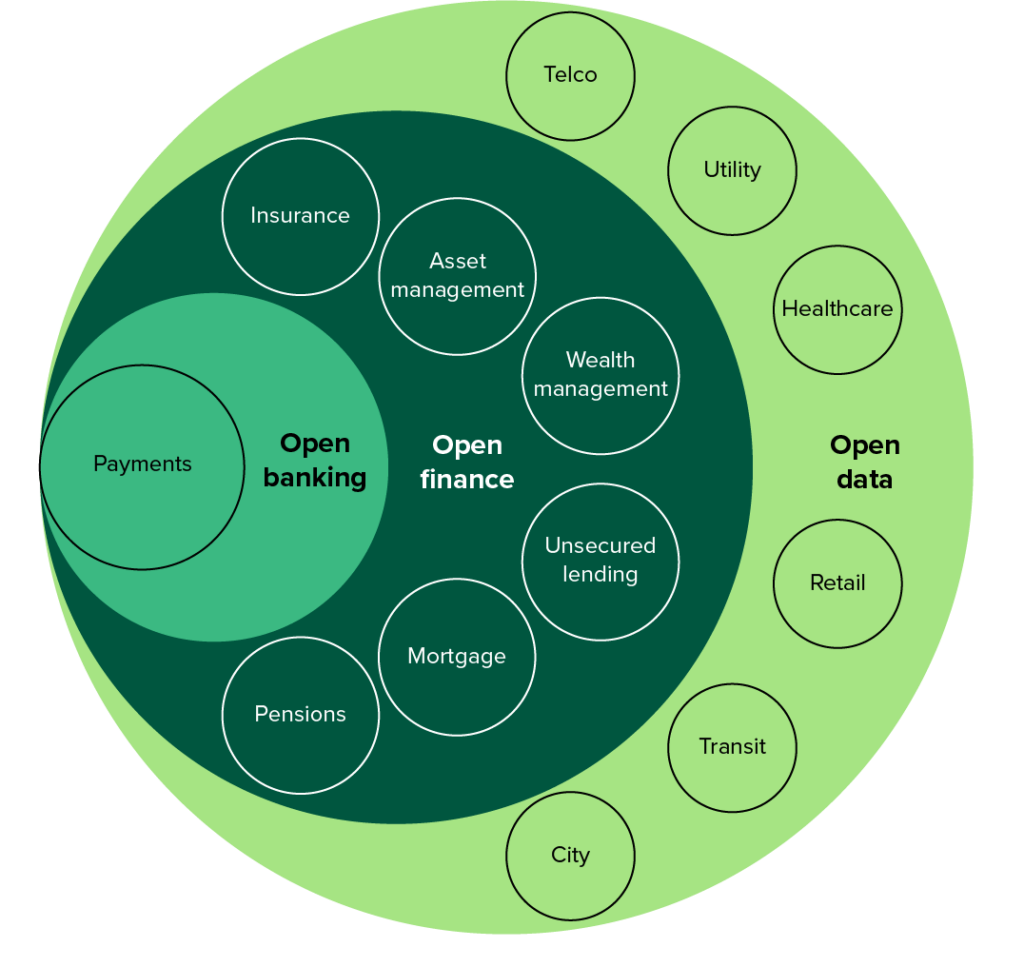

It required banks to open their payment services to third-party providers via APIs, laying the groundwork for Open Banking. PSD3 is being built on a similar foundation and its proposed framework for financial data access is intended to establish clear rights and obligations for customer data sharing in the financial sector, leading to the development of innovative financial products and services and fostering competition.

The USP 🥊 Panagiotis Kriaris shared a good summary on PSD3. Here’s what it’s all about:

Enhancements in Open Banking:

Introduction of stipulations for specialized data access interfaces.

Elimination of the necessity for banks to support dual data access interfaces.

Assurance of alternative data access for open banking providers to ensure uninterrupted business operations if the primary banking interface fails.

Implementation of a “control panel” for consumers to monitor, manage, and retract data access permissions.

Mandatory provision of access to financial data beyond payment account information.

Strengthening Measures Against Fraud:

Extension of reimbursement rights for victims of fraud

Implementation of a compulsory system to corroborate account names with IBANs

Intensification of customer authentication protocols

Establishment of a legal framework for PSPs to exchange information related to fraud

Promoting Equitable Competition Between Banks and Over 1,000 Non-Bank PSPs to Reduce Costs:

Granting PSPs access to all EU payment systems

Ensuring payment and e-money institutions (of which there are approximately 800 and 270 respectively) have access to banking services

Streamlining Processes:

Consolidation of e-money institutions (EMIs) and payment institutions (PIs) under a unified system

Integration of all payment regulations applicable to PSPs into a single, directly enforceable regulation

Augmenting the Accessibility of Cash in Stores and Through ATMs:

Permitting retailers to offer cash services to consumers without necessitating a purchase and clarifying regulations for independent ATM providers

Enhancing Consumer Rights (e.g. in situations where funds are withheld, increasing transparency in account statements and ATM fees)

All in all, while PSD2 has been successful in reducing fraud and enhancing user experiences, it faced challenges, especially in creating a level playing field for all PSPs. Non-bank PSPs often faced obstacles in accessing key payment systems directly, hindering fair competition and stifling innovation. PSD3 is thus aiming to address these issues, which are essential for fostering healthy competition and driving advancements for the future of finance.

✈️ THE TAKEAWAY

What’s next? 🤔 These proposals are good and positive developments for the future of financial services in Europe. In short, PSD3 is aimed at streamlining and securing the FinTech and financial services industry by ensuring better access to payment systems, protection for consumer data sharing, and combating fraud. It thus has the potential to harmonize the Open Banking framework across Europe and set trends for consumer protection that could be adopted globally. And Open Banking and Open Finance are considered fundamental for the future of finance in Europe.