The rise of AI-enabled fraud 🦹♂️🤖; Another spot Bitcoin ETF is in the books 📁; Angel investment platform to close the gender investment gap? 🤔

FinTech is Eating the World, 7 July

Hey Everyone,

TGIF! We’re finishing an intense week with a blast ⚡️ Today we’re looking at the rise of AI-enabled fraud (we must start paying attention!), another spot Bitcoin ETF that’s in the books (it’s a trend driving BTC up), and angel investment platform that aims to close the gender investment gap (the opportunities & risks + how you can raise money with no network). Let’s jump straight into the awesome stuff 🌶

The rise of AI-enabled fraud 🦹♂️🤖

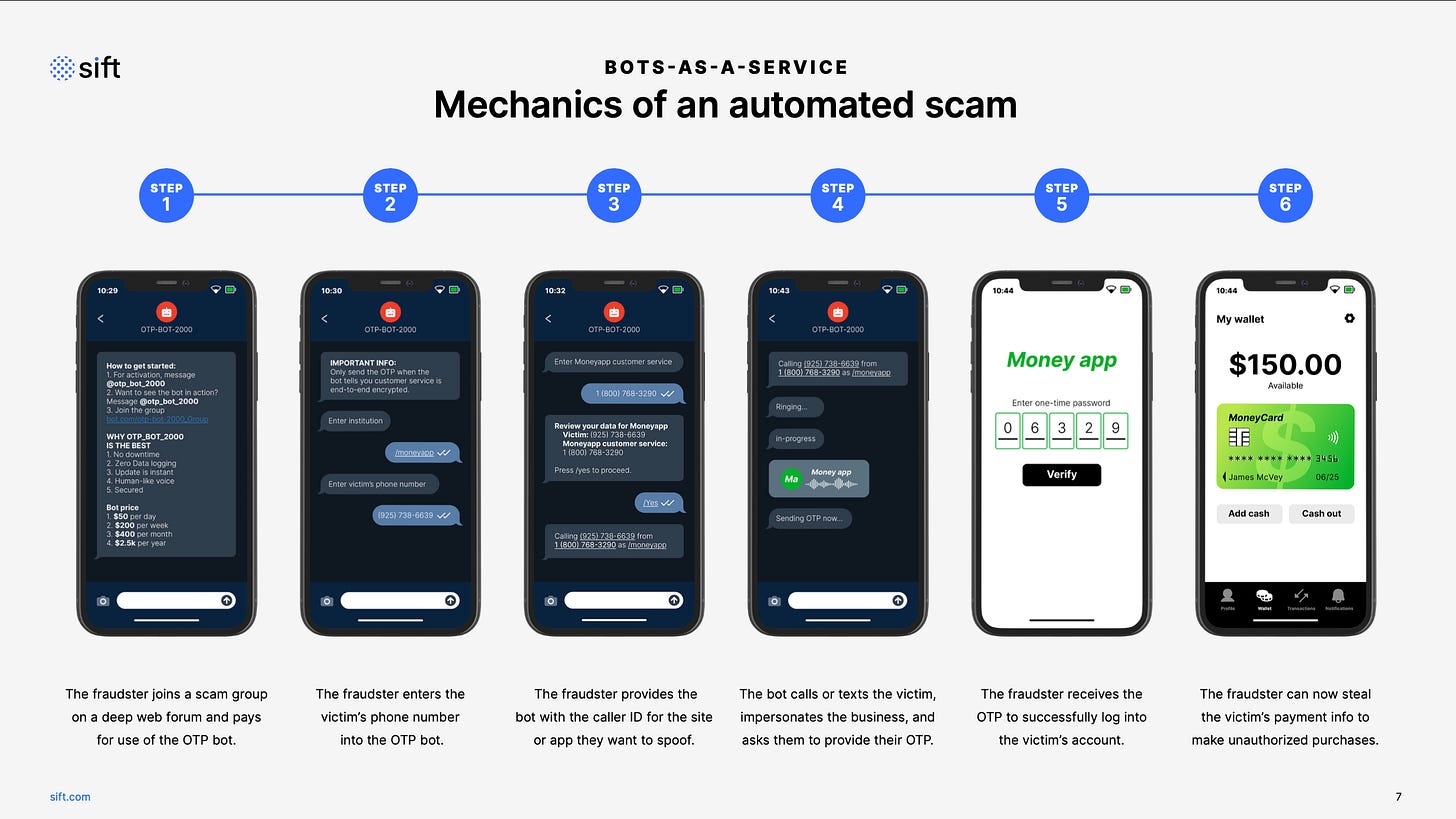

New data 📊 Sift, a US-based fraud detection provider, has released a new interesting report highlighting the rise of AI-enabled fraud.

This short yet good read provides some valuable insights we must all know. Let’s take a look.

More on this 👉 According to Sift's Q2 2023 Digital Trust & Safety Index, over two-thirds of US consumers have experienced an increase in spam and scams, attributed to the emergence of consumer-oriented generative AI tools in late 2022. That’s a lot…

The report also reveals that approximately 50% of consumers struggle to identify scams, and around 20% have fallen victim to successful phishing attempts.

On top of that, the surge in AI-empowered scams has led to a significant rise in account takeover attacks (ATO), with the ATO rate increasing by 427% in Q1 2023 compared to the entirety of 2022.

✈️ THE TAKEAWAY

What this means? 🤔 First and foremost, it’s clear that the marketability and accessibility of fraud tools - whether AI-based ones or not - are some of the key factors contributing to the democratization of fraud. This means that anyone, regardless of their prior knowledge, can now utilize stolen credentials or payment information to commit fraud. More importantly, although generative AI is a somewhat recent development, its potential for fraudulent activities and its impact on consumers and businesses cannot be ignored. To mitigate these new threats and safeguard revenue and customers, businesses must adopt AI and automation, which can not only enhance security but also reduce friction for legitimate users. With that in mind and looking at the big picture, I must say that I’ve never been more bullish on AI-powered RegTech solutions. Both in FinTech and Web3.