European FinTech funding is in freefall 📉🫣; Checkout.com uses AI to take on Plaid 😳; Tell me Binance is in trouble without telling me Binance is in trouble 👀

FinTech is Eating the World, 11 July

Hey Everyone,

Happy Tuesday! Monday was hot, but today is burning 🔥 We’re looking at the European FinTech funding which is now in freefall (latest data & what you can do to still win), Checkout.com that uses AI to take on Plaid (why it makes sense + a deeper dive into Plaid), and Binance, which is starting to get into a big pile of 💩 problems (a signal or just noise?). Let’s jump straight into the fascinating stuff 🌶

European FinTech funding is in freefall 📉🫣

NEW data is out 📊 As we are already in July, we can now take a look at the data on European FinTech funding in the first half of 2023. And it’s not good...

Let’s take a brief look at the most important things.

More on this 👉 Top things to know from the latest Dealroom data:

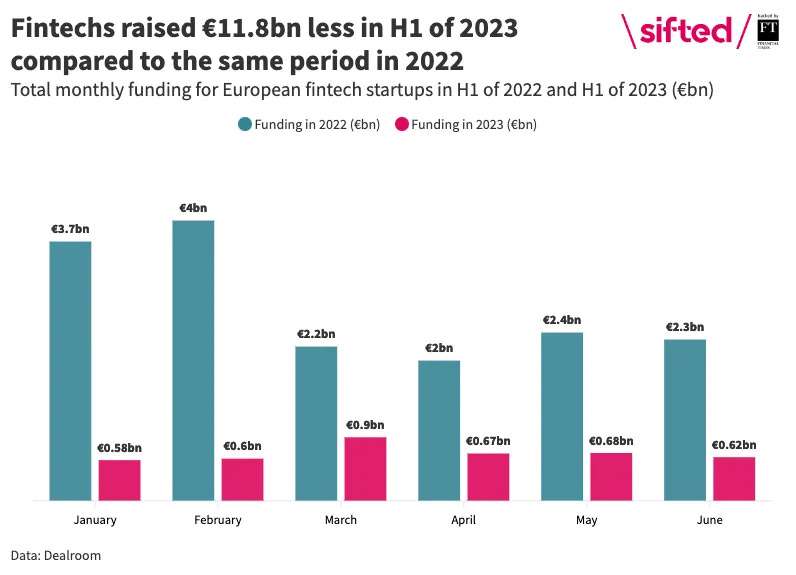

Overall funding is down by a lot. European FinTechs brought in only €3.4 billion during H1 2023 compared to €15.2 billion raised during the same period last year. That’s nearly a 5X drop… 🥶

We must note that while the total funding figure for H1 2023 is likely to be higher after any reporting lag, it’s highly unlikely to be enough to bridge the €11.8 billion gap in capital. That’s a huge gap 🕳️

The subsector that brought in the most funding was mortgage and lending providers, with €409M. InsurTech took second place with around €378M. Not surprised, to be honest…

The UK was the country that attracted the most FinTech funding overall, with €1.6 billion, almost half of the total funding for the period. France was in second place, raising €405M.

The below graph from Sifted perfectly visualizes the downward spiral:

✈️ THE TAKEAWAY

What’s next? 🤔 It’s obvious now that the ongoing global macroeconomic challenges, inflation concerns, and geopolitical uncertainties are keeping VCs and investors concerned, which means that the current pullback in startup investing is likely to linger like a bad headache into Q3 and maybe even Q4 of 2023. So buckle up! And to make your life a bit easier, I’ve got some valuable stuff 👇🏼

If you’re building and scaling, read this:

If you’re raising right now, check these:

If you’re looking to do an M&A, this is a must: