Embedded Finance is a $242B opportunity in APAC by 2025 😳; Walmart is solidifying its Super App ambitions 📲; A list of new VC funds at/below $200M in size 🤑

FinTech is Eating the World, 31 July

Hey Everyone,

Happy Monday! I hope you managed to recharge over the weekend because we’re going full speed into the new week 🚀 Today we’re looking at embedded finance, which is a $242 billion opportunity in APAC by 2025 (why you can’t ignore it + more bonus reads), Walmart, which is solidifying its Super App ambitions (why Walmart Super App could be huge + unbundling the Walmart Bank), and a list of new VC funds at/below $200M in size (150+ VC funds + more invaluable startup resources). Let’s jump straight into hot stuff 🌶

Embedded finance is a $242B opportunity in APAC by 2025 😳

Data in 📊 In November 2022, card network giant Visa V 0.00%↑ conducted a study that shed light on the immense potential of embedded finance within the Asia Pacific (APAC) region.

The study provides some valuable insights and yet again proves the importance of embedded finance as part of your FinTech strategy, so let’s take a look.

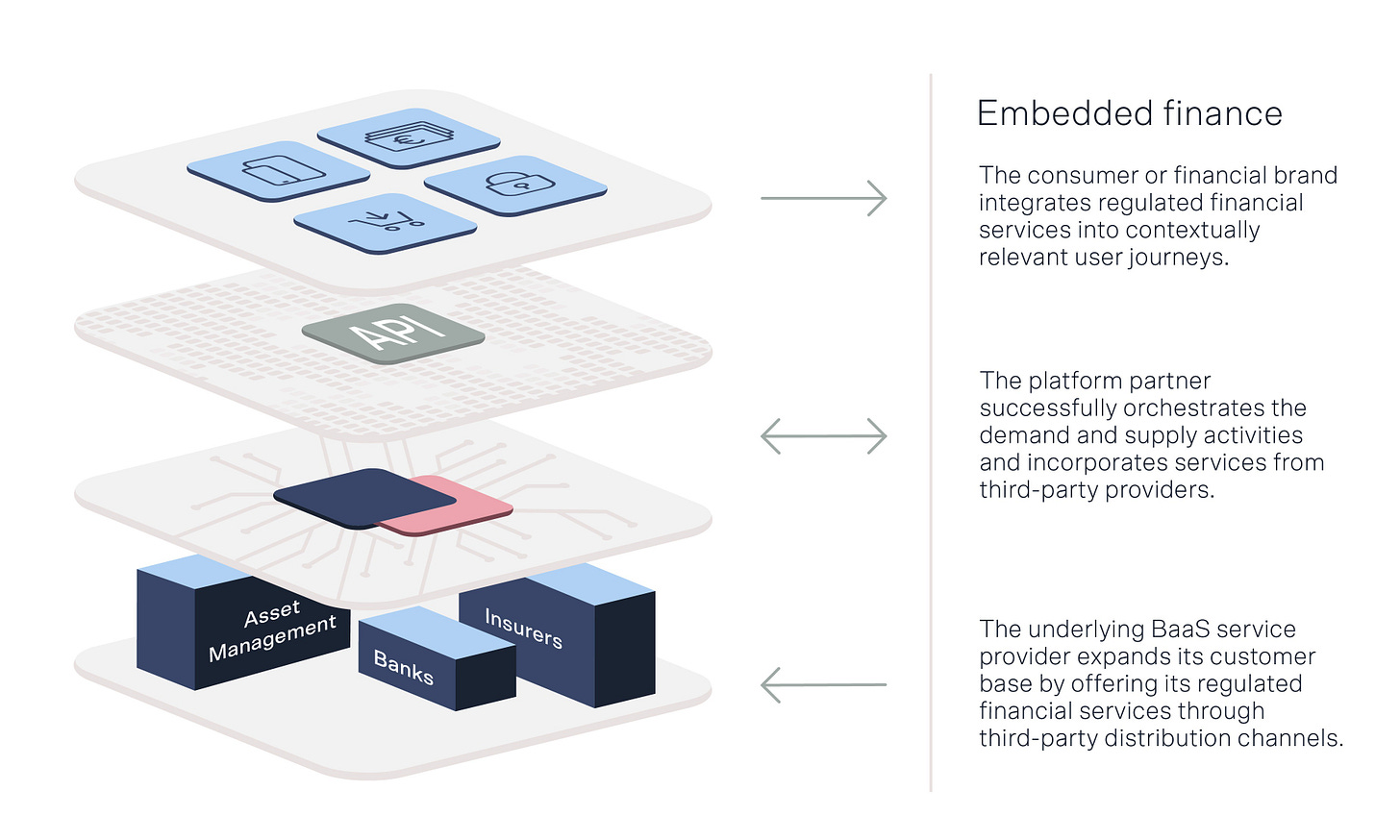

More on this 👉 Embedded finance, or simply put the integration of financial services into non-financial platforms, offers a wide array of possibilities and business growth opportunities. From streamlining customer experiences to providing easy access to financial services on everyday digital platforms, embedded finance has the potential to unlock $242 billion in revenue by 2025 across small and medium-sized businesses (SMBs) and consumer segments in APAC, according to Visa.

The study identified lending as the leading use case for embedded finance, projecting it to reach $141 billion in revenue, followed by deposits at $56 billion, and payments at $41 billion.

The USP 🥊 Visa emphasized that embedded finance represents a transformative opportunity for financial service and technology providers, as well as software and digital providers in the APAC region. Financial institutions are increasingly recognizing the potential and investing in building differentiated embedded finance experiences across various verticals like issuing, lending, and payments.

Visa itself is (obviously) expanding its offerings and partnering with banks, fintechs, platform providers, and merchants along the value chain to capture growth opportunities, drive innovation, and maintain cost efficiency.

✈️ THE TAKEAWAY

Looking ahead 👀 The Visa study is yet another great reminder about the power of embedded finance. Embracing embedded finance enables traditional banks, merchants, and platforms to meet customer expectations for relevant and user-friendly financial services. More importantly, it becomes a driver of business growth. A case in point here could be PayPal PYPL 2.31%↑ which is the largest non-bank lender or Shopify SHOP 1.71%↑ which derives 73% of its revenue from FinTech services. However, amid the dynamic market opportunity, industry players must navigate challenges related to data privacy, regulatory requirements, and maintaining brand saliency and differentiation. Successfully managing these aspects is crucial to maximizing the potential of embedded finance and seizing the valuable opportunities it presents. Because the future of finance is embedded, and if you don’t have a strategy for that, I would be seriously worried.

ICYMI: Amazon shows why the future of FinTech is Embedded 🗂 (+4 extra reads)