Bold move: Coinbase acquires minority stake in Circle 😳; The future of finance is being piloted in LatAm: Nubank to test Brazilian CBDC 🇧🇷; Checkout.com cuts ties w Binance over money laundering 🤯

FinTech is Eating the World, 22 August

Hey Everyone,

Happy Tuesday! Today’s issue is extra hot as we’re looking at Coinbase acquiring a minority stake in Circle (why it’s a bold move & what’s next + a deep into Coinbase), Nubank that is to test Brazilian CBDC (LatAm is leading by example + a deeper dive into Nu that’s crushing the Fintech space), and Checkout.com that just cut ties with Binance over money laundering and compliance concerns (tell me Binance is in trouble without telling me Binance is…). Let’s jump straight into the burning stuff 🌶

Bold move: Coinbase acquires a minority stake in Circle 😳

The deal 🤝 Crypto pioneer Coinbase COIN 0.00%↑ has acquired a minority stake in Circle Internet Financial and aims to shut down the Centre Consortium partnership that had issued USD Coin (USDC), the world’s second-largest stablecoin.

This is a bold move with lots at stake, so let’s take a look.

More on this 👉 In light of this development, Circle will take over the complete issuance and governance of USDC in-house. Additionally, USDC will be natively supported on 6 more blockchains, expanding the total number of supported blockchains to 15.

Even though specific details about the additional blockchains have not been disclosed, Circle had previously mentioned plans to include Polkadot, Near, Optimism, and Cosmos in 2023. Coinbase has also introduced its own blockchain called Base.

ICYMI: Coinbase becomes the first publicly traded company to launch its own decentralized blockchain 😳 [why it’s a game-changer and a critical part of their "Master Plan" + a deeper dive into Coinbase]

The exact size of Coinbase's stake in Circle has not been revealed, and no cash exchange took place between the two companies for this stake according to Coindesk.

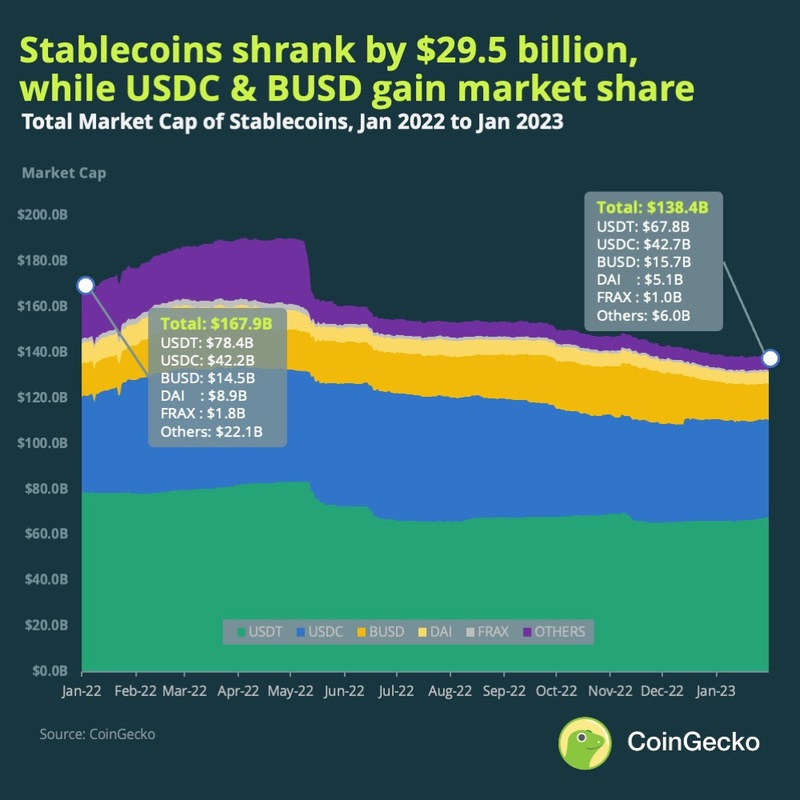

The move comes at a time during tectonic shifts in the world of dollar-pegged stablecoins. Most recently, FinTech giant PayPal PYPL 0.00%↑ took a step to shake up the dominance of Tether’s USDT and USDC by introducing its own PYUSD token. PayPal could prove a worthy contender given its deep ties in payments and remittances.

ICYMI:

✈️ THE TAKEAWAY

What does it mean? 🤔 Let’s look at the big picture first. Seeing this news just after PayPal launched PYUSD is brilliant proof that the stablecoin market is growing. More importantly, the regulatory clarity for stablecoins is increasing around the world (i.e. in Europe, the UK, Singapore, etc.) which is a solid building block for stablecoins to become a global dollar payments rail. Furthermore, given Circle is backed by BlackRock, Fidelity, and hedge fund Marshall Wace, we can expect more USDC applications for tokenized asset settlement. And this is a massive industry on its own. This now brings us to Circle. The crypto company tried to go public via SPAC multiple times yet it didn’t work out. Hence, Coinbase equity could be a way to achieve that exit for Circle investors and/or staff. Finally, we have to talk about Coinbase that’s probably the biggest winner in this deal. If the crypto giant is really trying to build an open financial system, USDC fits elegantly into Coinbase's offerings. It will surely be added on Base. But more importantly, we have to understand that USDC stretches far beyond crypto trading, into areas like foreign exchange, and transfers of funds across borders aka remittances, to name a few. If things go well, Coinbase will probably end up acquiring Circle altogether becoming a global crypto/finance super power.

ICYMI: Coinbase’s Q2 paints a promising picture 🖼️ [earnings review + why you should be bullish]